Helping you do more

Our advisor website helps you quickly get the information you need, saving time and simplifying client and participant interactions.

Accessing the Retirement Plan Dashboard

To get the details you need about your Principal® retirement plan business, use the Retirement Plan Dashboard. Go to advisors.principal.com to find it under Key Business Tools.

Navigating the Retirement Plan Dashboard

Look up key information for your retirement plan clients, block of business and individual participants.

Click the screen to keep going

Defined contribution client list

Search a list of your DC clients and access the plan summary, which brings together key plan details in a few easy-to-navigate tabs. Or, you can use the direct link to view the Employer website for:

-

Plan health metrics

-

Plan level/participant reporting

-

Compliance/government filings

-

Plan documents and forms

-

Client to-dos and tasks

Click the screen to keep going

Plan summary

Easily access plan health information, plan provisions and quick links for things like:

• notices

• compliance

• client tasks

Click the screen to keep going

Investment details

See at-a-glance information, search and easily download all available investment options within the plan.

Click the screen to keep going

Participants invested

Easily see the participants currently invested within each available investment option and download the list with the click of a button.

Click the screen to keep going

Customize and download (or order) participant enrollment materials and forms

The updated Retirement Plan Dashboard guide shows you how you can do this directly from the Retirement Plan Dashboard.

Click the screen to keep going

Participant lookup

Search a participant by name from the main Retirement Plan Dashboard page.

Click the screen to keep going

Block of business summary

View a book of business summary as well as a quick contract overview for additional plan types such as DB and ESOP. You can also access reports to analyze your book of business and participants within the plans you service.

< Back to beginning

Learn how we can help

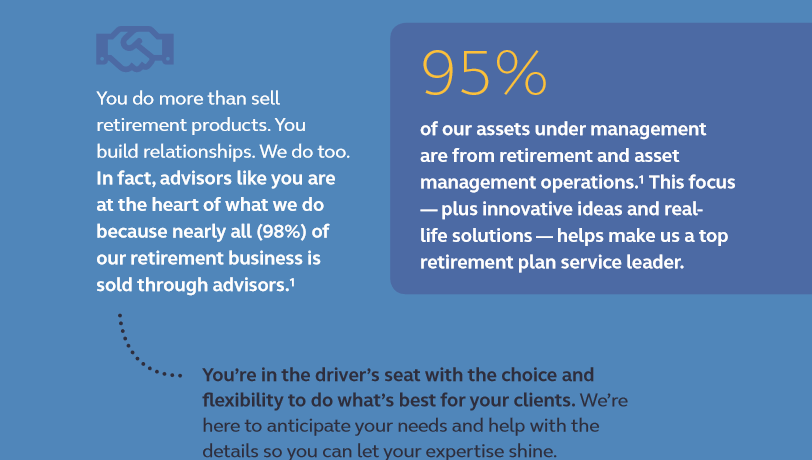

1 As of Dec. 31, 2019

Frequently asked questions

Need help?

at 800-952-3343

Carefully consider the Fund's objectives, risks, charges, and expenses. Contact your financial professional or visit principal.com for a prospectus, or summary prospectus if available, containing this and other information. Please read it carefully before investing.

Before directing retirement funds to a separate account, investors should carefully consider the investment objectives, risks, charges and expenses of the separate account as well as their individual risk tolerance, time horizon and goals. For additional information contact us at 800-547-7754 or by visiting principal.com.

Investing involves risk, including possible loss of principal.

Asset allocation and diversification does not ensure a profit or protect against a loss. Equity investment options involve greater risk, including heightened volatility, than fixed-income investment options. Fixed-income investments are subject to interest rate risk; as interest rates rise their value will decline.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, investment advice or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, investment or accounting obligations and requirements.

1362468-102020