Please note the illustration above is hypothetical and doesn’t represent any particular investment. It also can’t be used to predict an expected outcome for your particular situation.

The importance of tax deferral

Maximize your clients' retirement savings goals

The Principal® Pivot Series Variable Annuity offers your clients another tax-deferred savings option. They’ll benefit from compounding interest on both their premium(s) and any interest earned. And there are no IRS contribution limits for nonqualified assets—so they don’t have to restrict their retirement savings goals.

How your clients' investment could benefit from tax deferral:

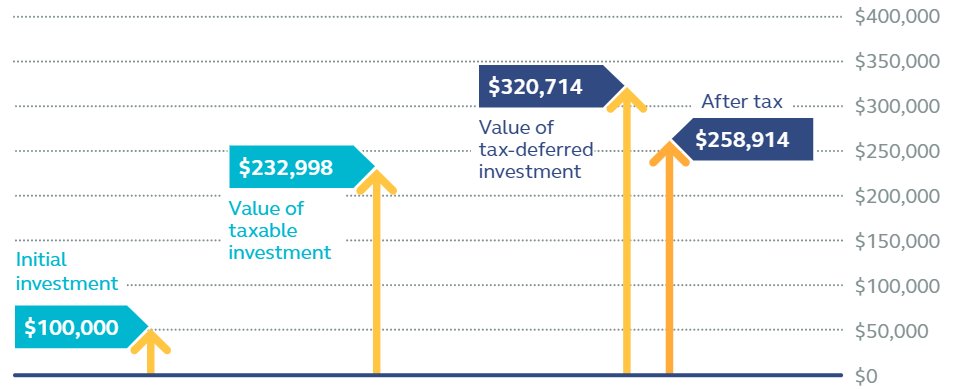

This chart shows a $100,000 investment with and without tax deferral.

$100,000 investment with and without tax deferral

Initial investment

Each investment started with a $100,000 investment compounding 10% per year for 20 years.

Value of taxable investment

The value of the investment that isn't tax-deferred only grows to $232,998 at the end of 20 years because taxes were paid on earnings annually at a tax rate of 28%.

Value of tax-deferred investment

After tax

The value of the tax-deferred investment grows to $320,714 at the end of 20 years. Since taxes aren't paid on any potential earnings, the money compounds faster than if it was taxed. Even after taxes, the accumulated value would be $258,914.

Each investment started with a $100,000 investment compounding 10% per year for 20 years.

The value of the investment that isn't tax-deferred only grows to $232,998 at the end of 20 years because taxes were paid on earnings annually at a tax rate of 28%.

The value of the tax-deferred investment grows to $320,714 at the end of 20 years. Since taxes aren't paid on any potential earnings, the money compounds faster than if it was taxed. Even after taxes, the accumulated value would be $258,914.

Tax management

A client could also elect to take partial distributions from their annuity rather than a lump sum distribution. This allows the remaining accumulated value to continue to grow tax deferred, and the client doesn’t have to pay taxes all at once. This approach gives you flexibility in managing your client’s taxes.

Learn more

Contact your local Principal® rep to ask about variable annuity solutions:

For financial professional use only. Not for distribution to the public.

Annuity products and services are offered through Principal Life Insurance Company. Principal Variable Contracts Funds are distributed by Principal Funds Distributor, Inc. Securities offered through Principal Securities, Inc., member SIPC, and/or independent broker/dealers. Referenced companies are members of the Principal Financial Group®, Des Moines, Iowa 50392, principal.com.

Tax-qualified retirement arrangements such as IRAs, SEPs, and SIMPLE-IRAs are tax-deferred. You derive no additional benefit from the tax-deferral feature of the annuity. Consequently, an annuity should be used to fund an IRA, or other tax-qualified retirement arrangement, to benefit from the annuity’s features other than tax deferral. These features may include guaranteed lifetime income, death benefits without surrender changes, guaranteed caps on fees, and the ability to transfer among investment options without sales or withdrawal charges.

Guarantees are based on the claims-paying ability of the issuing insurance company.

All guarantees and benefits of the insurance policy are backed by the claims-paying ability of the issuing insurance company. Policy guarantees and benefits are not obligations of, nor backed by, the broker/dealer and/or insurance agency selling the policy, nor by any of their affiliates, and none of them makes any representations or guarantees regarding the claims-paying ability of the issuing insurance company.

Contract rider descriptions are not intended to cover all restrictions, conditions or limitations. Refer to rider for full details.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and service marks of Principal Financial Services, Inc., in various countries around the world.

2874476-052023