Principal® Real Start

Reach more participants. Drive informed decisions. Gain more opportunities.

Transition experience

Click anywhere on the screen to keep going.

Transition experience

Welcome screen

We’ve created a personalized platform to help participants, no matter if it’s a transitioning plan or newly eligible participant. And no matter the plan design.

Transition experience

Set up the account

Help secure account access:

-

Create a unique username and strong password

-

Get started with 2-factor authentication

Transition experience

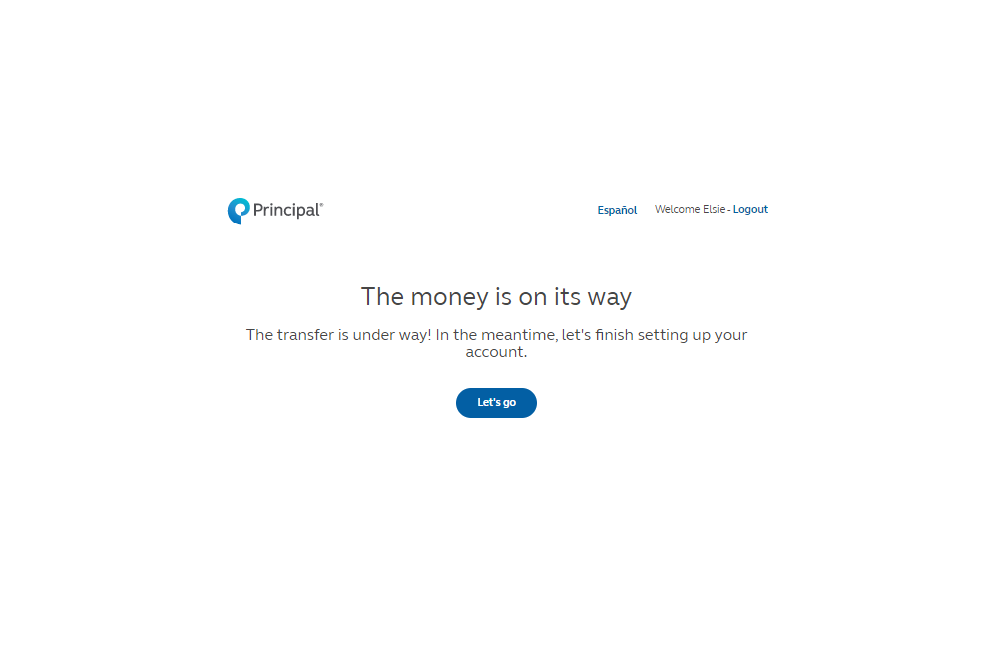

Money is on the move

During a transition, it's good to know where the money is in the process with this money tracker.

Transition experience

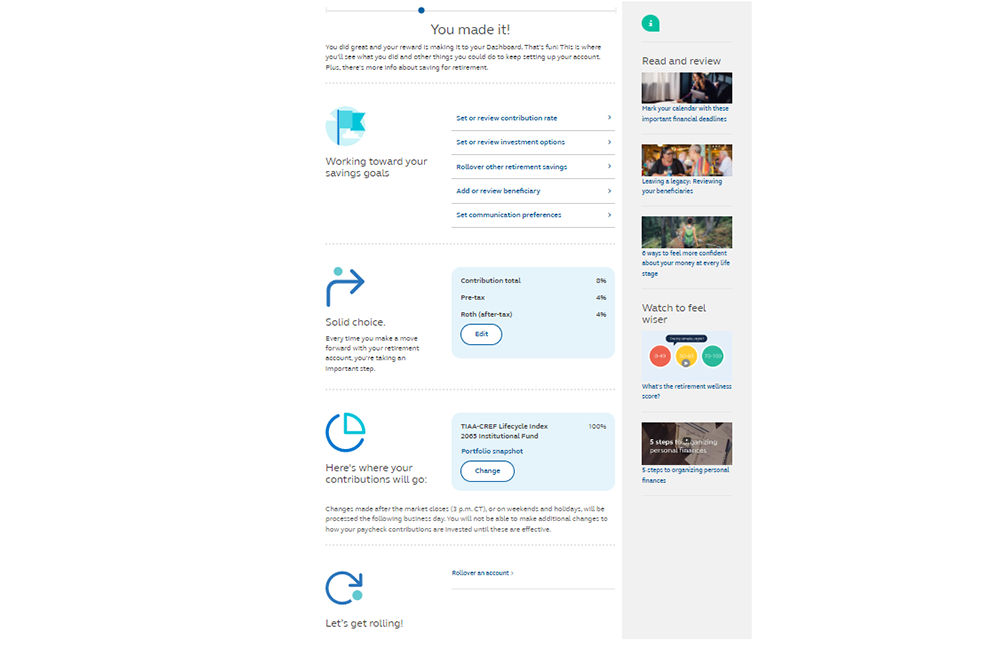

Dashboard

On the dashboard, there are action items that participants can complete, including setting a contribution rate, adding or reviewing a beneficiary, adding communication preferences, and a link to more retirement planning resources when onboarding is complete.

The dashboard is available any time up to 90 days after effective date or until the transfer money has been deposited.

Transition experience

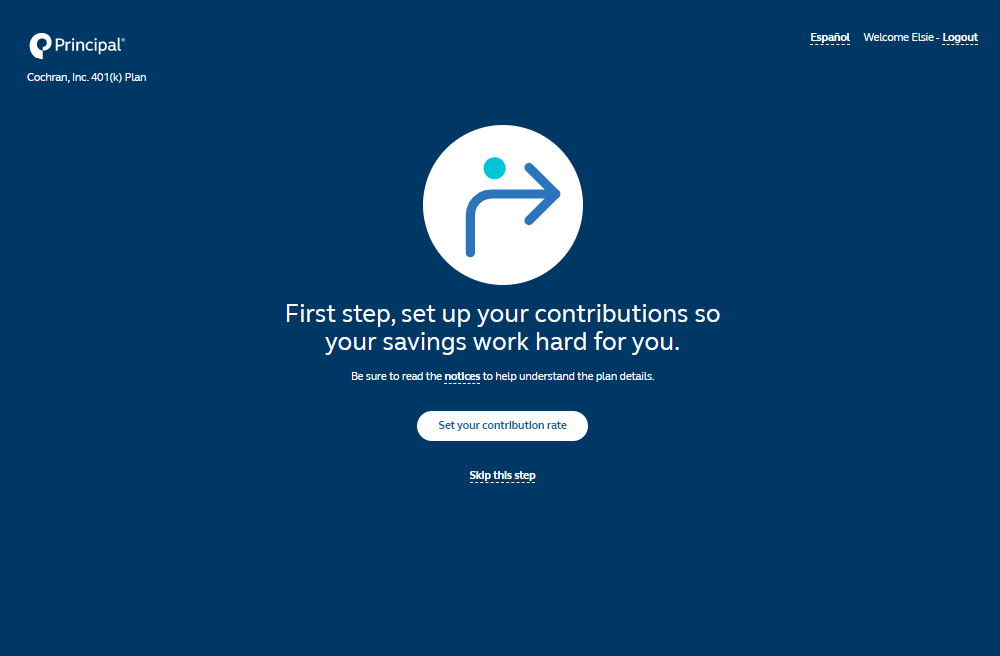

Starting setup

First up, contributions (for non-mapping scenarios).

After the account setup process, there's access to applicable required notices. Links to notices will also be available on most screens within the platform.

Transition experience

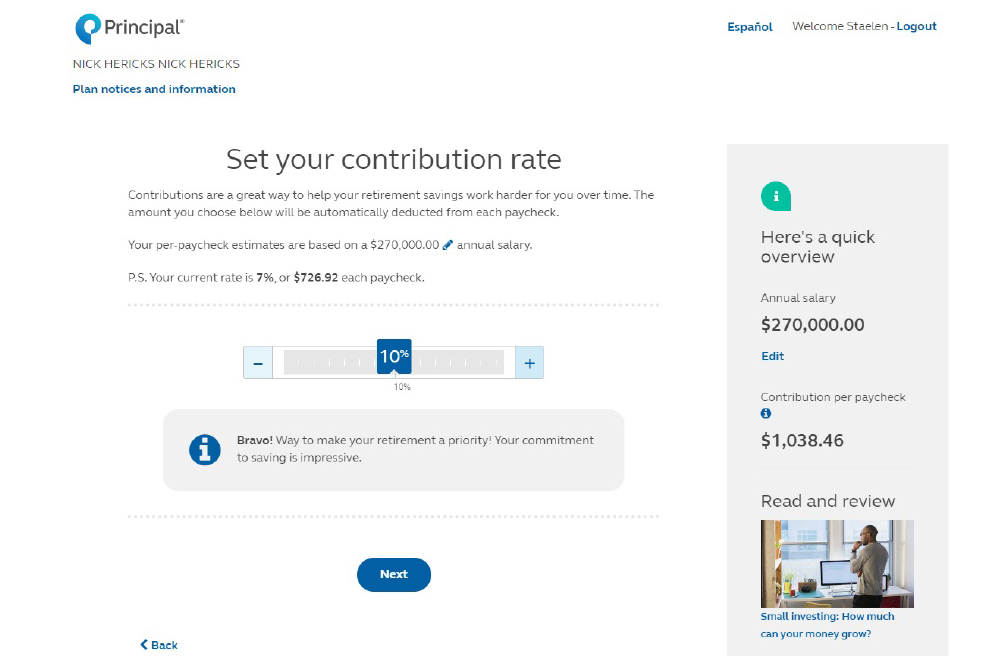

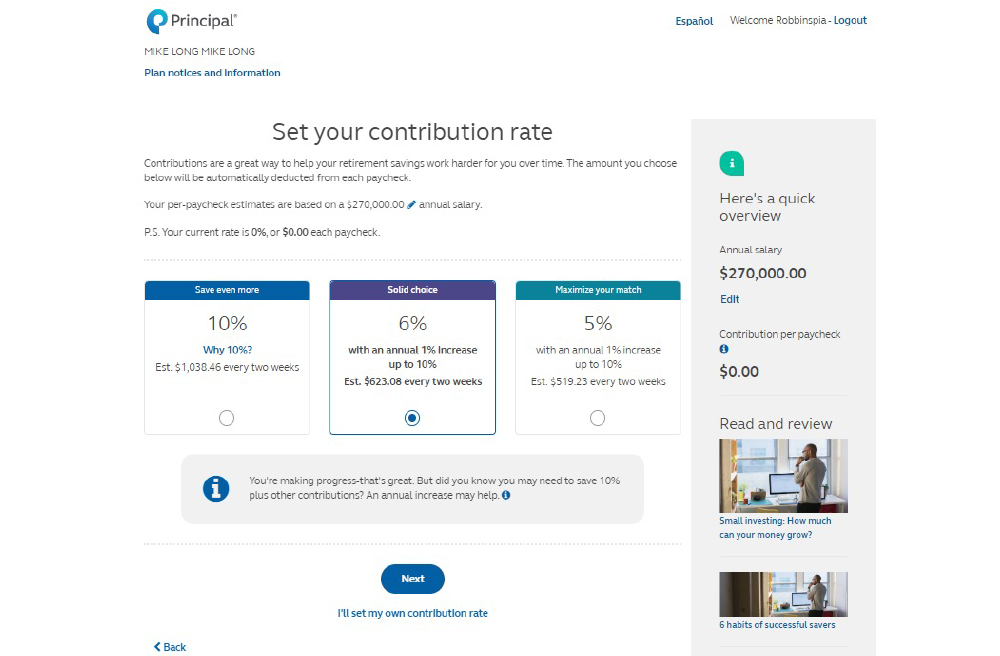

Encourage contributions

The experience includes educational messaging around starting off with saving 10% and information about starting small and building with an annual increase.

Transition experience

Flexible options

Setting a different rate is also available.

Transition experience

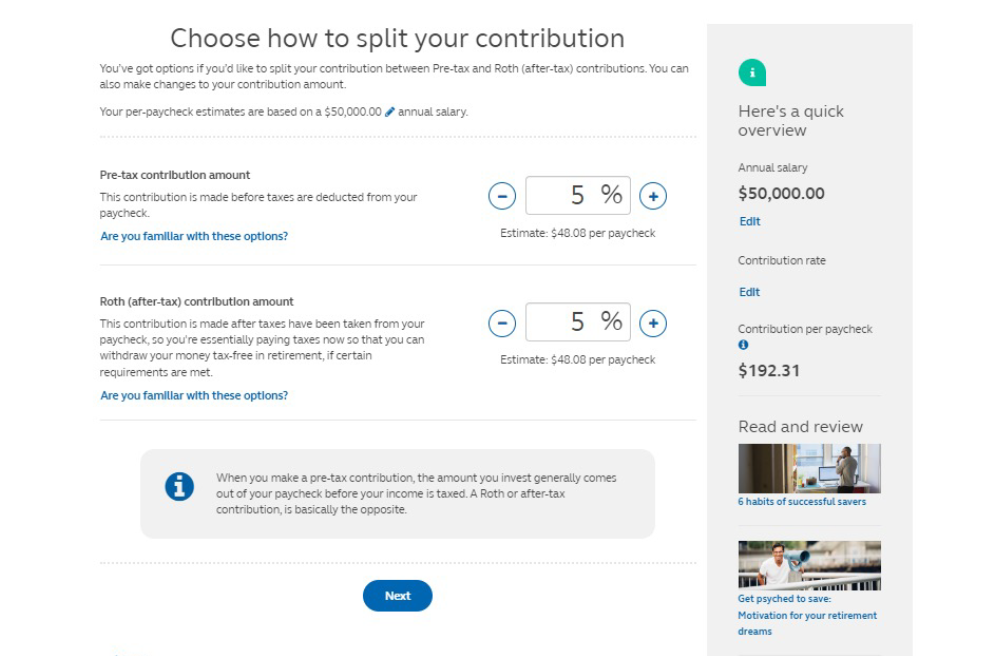

Roth contributions

The platform provides the ability to split the contributions between pre-tax and Roth (if allowed).

Transition experience

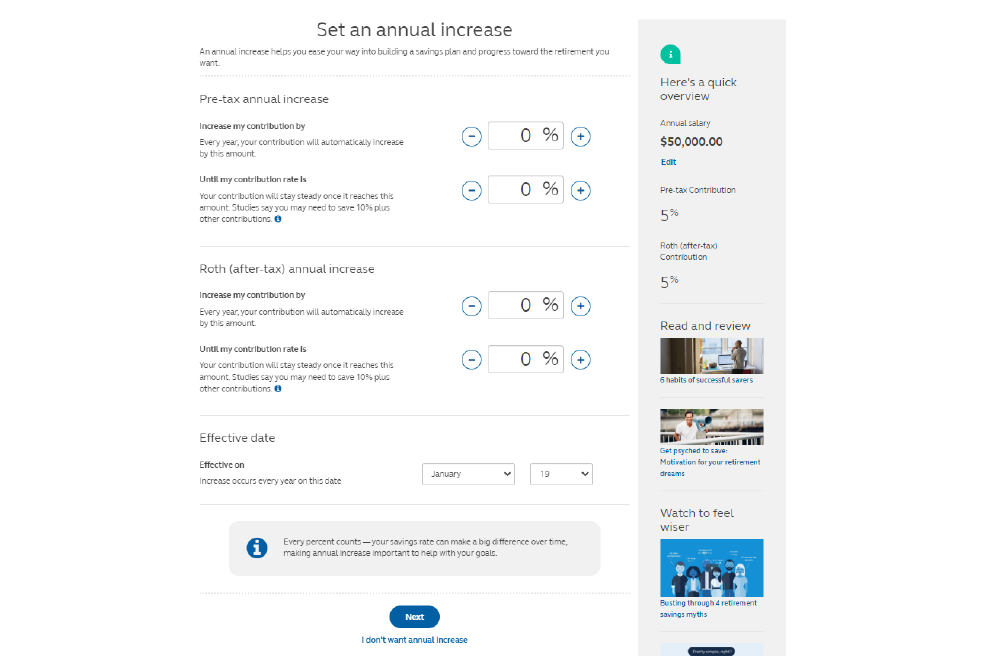

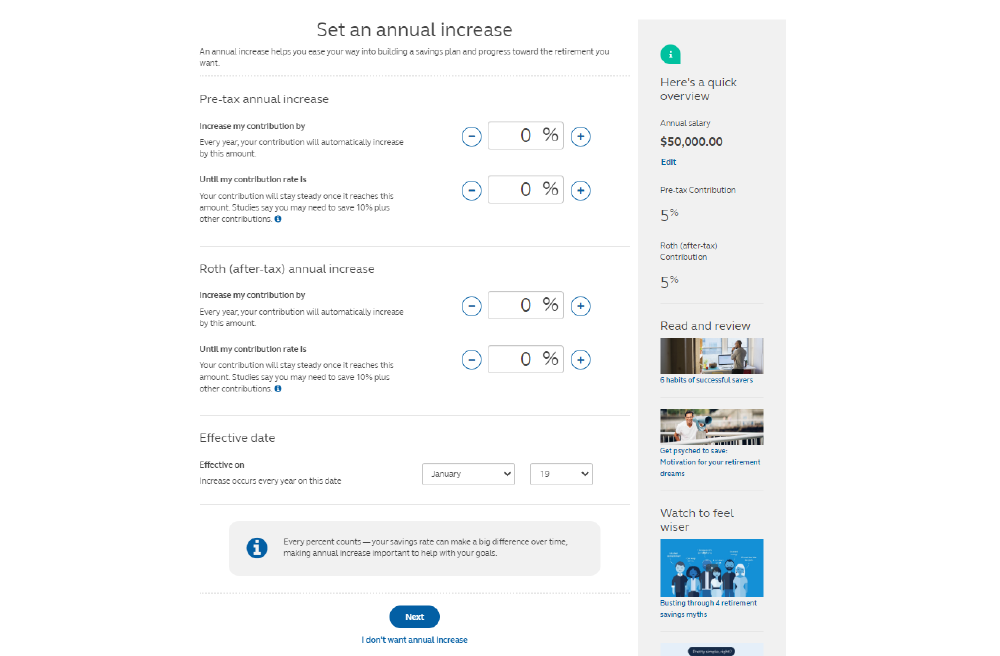

Annual increase:

Set up an annual increase to the contribution amount (if allowed) Indicate the annual increase amount

Put a cap on how high their contribution rate should go Choose the effective date of the increase (if allowed)

Transition experience

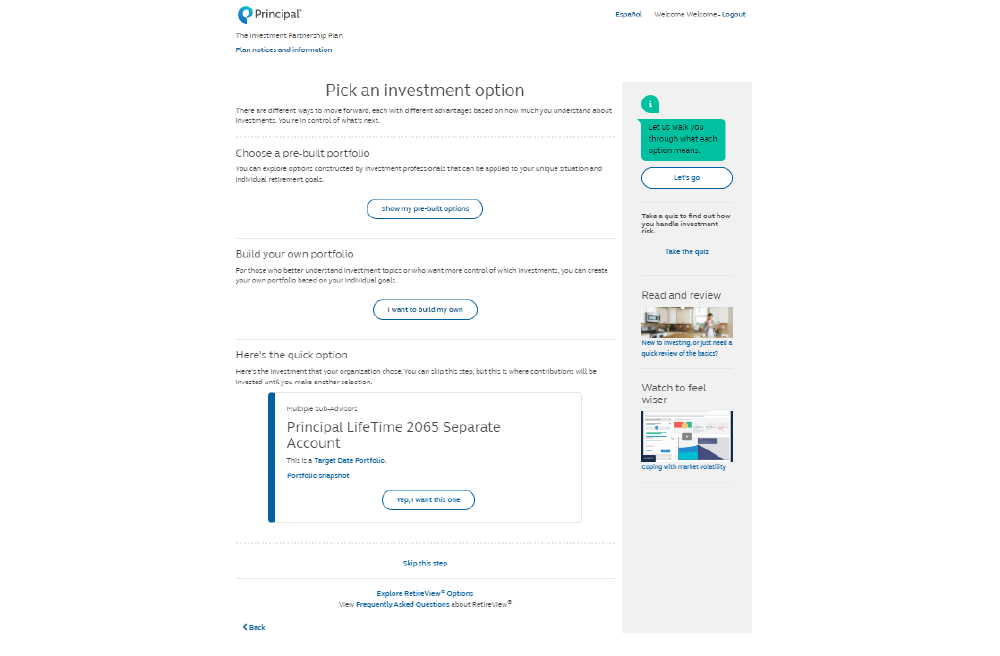

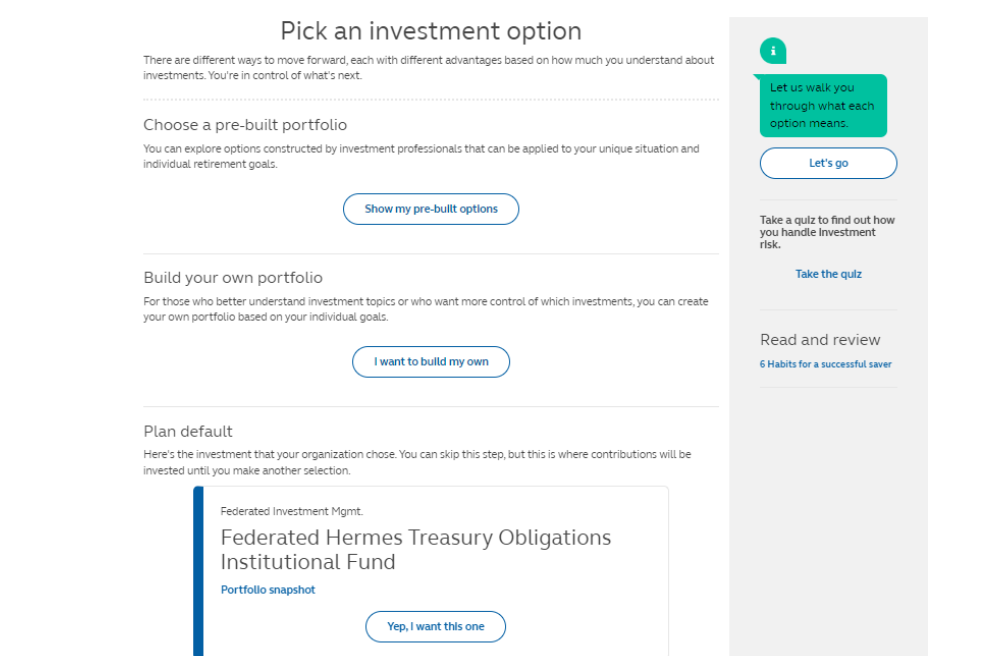

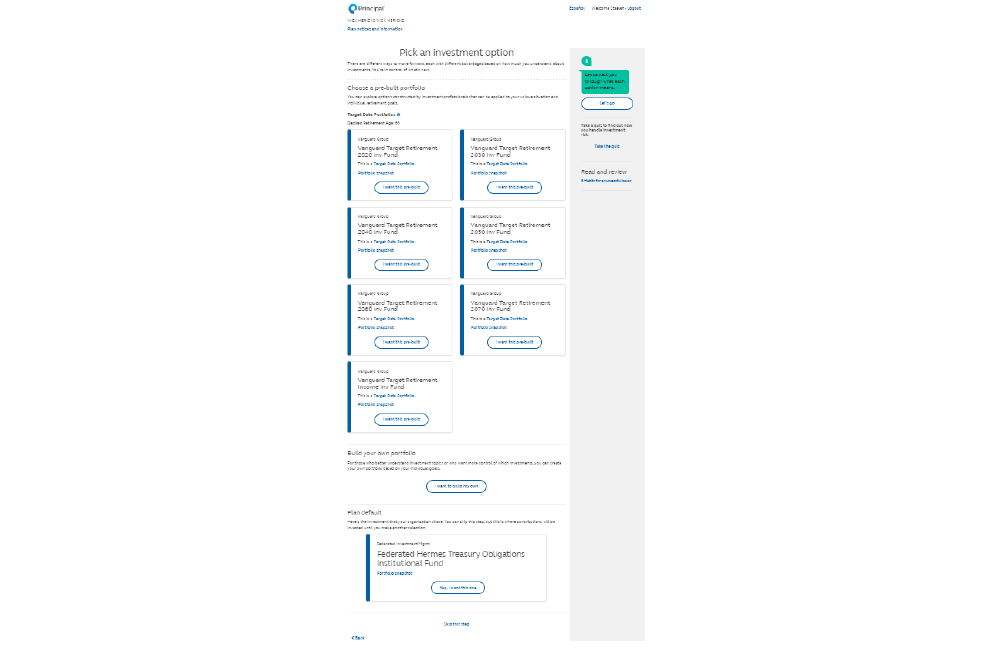

Investment options

Investments can be confusing, so we’re making it simpler to either set investments later—which means going to the plan’s default—or do it now.

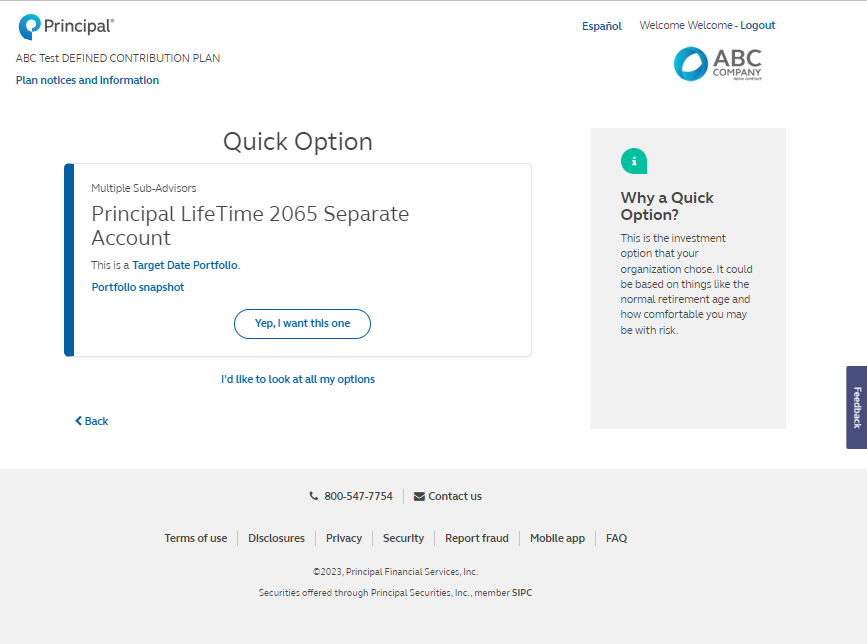

Transition experience

Quick option:

First shown is the Quick Option—chosen by their organization

May be based on normal retirement age and level of comfort with risk

Transition experience

Explaining investment options

Deciding between all the different investment options is a known pain point. Many don’t feel that they have enough information to make an educated decision, so we’re providing additional context and education about investment options.

Transition experience

Explaining investment options

Deciding between all the different investment options is a known pain point. Many don’t feel that they have enough information to make an educated decision, so we’re providing additional context and education about investment options.

Transition experience

Investment options

For those who want to review all the investment options, the platform includes:

-

Helpful descriptions

-

Access to the investor profile quiz

-

Ability to see the quick option or quick choice (if applicable)* and pre-built and build your own portfolios

*For plans with a QDIA. Features displayed may not be available on all plans – refer to your plan for applicable features. For illustrative purposes only.

Transition experience

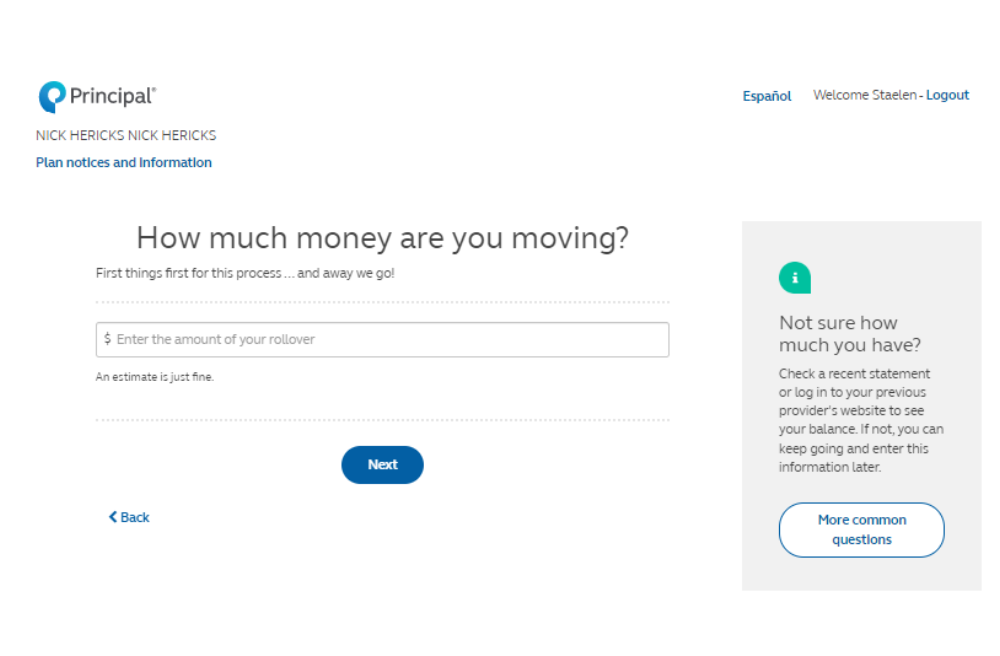

Rollovers

There's also the ability to rollover eligible outside retirement funds to get a holistic view of retirement planning.

Transition experience

Rollovers

For those who have questions, the right side expands and provides some FAQs.

Transition experience

Celebrate progress

Once complete, we celebrate this moment.

Transition experience

Dashboard

Transition experience

Paycheck calculator

Adding the pay and paycheck frequency helps to see how much each paycheck will be impacted.

Transition experience

Paycheck calculator

Increase the percentage rate, and the right rail shows the contribution per paycheck.

Newly eligible: auto-enroll experience

Click anywhere on the screen to keep going.

Newly eligible: auto-enroll experience

Welcome screen

We’ve created a personalized platform to help participants, no matter if it’s a transitioning plan or newly eligible participant. And no matter the plan design.

Newly eligible: auto-enroll experience

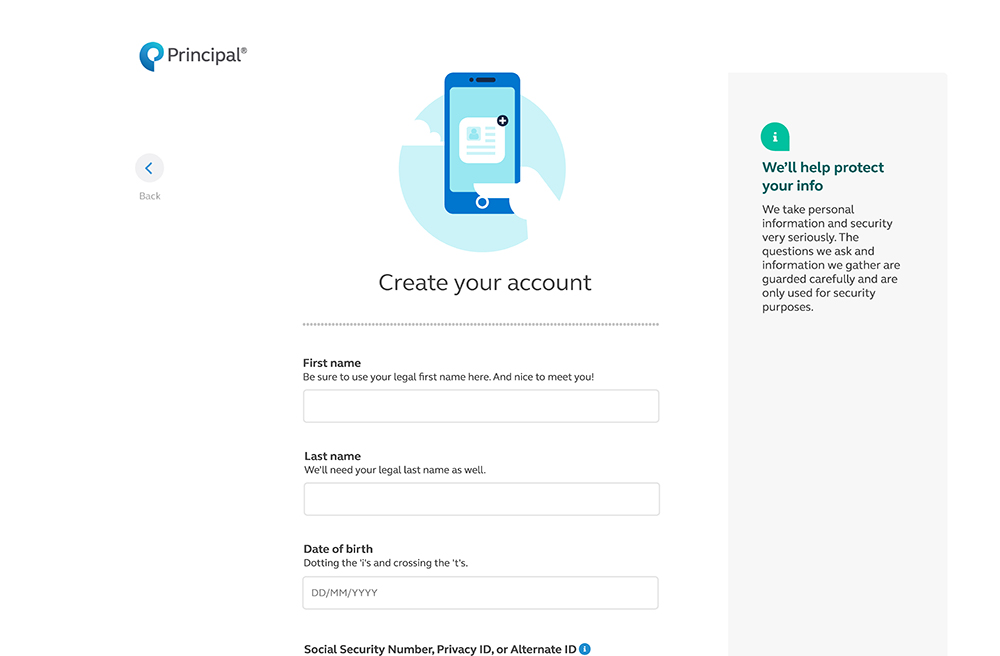

Set up the account

Help secure account access:

-

Create a unique username and strong password

-

Get started with 2-factor authentication

Newly eligible: auto-enroll experience

Starting setup

First up, contributions.

After the account setup process, there's access to applicable required notices. Links to notices will also be available on most screens within the platform.

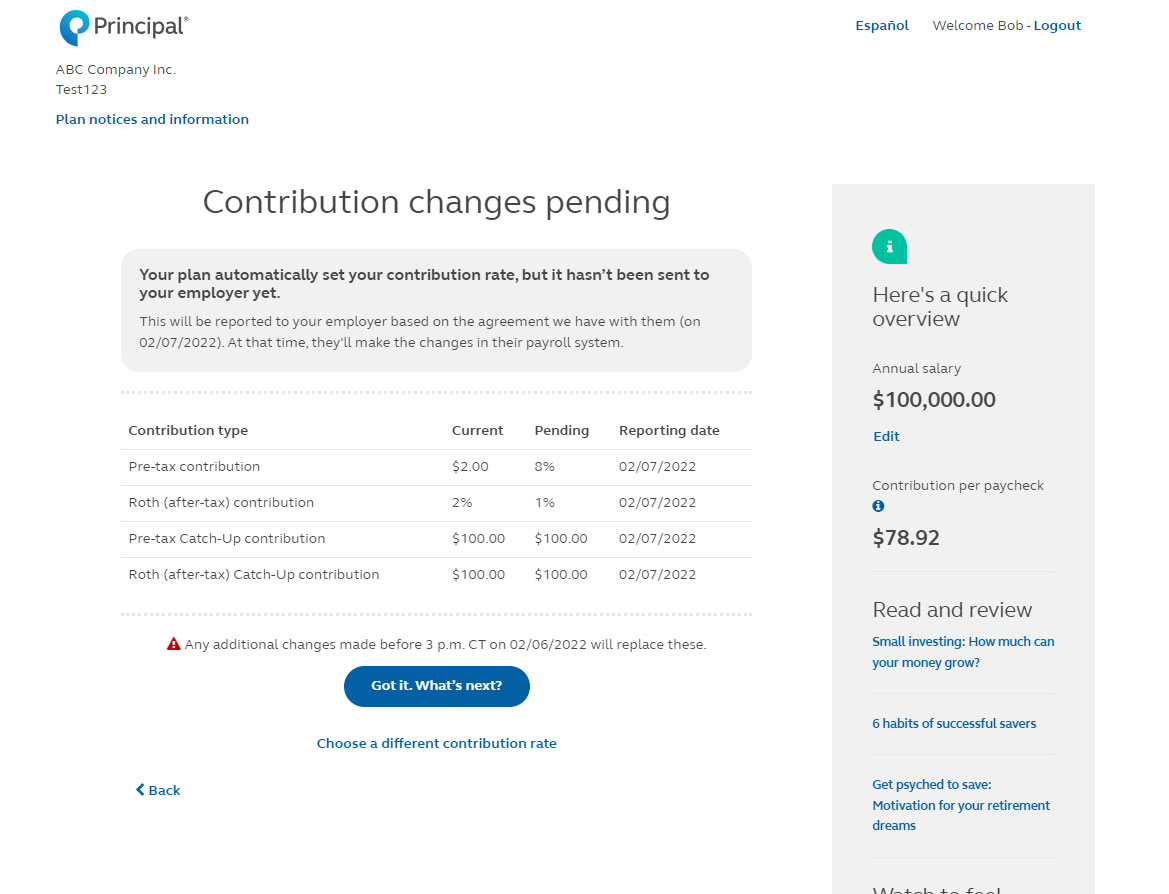

Newly eligible: auto-enroll experience

Contribution changes:

If they’re automatically enrolled, they’ll see pending rate information

Review the pending rate chosen by the organization

Keep the company’s chosen rate or pick a different rate

Newly eligible: auto-enroll experience

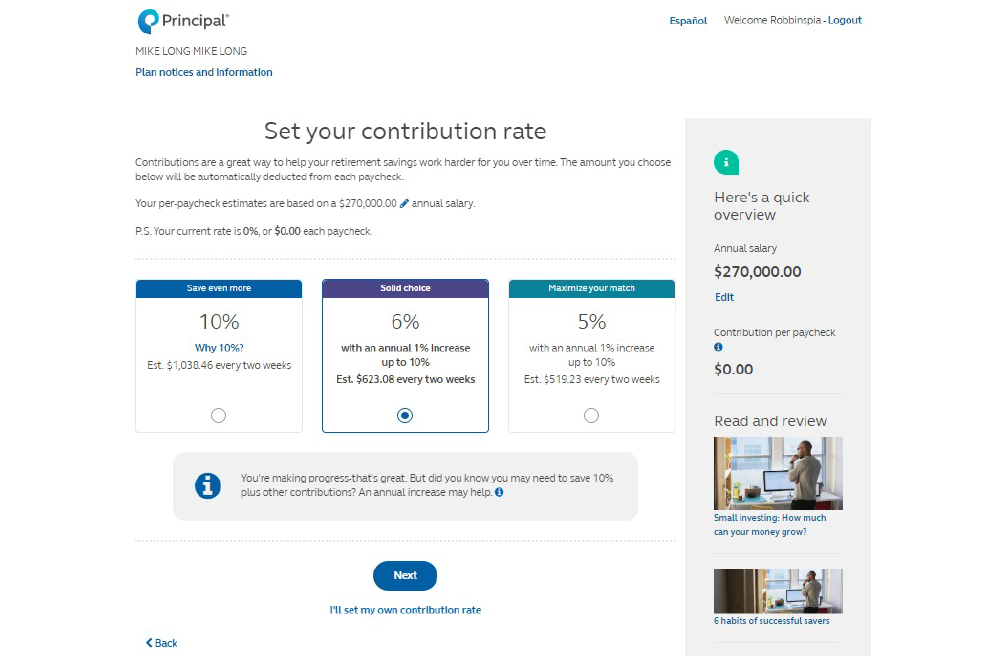

Encourage contributions

The platform includes educational messaging around starting off with saving 10% and information about starting small and building with an annual increase.

Newly eligible: auto-enroll experience

Flexible options

Setting a different rate is also available.

Newly eligible: auto-enroll experience

Roth contributions

The platform provides the ability to split the contributions between pre-tax and Roth (if allowed).

Newly eligible: auto-enroll experience

Annual increase:

Set up an annual increase to the contribution amount (if allowed)

Indicate the annual increase amount

Put a cap on how high their contribution rate should go

Choose the effective date of the increase (if allowed)

Newly eligible: auto-enroll experience

Investment options

Investments can be confusing, so we’re making it simpler to either set investments later—which means going to the plan’s default—or do it now.

Newly eligible: auto-enroll experience

Quick option:

First shown is the Quick Option—chosen by their organization

May be based on normal retirement age and level of comfort with risk

Newly eligible: auto-enroll experience

Explaining investment options

Deciding between all the different investment options is a known pain point. Many don’t feel that they have enough information to make an educated decision, so we’re providing additional context and education about investment options.

Newly eligible: auto-enroll experience

Investment options

For those who want to review all the investment options, the platform includes:

-

Helpful descriptions

-

Access to the investor profile quiz

-

Ability to see the quick option or quick choice (if applicable)* and pre-built and build your own portfolios

*For plans with a QDIA. Features displayed may not be available on all plans – refer to your plan for applicable features. For illustrative purposes only.

Newly eligible: auto-enroll experience

Rollovers

There's also the ability to rollover eligible outside retirement funds to get a holistic view of retirement planning.

Newly eligible: auto-enroll experience

Rollovers

For those who have questions, the right side expands and provides some FAQs.

Newly eligible: auto-enroll experience

Celebrate progress

Once complete, we celebrate this moment.

Newly eligible: auto-enroll experience

The dashboard

On the dashboard, there are additional action items that may not have completed, including adding or reviewing a beneficiary, adding communication preferences, and a link to more retirement planning resources when onboarding is complete.

Newly eligible: auto-enroll experience

Paycheck calculator

Adding the pay and paycheck frequency helps to see how much each paycheck will be impacted.

Newly eligible: auto-enroll experience

Paycheck calculator

Increase the percentage rate, and the right rail shows the contribution per paycheck.

Newly eligible: enroll experience

Click anywhere on the screen to keep going.

Newly eligible: enroll experience

Welcome screen

We’ve created a personalized platform to help participants, no matter if it’s a transitioning plan or newly eligible participant. And no matter the plan design.

Newly eligible: enroll experience

Set up the account

Help secure account access:

-

Create a unique username and strong password

-

Get started with 2-factor authentication

Newly eligible: enroll experience

Starting setup

First up, contributions.

After the account setup process, there's access to applicable required notices. Links to notices will also be available on most screens within the platform.

Newly eligible: enroll experience

Encourage contributions

The platform includes educational messaging around starting off with saving 10% and information about starting small and building with an annual increase.

Newly eligible: enroll experience

Flexible options

Setting a different rate is also available.

Newly eligible: enroll experience

Roth contributions

The platform provides the ability to split the contributions between pre-tax and Roth (if allowed).

Newly eligible: enroll experience

Annual increase:

Set up an annual increase to the contribution amount (if allowed) Indicate the annual increase amount

Put a cap on how high their contribution rate should go Choose the effective date of the increase (if allowed)

Newly eligible: enroll experience

Investment options

Investments can be confusing, so we’re making it simpler to either set investments later—which means going to the plan’s default—or do it now.

Newly eligible: enroll experience

Quick option:

First shown is the Quick Option—chosen by their organization

May be based on normal retirement age and level of comfort with risk

Newly eligible: enroll experience

Explaining investment options

Deciding between all the different investment options is a known pain point. Many don’t feel that they have enough information to make an educated decision, so we’re providing additional context and education about investment options.

Newly eligible: enroll experience

Investment options

For those who want to review all the investment options, the platform includes:

- Helpful descriptions

- Access to the investor profile quiz

- Ability to see the quick option or quick choice (if applicable)* and pre-built and build your own portfolios

*For plans with a QDIA. Features displayed may not be available on all plans – refer to your plan for applicable features. For illustrative purposes only.

Newly eligible: enroll experience

Rollovers

There's also the ability to rollover eligible outside retirement funds to get a holistic view of retirement planning.

Newly eligible: enroll experience

Rollovers

For those who have questions, the right side expands and provides some FAQs.

Newly eligible: enroll experience

Celebrate progress

Once complete, we celebrate this moment.

Newly eligible: enroll experience

Dashboard

On the dashboard, there are additional action items that may not have completed, including adding or reviewing a beneficiary, adding communication preferences, and a link to more retirement planning resources when onboarding is complete.

Newly eligible: enroll experience

Starting setup

First up, contributions (for non-mapping scenarios).

After the account setup process, there's access to applicable required notices. Links to notices will also be available on most screens within the platform.

Newly eligible: enroll experience

Paycheck calculator

Adding the pay and paycheck frequency helps to see how much each paycheck will be impacted.

Newly eligible: enroll experience

Paycheck calculator

Increase the percentage rate, and the right rail shows the contribution per paycheck.

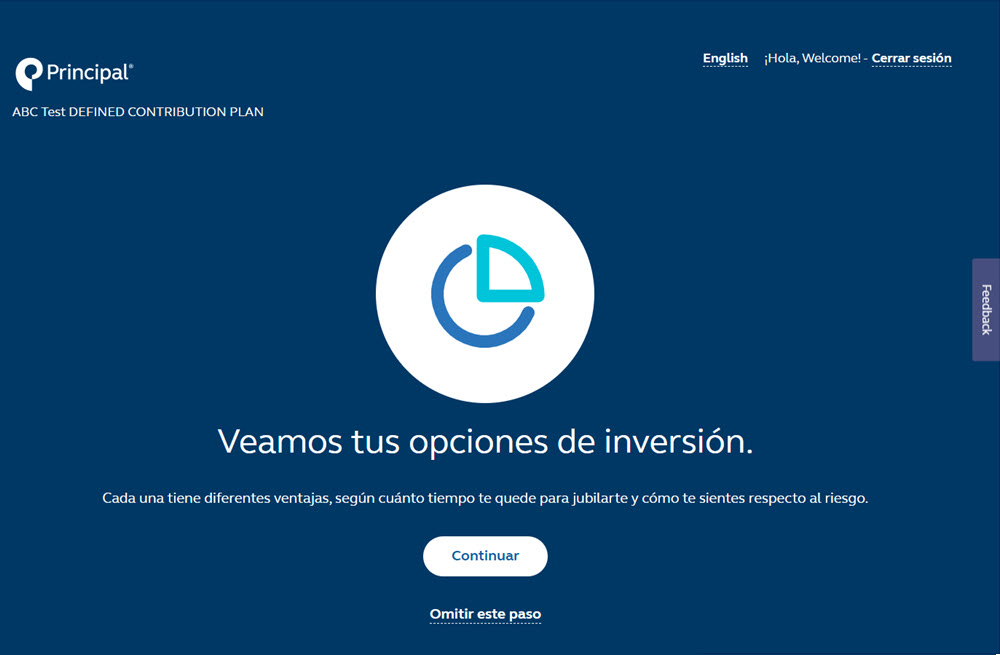

Spanish experience

Click anywhere on the screen to keep going

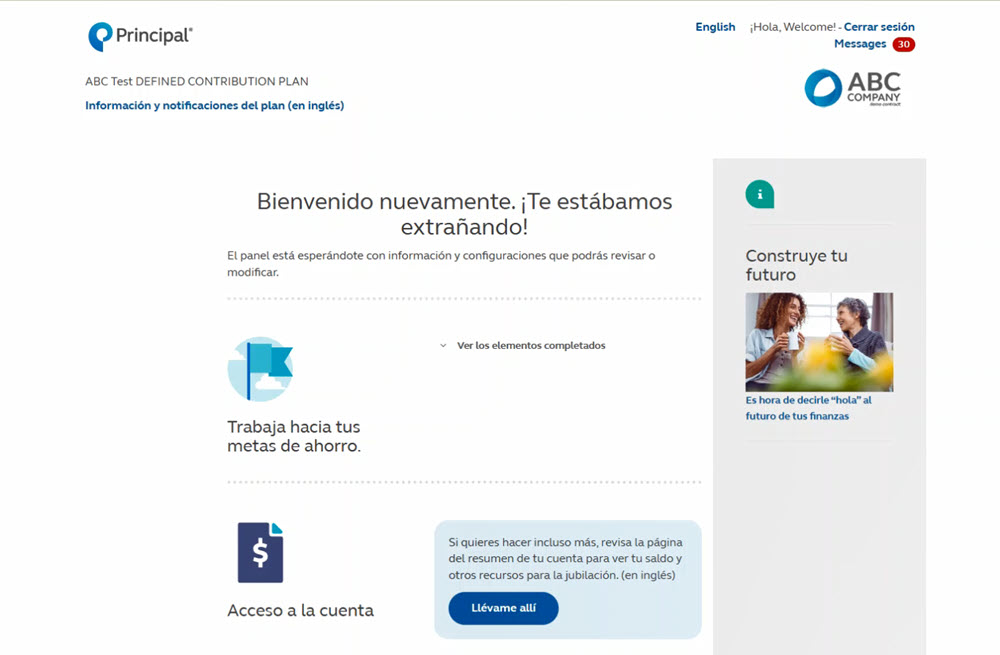

Spanish experience

Welcome screen

We’ve created a personalized platform to help participants, no matter if it’s a transitioning plan or newly eligible participant. And no matter the plan design.

Our experience is also available in Spanish using transcreation not translation. That means we’re using a bicultural approach to how we talk to participants.

Spanish experience

Set up the account

Help secure account access:

-

Create a unique username and strong password

-

Get started with 2-factor authentication

We’ll continue to make enhancements like addressing account setup in Spanish.

Spanish experience

Switch to Spanish

Changing the language on the screen is simply the click of a button.

Spanish experience

Encourage contributions

The platform includes educational messaging around starting off with saving 10% and information about starting small and building with an annual increase..

Spanish experience

Investments

Investments can be confusing, so we’re making it simpler to either set investments later—which means going to the plan’s default—or do it now.

Spanish experience

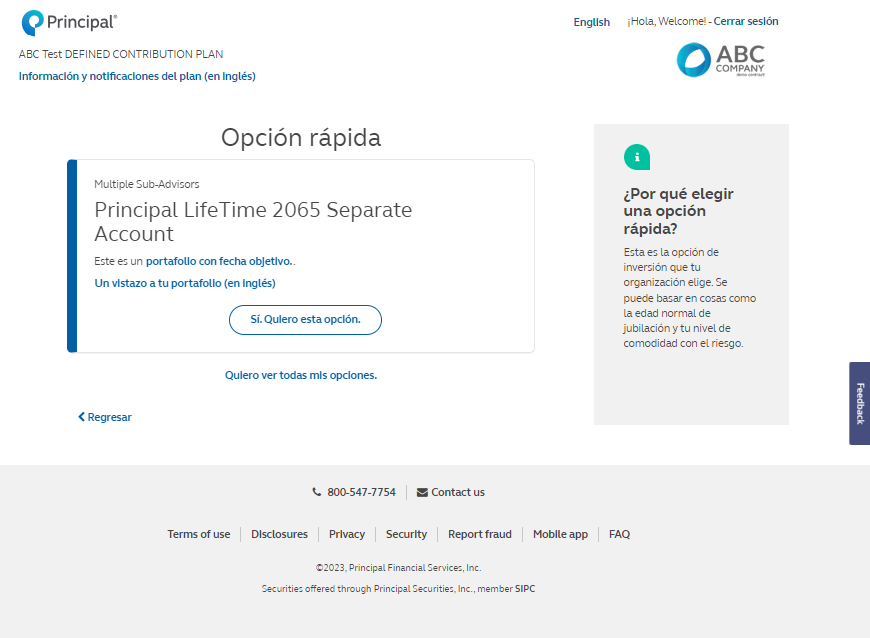

Quick option:

First shown is the Quick Option—chosen by their organization

May be based on normal retirement age and level of comfort with risk

Spanish experience

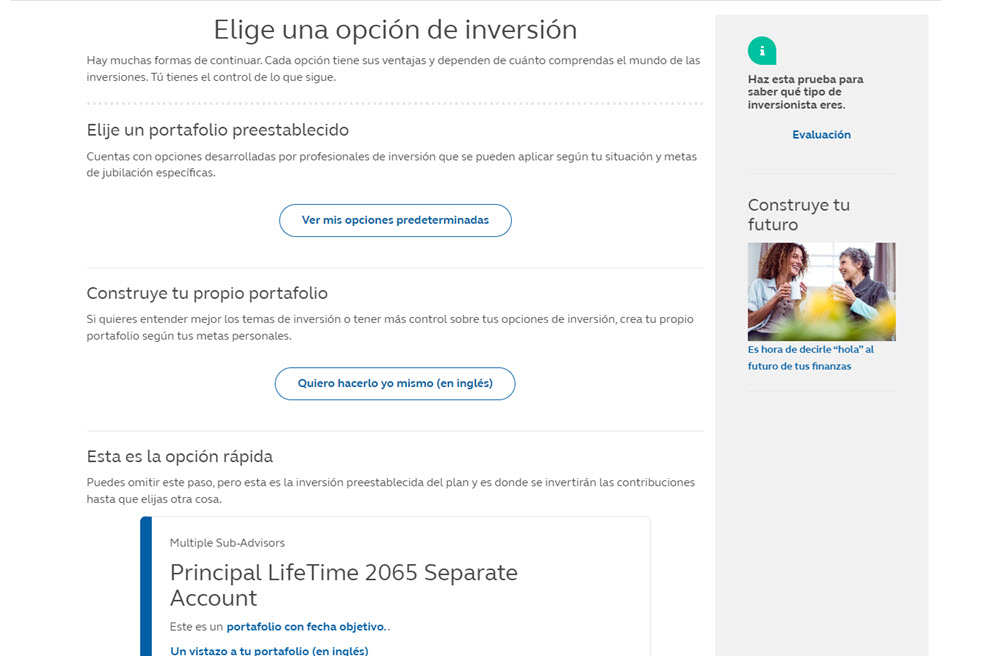

Investment options

For those who want to review all the investment options, the platform includes:

-

Helpful descriptions

-

Access to the investor profile quiz

-

Ability to see the quick option or quick choice (if applicable)* and pre-built and build your own portfolios

*For plans with a QDIA. Features displayed may not be available on all plans – refer to your plan for applicable features. For illustrative purposes only.

Spanish experience

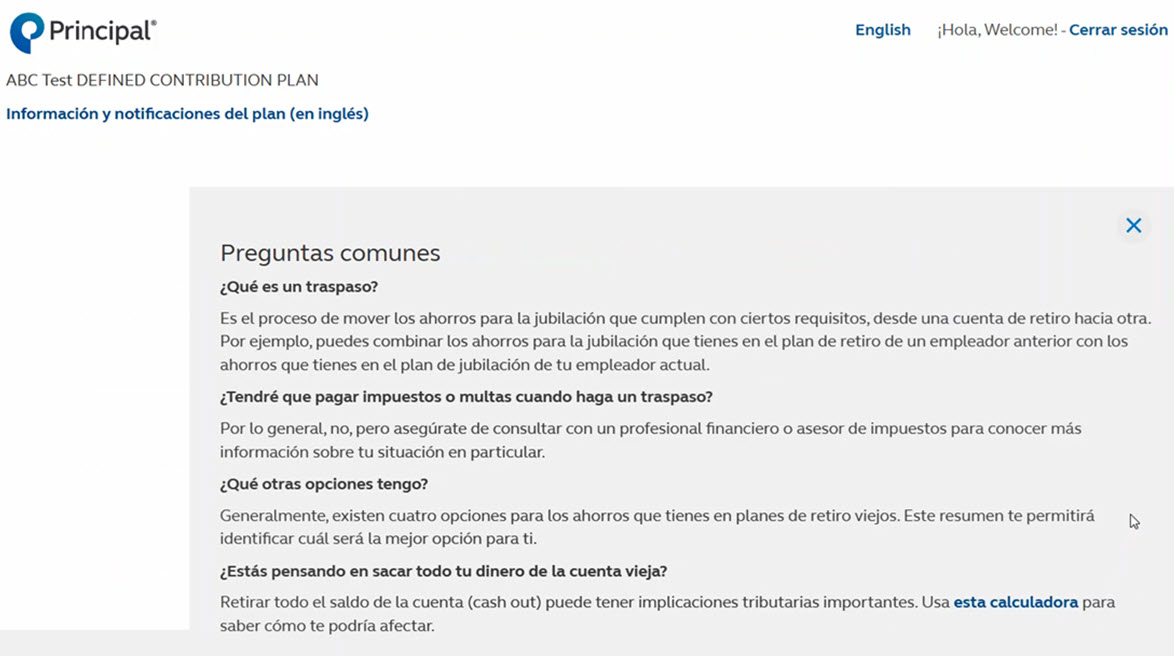

Rollovers

There's also the ability to rollover eligible outside retirement funds to get a holistic view of retirement planning.

Spanish experience

Rollovers

For those who have questions, the right side expands and provides some FAQs.

Spanish experience

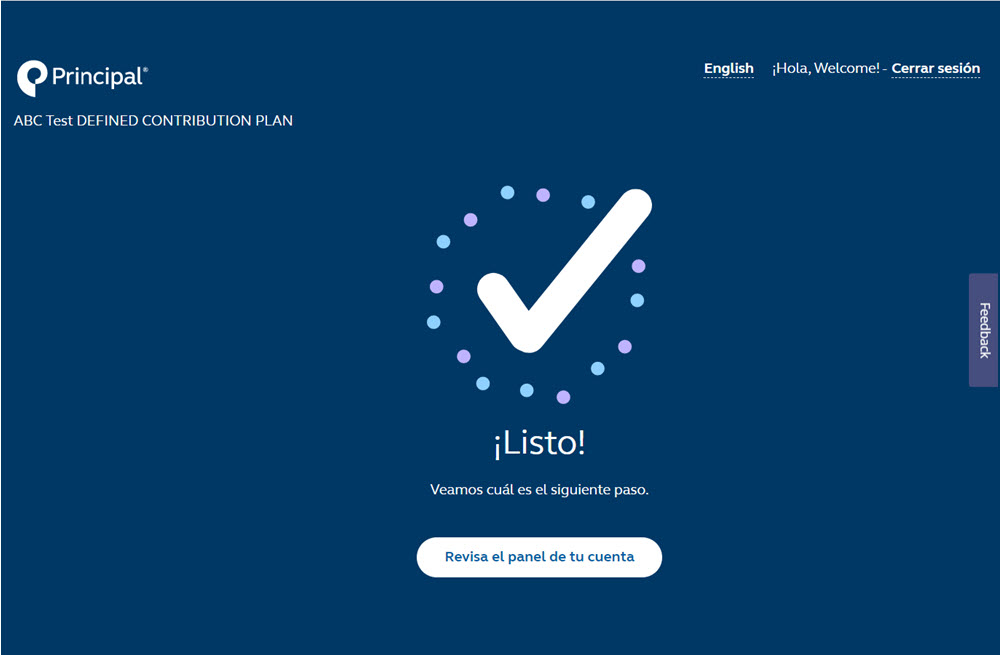

Celebrate progress

Once complete, we celebrate this moment.

Spanish experience

The dashboard

On the dashboard, there are additional action items that may not have completed, including adding or reviewing a beneficiary, adding communication preferences, and a link to more retirement planning resources when onboarding is complete.

Who will see this?

New experience

_contributions.png?v=07172023152945)