Investments pack an emotional punch for retirement savers

Understanding their concerns can help you best support their needs.

Our survey uncovers several simple ways financial professionals and plan sponsors can help investors feel more confident about their investments—and their overall retirement security.

What you should know:

- Investors generally don’t know what they don’t know—and that worries them.

- Guidance is something investors are generally hungry for, and they’re typically looking for it earlier in their careers. (But they tend to be concerned about the costs.)

Findings show a correlation between the availability of financial resources and professional advice and investors being more confident. Investment education could be key to boosting investor know-how.

FINDING 1

Investors have lots of concerns and little confidence.

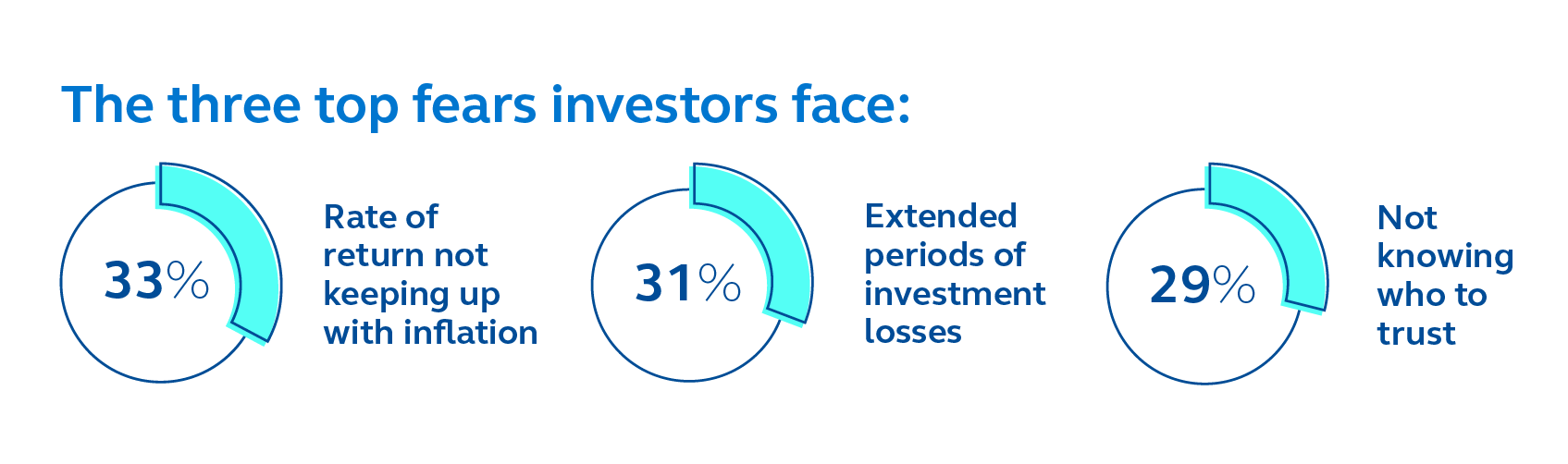

Investing can often be an emotional experience, filled with questions and concerns. The three top fears investors face:

With these concerns heavy on their minds, investors sometimes don’t feel good about making investment decisions:

But, this is a known issue to most investors and they want to make positive changes in their investment strategies going forward—like working with a financial professional.

.png?v=08242022175117)

Considerations: This opens a door for financial professionals and business decision makers to step in and help investors connect with educational resources and financial advice. We see confidence levels increase by a dramatic 85.7% when investors are offered support from a financial professional.

FINDING 2

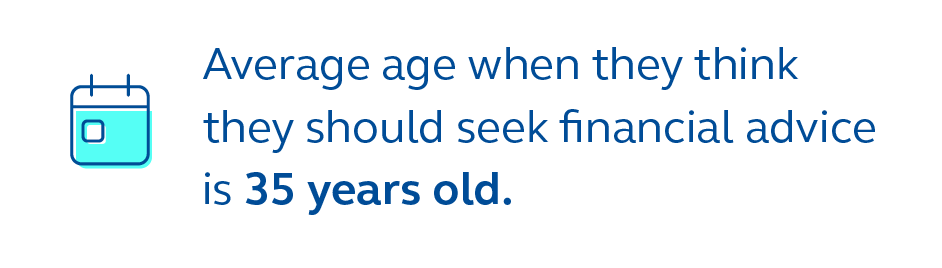

Investors generally want advice, and are typically looking for it earlier in their savings journey. But, they tend to worry about the associated costs.

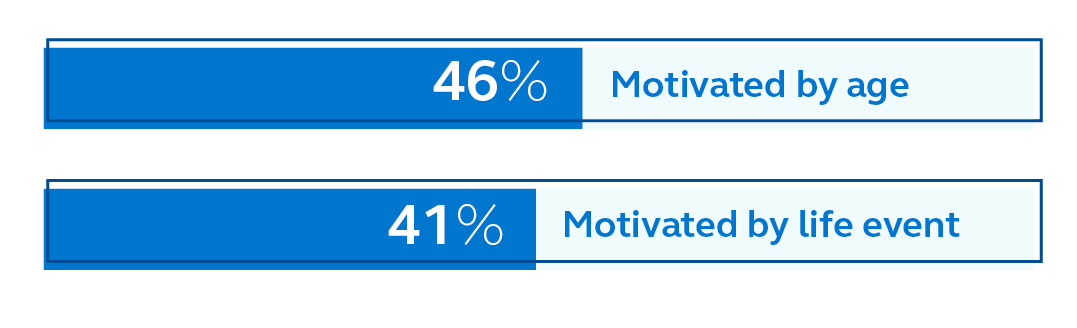

Many investors don’t connect needing financial advice when their salary increases or savings account balances rise. Instead, they cite major milestones—like reaching a certain age or starting a family—as the inspiration to work with a financial professional.

What’s holding them back? Cost is the number one reason investors don’t seek out professional financial advice.

What many younger investors may not know is that their employer’s current retirement plan or employer may already offer built-in financial professional services (with no additional costs necessary). This, combined with the plan’s qualified default investment alternatives (QDIA) and explaining QDIA benefits, could be valuable and easy ways for them to help build their retirement security—and their investment know-how and confidence.

"I was never taught anything about investing and I need all the help I can get so I can retire comfortably someday"

Considerations: Help investors, particularly younger retirement savers, see the dotted line between healthy financial behaviors and the value of investing in professional financial advice.

Building a relationship with younger retirement savers may contribute to healthier savings behaviors--particularly with many retirement savers starting families and growing careers in their 20s and 30s. By inspiring this group of investors to build strong financial habits and work with a financial pro earlier in their careers, they’ll be on track to build stronger retirement security in their futures.

Want to know more?

Kick-start conversation with clients and gain access to retirement-planning and investment resources (including client guides, educational articles, and checklists) by visiting:

Reach out to your Principal® representative for additional information to help people better prepare for retirement.

SURVEY METHODOLOGY AND RESPONDENTS

Online survey

20-minute survey conducted by Principal®

Field dates

May 4, 2022 – May 16, 2022

Respondents

698 workers

Margin of error

+/- 3.7% for workers at the 95% confidence level

Qualifications

Workers: age 18+, U.S. resident, has a retirement plan with services by Principal

Background

Principal® conducts periodic “pulse” surveys with customers, employers, financial professionals, and consultants to gain insights into timely topics.

The survey findings reported here explore consumer concerns and actions surrounding saving for retirement, financial behaviors related to market volatility, and current events.

Important information

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, investment or tax advice. You should consult with appropriate counsel, financial professionals, and other advisors on all matters pertaining to legal, tax, investment or accounting obligations and requirements.

Insurance products and plan administrative services provided through Principal Life Insurance Company®, a member of the Principal Financial Group®, Des Moines, IA 50392.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

© 2022 Principal Financial Services, Inc.

PQ13157 | 2064751-032022 | 3/2022