Now's the right time for the small plan market

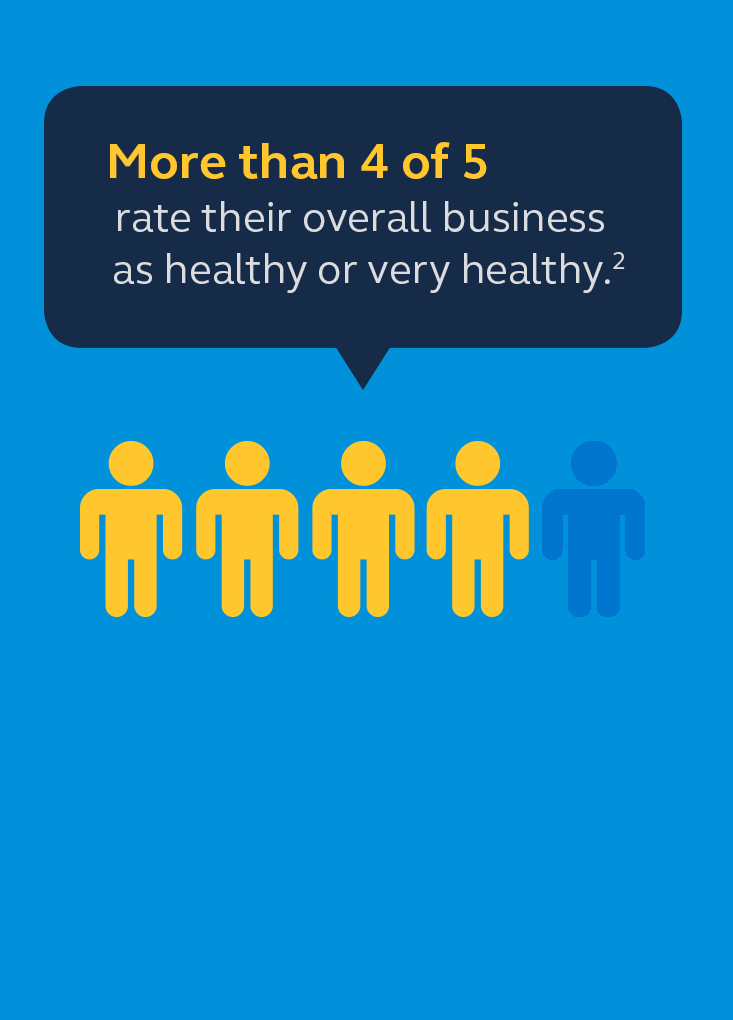

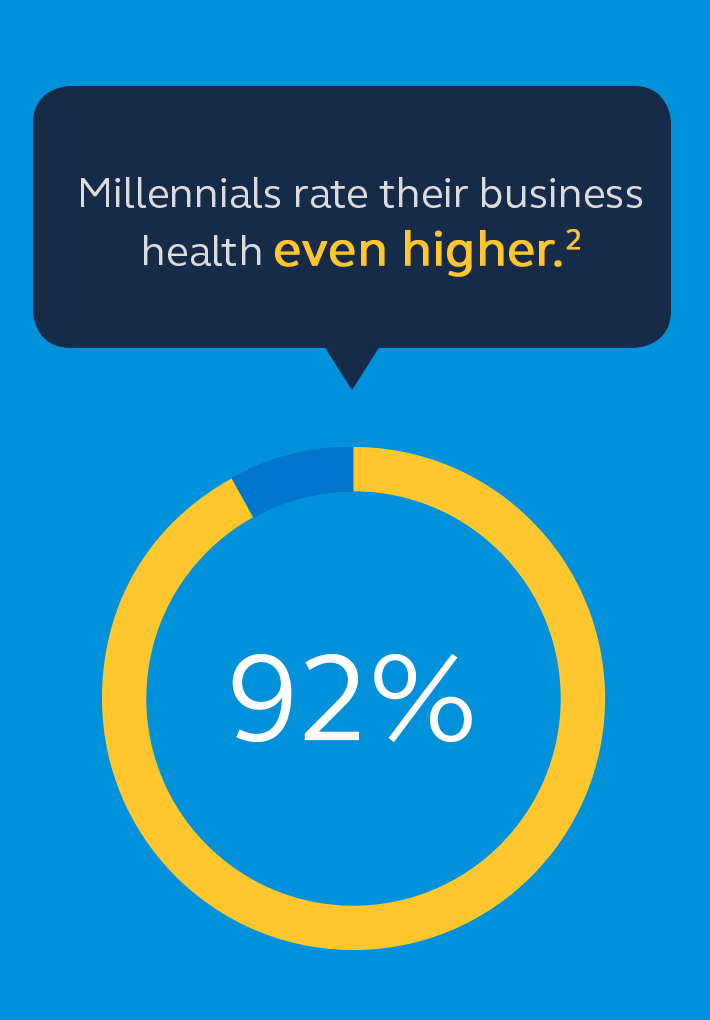

Small businesses continue to show growth in income, jobs and number of employer firms.1 With the market rapidly changing, it’s time to take a fresh look.

In talking to business owners, conducting research and analyzing trends, we’ve uncovered a better sense for what’s really happening. Small business owners tell us they’re ready to hire and it doesn’t appear to be slowing down anytime soon. That makes this market ripe for benefits right now with more opportunities than ever before.

Use our data-driven perspectives to get a handle on this evolving market. And find out how it can influence your business.

Business

environment

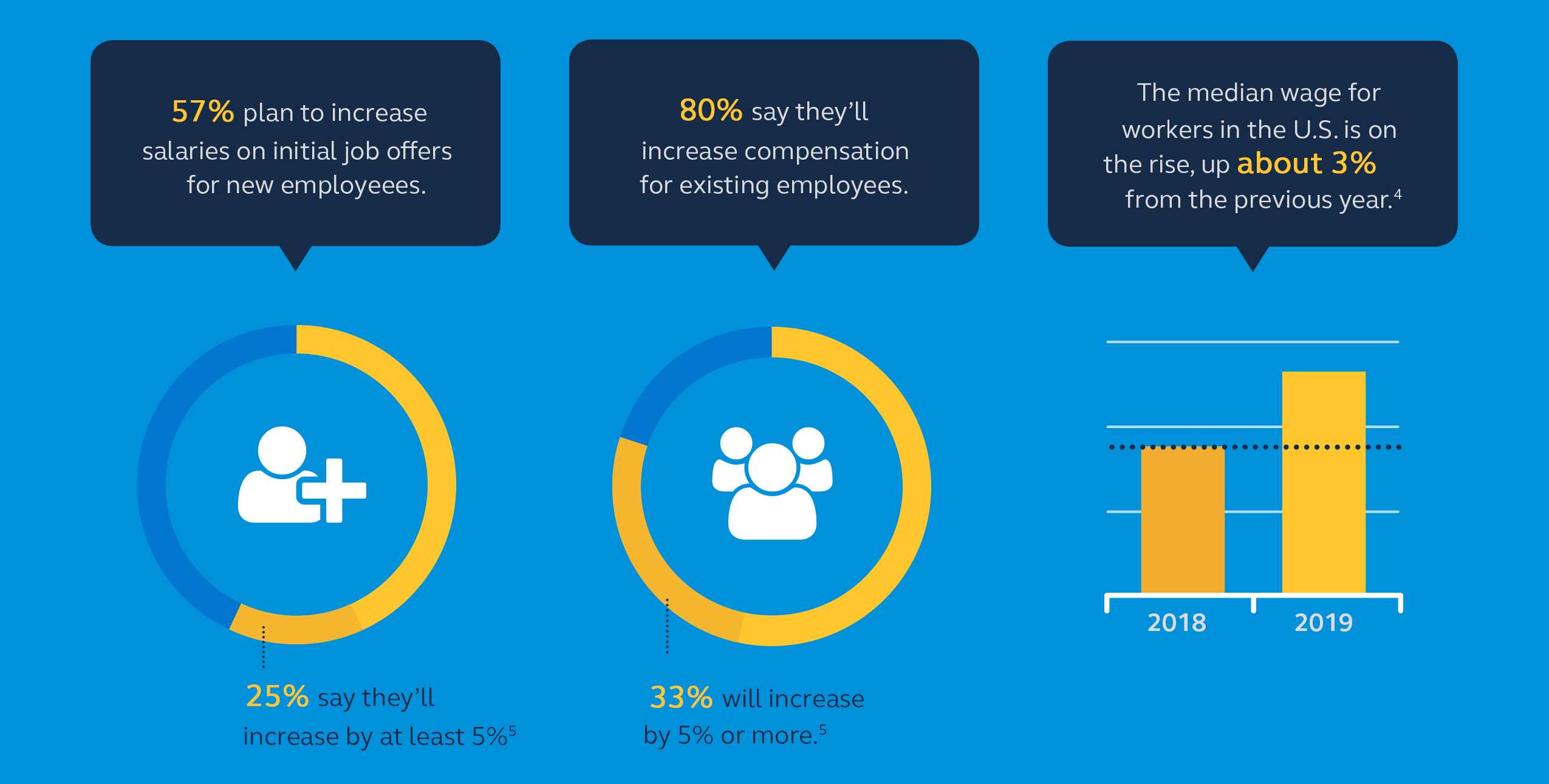

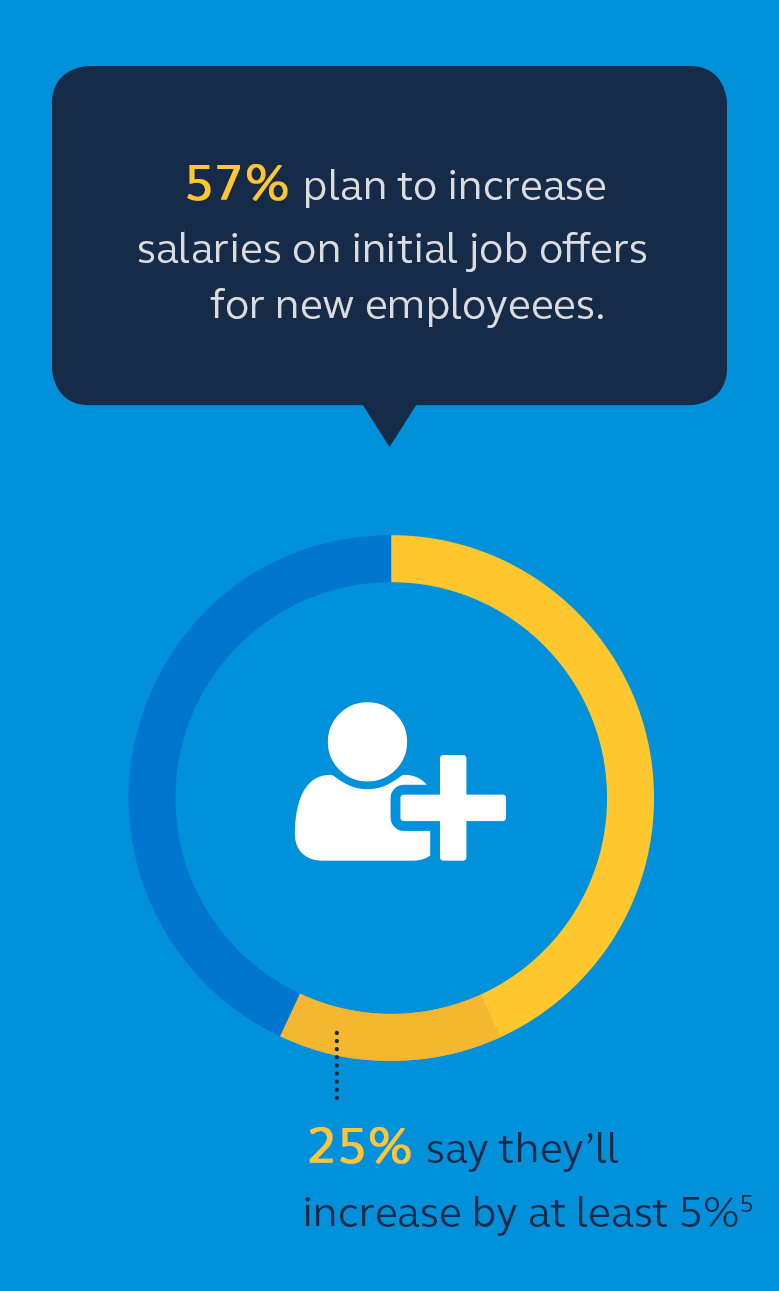

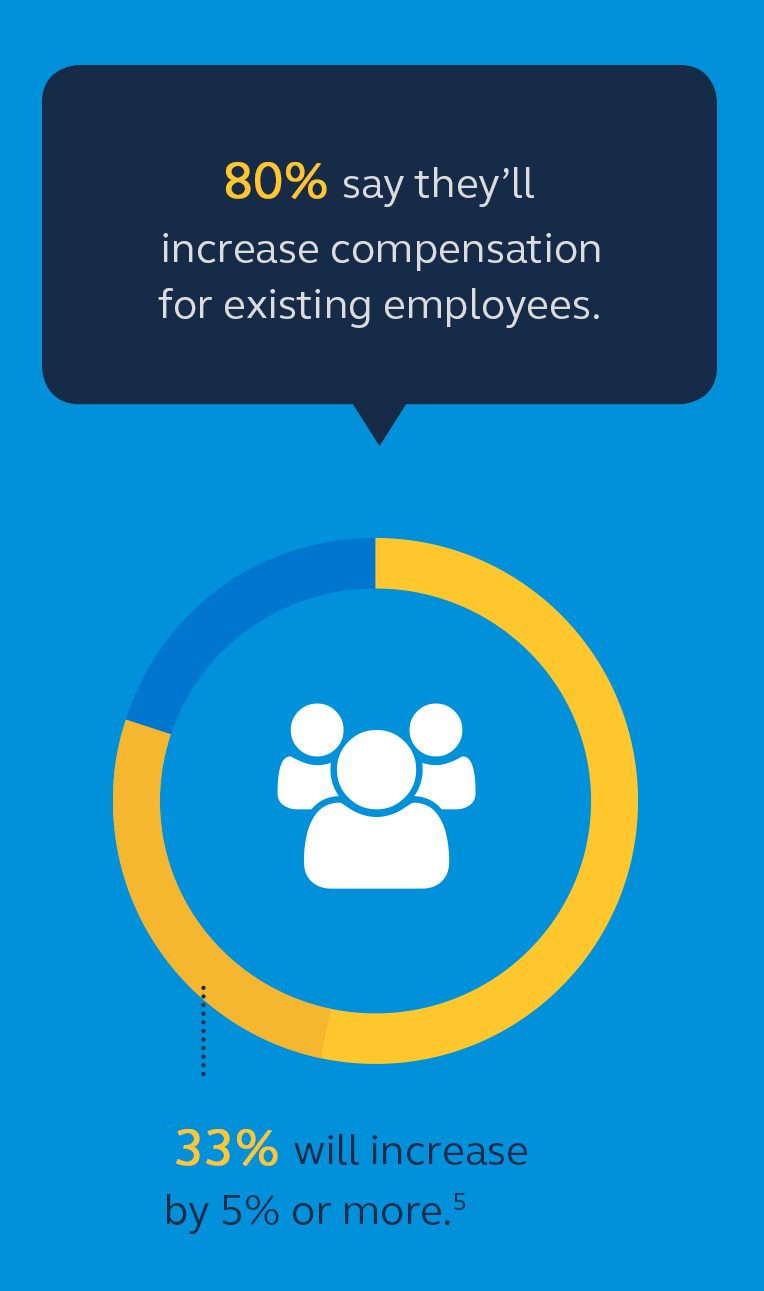

Competition

for talent

Right time for

your practice

+

=

Business

environment

Competition

for talent

Right time for

your practice

+

=

Business

environment

Competition

for talent

Right time for

your practice

+

=

Business

environment

Competition

for talent

Right time for

your practice

+

=

Small- to medium-sized business (SMB)

500 or fewer employees

Small- to

medium-sized

business (SMB)

medium-sized

business (SMB)

500 or fewer employees

- Business environment

- Competition for talent

- Right time for your practice

>

Get all the details

Startup plans for less than 100 employees

Simply Retirement by Principal®Startup plans - $10 million in AUM

Principal® EASE$1 million - $10 million

Principal® IMPACT>

Get all the details

Startup plans for less than 100 employees

Simply Retirement by Principal®$1 million - $10 million

Principal® IMPACT