RetireView® Demo

What type of investor are you?

RetireView® is an investment educational service with 25 different models using a variety of different levels of risk and associated asset classes.

How models are created

Comfort level

with risk

- Conservative

- Moderate conservative

- Moderate

- Moderate aggressive

- Agressive

Years to

retirement

- 21+ years

- 16-20 years

- 11-15 years

- 6-10 years

- ≤ 5 years

The asset allocation percentages within the models are created by Morningstar Investment Management LLC, an independent third party. They’re designed for a wide range of situations and consider comfort with risk and time until retirement. Models are populated with the plan’s investment options suggesting a mix of investment options that may be right for the participant.

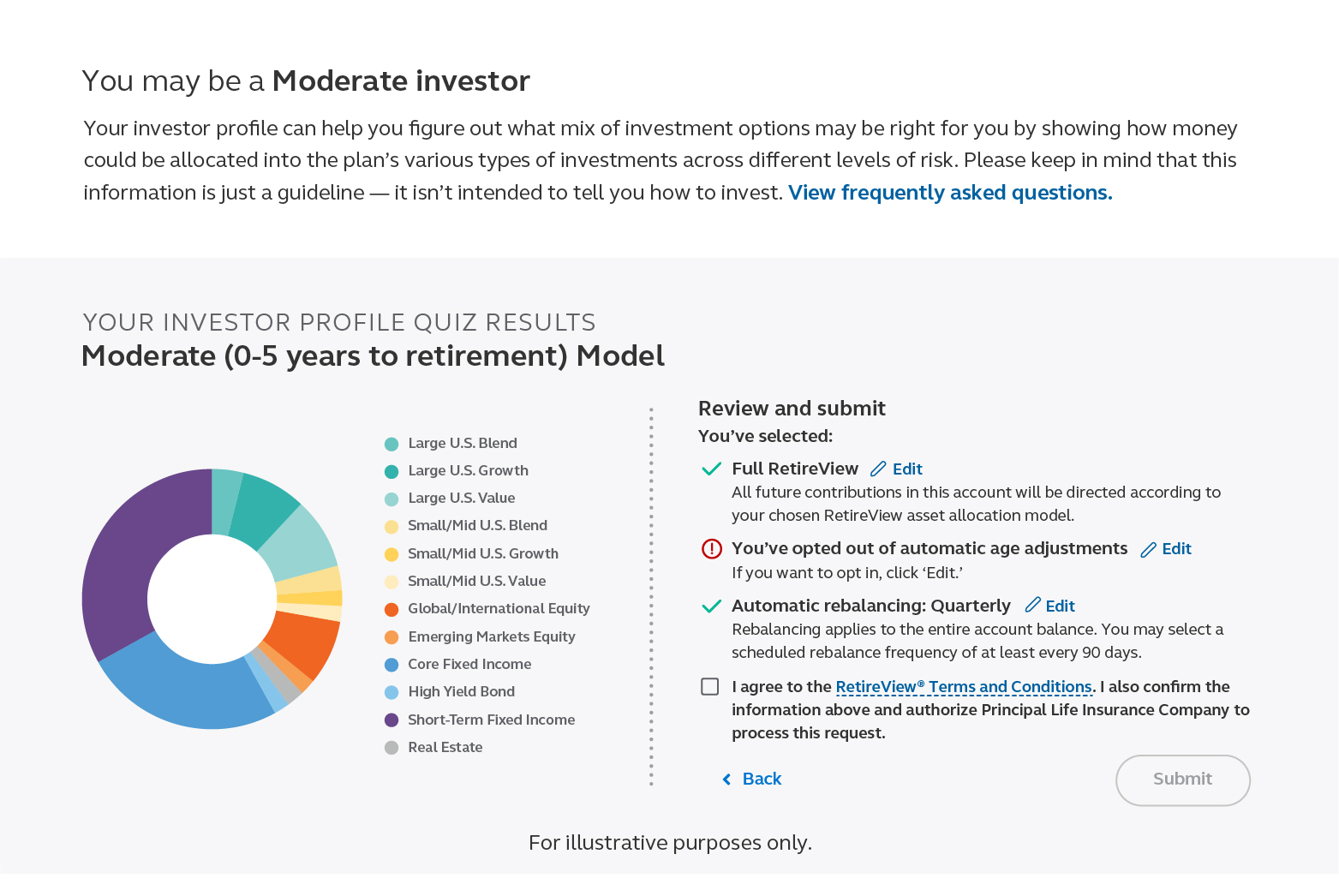

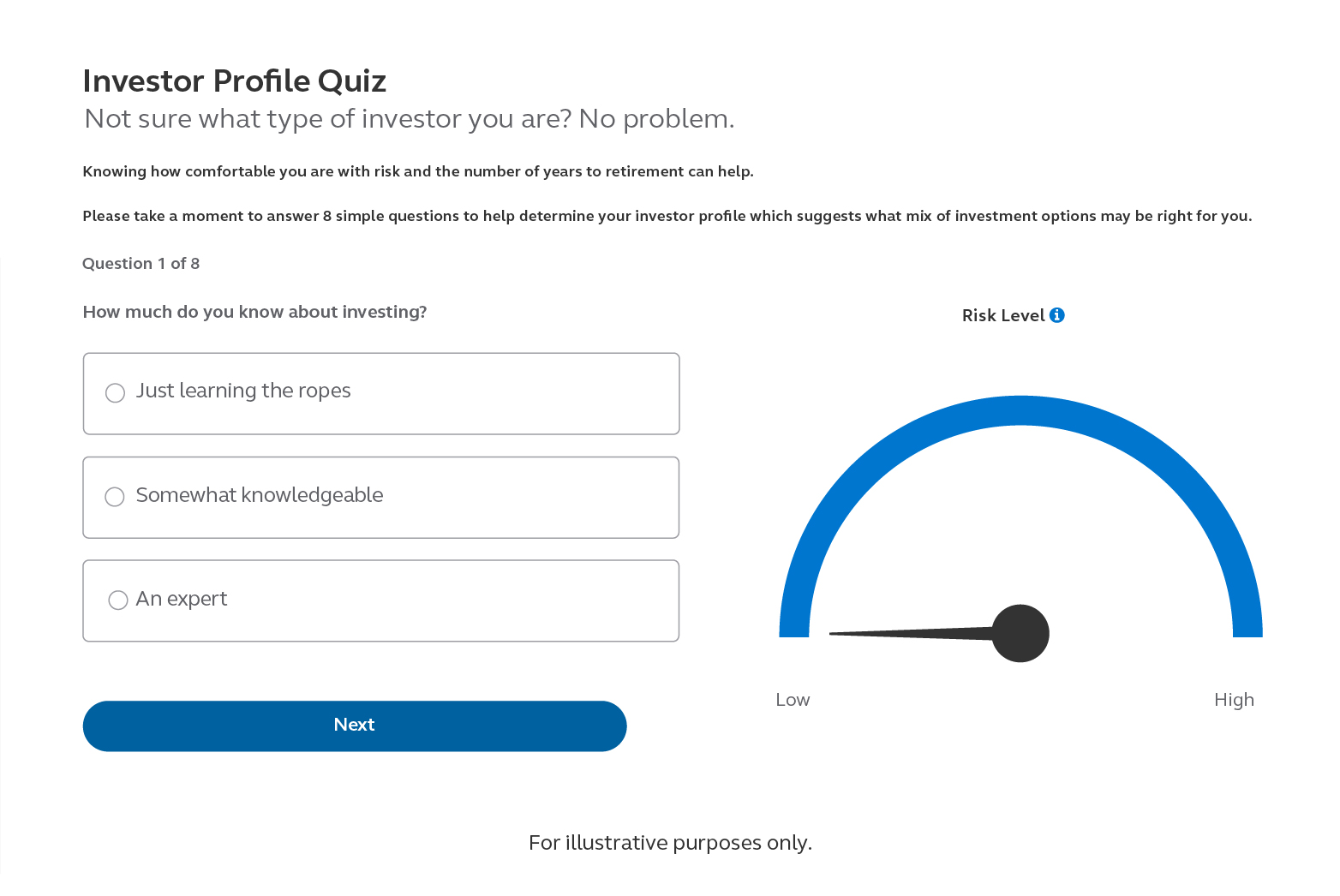

RetireView® Investor Profile Quiz

Participants can start by taking the investor profile quiz to see how comfortable they are with risk. Start by answering eight simple questions to help determine which RetireView model may be right for the participant.

Access the Participant RetireView investor profile quiz at: Principal.com/RetireViewIPQ

A few more things about RetireView

Percentages within

models are

updated annually

Check-in on your account

at least annually or as

significant events occur

Morningstar Investment Management makes model updates annually to reflect current market conditions. Money in the account, as well as future contributions, will be reallocated according to the most current RetireView model, unless the plan sponsor has opted out of this feature. Reviewing the model at least annually or as life changes occur is suggested to help keep in line with goals.

Important Information

Morningstar Investment Management LLC is not an affiliate of any company of the Principal Financial Group.

Equity investment options involve greater risk, including heightened volatility, than fixed-income investment options. Fixed-income investments are subject to interest rate risk; as interest rates rise their value will decline. Small and mid-cap stocks may have additional risks including greater price volatility. International and globalinvestment options are subject to additional risk due to fluctuating exchange rates, foreign accounting and financial policies, and other economic and political environments. Asset allocation does not ensure a profit or protect against a loss. Fixed-income and asset allocation investment options that invest in mortgage securities are subject to increased risk due to real estate exposure. Review the RetireView Terms and Conditions for a full discussion of the features of this service, including rebalancing and automatic age adjustment of the populated models. Investing involves risk, including possible loss of principal.

RetireView® is an educational service designed to help retirement plan participants determine an appropriate investment mix for their retirement account. Principal retained Morningstar Investment Management LLC, a registered investment adviser and subsidiary of Morningstar, Inc., to create asset class-level model portfolios (“Models”) for RetireView. In no way should Morningstar Investment Management’s creation of the Models be viewed as advice or establishing any kind of advisory relationship with Morningstar Investment Management. Morningstar Investment Management does not endorse and/or recommend any specific financial product that may be used in conjunction with the Models. Morningstar Investment Management LLC is not an affiliate of any company of the Principal Financial Group.

Models are created by Morningstar Investment Management LLC. Morningstar Investment Management begins by analyzing asset classes and constructs long-term expected returns, standard deviations, and correlation coefficients. These form the inputs for the mean-variance optimization, a statistical technique. Because forecasting is a critical and pivotal step in the asset allocation process, Morningstar Investment Management develops proprietary capital market forecasts for each asset class using a combination of historical data, current market information and additional analysis. Each forecast becomes an input in portfolio creation.

The Models are intended to be used as an additional information source for retirement plan participants making investment allocation decisions. Pursuant to the Department of Labor’s Definition of Investment Education, such models (taken alone or in conjunction with this document) do not constitute investment advice for purposes of the Employee Retirement Income Security Act (ERISA), and there is no agreement or understanding between Morningstar Investment Management and us or any plan or plan fiduciary, or any participant who uses this service, under which the latter receives information, recommendations or advice concerning investments that are to be used for any investment decisions relating to the plan. Accordingly, neither we nor Morningstar Investment Management are a fiduciary with respect to your plan sponsor’s plan for purposes of this service, including the features of rebalancing and aging. Following an asset allocation Model does not ensure a profit or protect against a loss. Performance of the individual Models may fluctuate and will be influenced by many factors. In applying particular asset allocation Models to their individual situations, participants or beneficiaries should consider their other assets, income and investments (e.g., equity in a home, Social Security benefits, IRA investments, savings accounts and interests in other quailed and nonqualified plans) in addition to their interests in the plan.

© 2024 Morningstar Investment Management LLC. All rights reserved.

Morningstar Investment Management LLC is a registered investment adviser and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. This questionnaire is provided as education and informational only. As a retirement plan participant, you should consult with your financial professional about your responses to this questionnaire and other relevant factors that you should consider before making an allocation decision. The questionnaire is made available through a license agreement with the Principal Financial Group® and use by a participant in no way establishes a relationship (including advisory relationship) between the participant and Morningstar Investment Management LLC. Past performance does not guarantee future results.

Insurance products and plan administrative services provided through Principal Life Insurance Company®. Securities ordered through Principal Securities, Inc., member SIPC and/or independent broker-dealers. Referenced companies are members of the Principal Financial Group®, Des Moines, IA 50392.

For additional information visit us at principal.com.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and service marks of Principal Financial Services, Inc., in various countries around the world.

For financial professional/institutional use only.

© 2024 Principal Financial Services, Inc. | 3497101-042024