- Health insurance

- Paid time-off/vacation time

- Workplace retirement plan

Retirement outlook by role

What your clients think now

Everyone has a unique outlook and their own opinions, but workplace roles and experiences can color those views. When talking with retirement plan sponsor clients or prospects, the role your contact has at the organization likely influences much of what they think and feel.

Principal® conducts quarterly surveys of plan sponsor clients and individuals to bring you insights that should help you tailor your approach and recommendations and likely bring more success.*

Here's what we found when comparing C-suite respondents and those in human resources (HR) roles.

Common ground

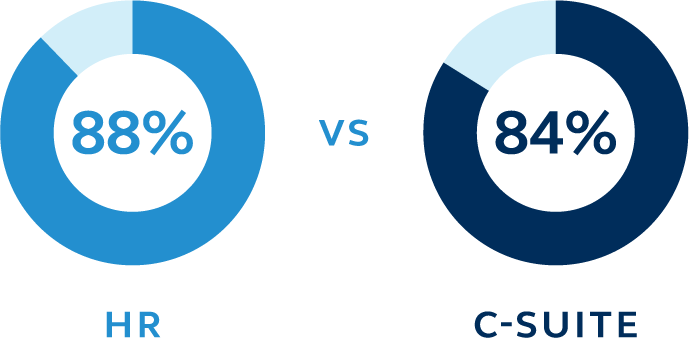

They agree when it comes to the top three benefits employees find of interest:

They both feel:

Responsible for offering a workplace retirement plan

Responsible for offering financial wellness solutions

Participants want more investment education

Under-informed about their plan's QDIA option

Takeaway: People in both roles have a common understanding of employees’ needs—take the opportunity to educate on and underscore the importance of the plan’s QDIA.

C-suite focuses on the big picture

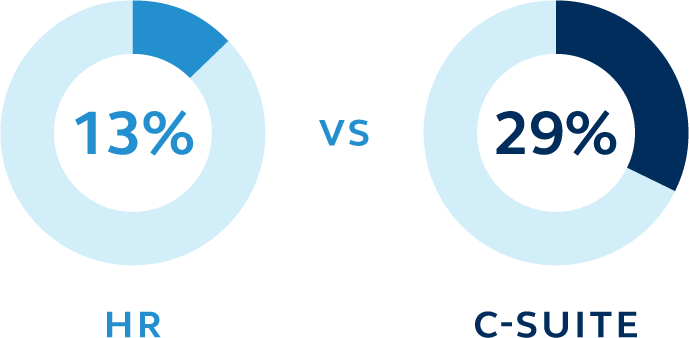

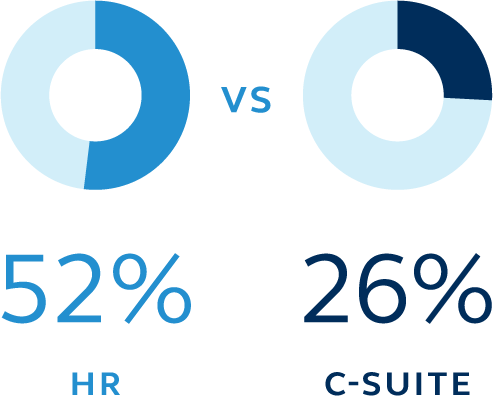

Optimism that economic conditions will improve over the next 12 months:

HR

13%

C-SUITE

41%

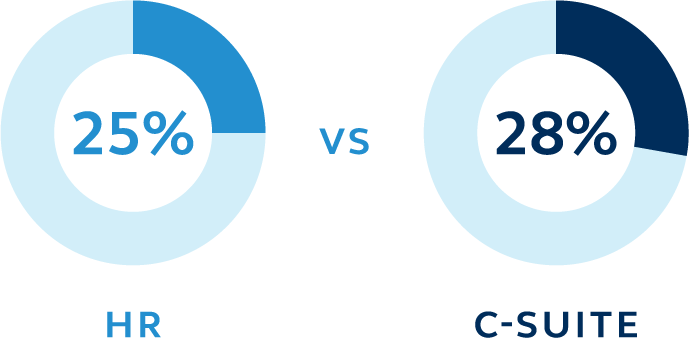

Regarding plan fees, the feeling that the company—rather than participants—should pay them:

Retirement plan success metrics are driving the C-suite’s area of focus more than HR:

Takeaway: Be cognizant of the different outlook on economic conditions and share any insights you might have. Know who makes the fee decisions—and who influences them—and tailor your approach accordingly. And add more focus to improving plan metrics when talking with the C-suite.

Perspective from the frontline: HR feels the heat on talent retention/acquisition

HR reports:

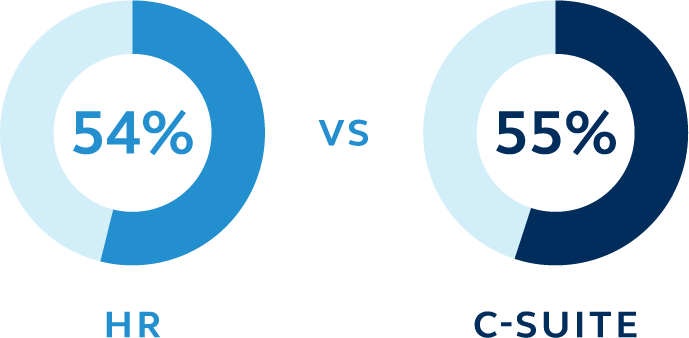

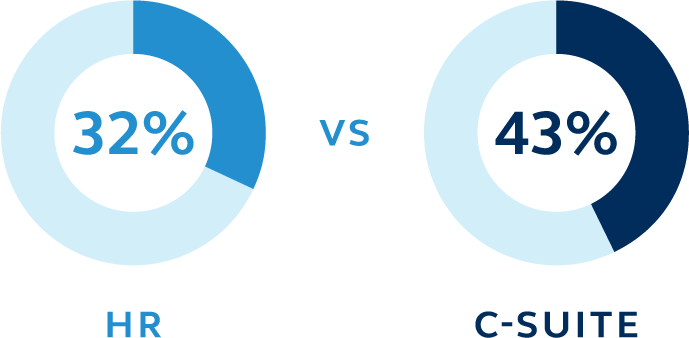

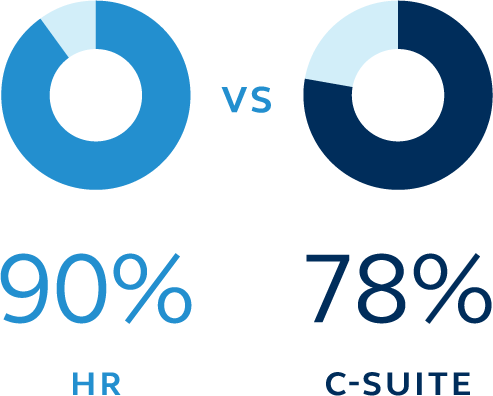

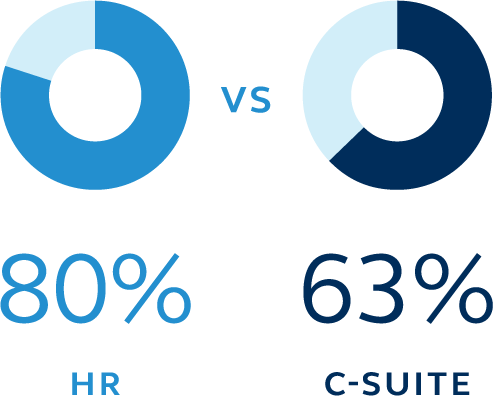

More concern for increased competition for talent:

Struggling to find qualified candidates:

Experienced more turnover:

And they’re more worried about COVID-19’s impact on participants’ saving and investing decisions:

HR

C-SUITE

63%

Takeaway: Both groups are concerned, but HR is clearly on the front lines of these issues. Reinforce the positive power of retirement benefits when it comes to recruiting and retention, especially with HR. The C-suite may be interested in strengthening the retirement offering, too, so make sure to touch on how a stronger plan will likely have better success metrics.

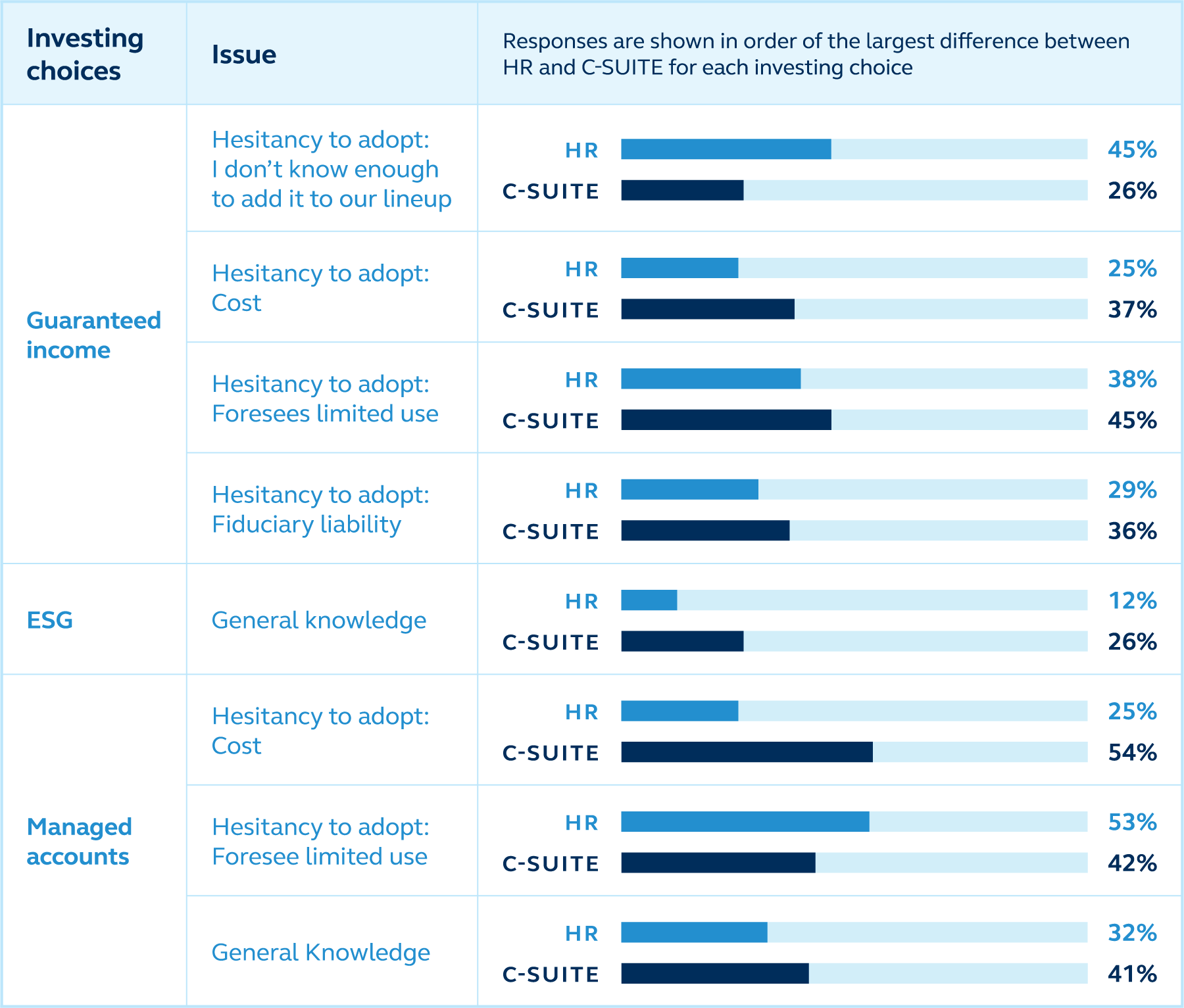

New investing choices—and the reservations

Investing choices

Issue

Responses are shown in order of the largest difference between HR and C-SUITE for each investing choice

Hesitancy to adopt: I don't know enough to add it to our lineup

HR

45%

C-SUITE

26%

Hesitancy to adopt: cost

HR

25%

C-SUITE

37%

Guaranteed income

Hesitancy to adopt: foresees limited use

HR

38%

C-SUITE

45%

Hesitancy to adopt: fiduciary liability

HR

29%

C-SUITE

36%

ESG

General knowledge

HR

12%

C-SUITE

26%

Hesitancy to adopt: cost

HR

25%

C-SUITE

54%

Managed accounts

Hesitancy to adopt: foresee limited use

HR

53%

C-SUITE

42%

General knowledge

HR

32%

C-SUITE

41%

Takeaway: General knowledge of these investing choices needs a boost. Help your client understand the purpose—and the demand—for them. Remind your clients to keep employee demographics in mind. Both managed accounts and guaranteed income are likely to appeal more to those with an older employee base.

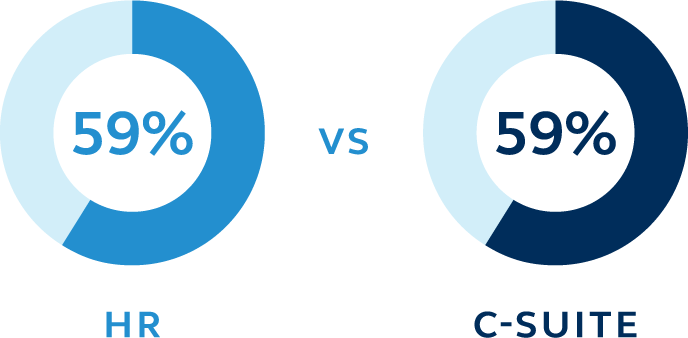

Opinions differ on the participant education needs

Topic

Responses are shown in order of the largest difference between HR and C-SUITE

Rolling in prior retirement savings

HR

34%

C-SUITE

7%

Increased financial literacy

HR

61%

C-SUITE

37%

Increasing deferral

HR

39%

C-SUITE

20%

Retirement planning/mid-career actions

HR

54%

C-SUITE

35%

When to open additional retirement savings account/IRA

HR

34%

C-SUITE

17%

When to reallocate savings

HR

58%

C-SUITE

43%

Inflation's impact on retirement

HR

29%

C-SUITE

15%

Selecting investments

HR

56%

C-SUITE

46%

Knowing when to retire

HR

34%

C-SUITE

26%

When/how to plan retirement income

HR

42%

C-SUITE

37%

Options with retirement savings upon job change

HR

24%

C-SUITE

19%

Increasing investment knowledge

HR

59%

C-SUITE

59%

Takeaway: HR has stronger feelings about the education needs of employees, centering on financial wellness and investments. Know your audience and touch on the topics they find necessary—unless you feel you need to educate and advocate for something missing in their plans’ education program.

What's driving them to focus on the retirement plan offering?

Topic

Responses are shown in order of the largest difference between HR and C-SUITE

Cost to the organization

HR

31%

C-SUITE

49%

Helping employees achieve financial security

HR

73%

C-SUITE

57%

The impact of COVID-19 on employees

HR

17%

C-SUITE

4%

Feedback from employees surveys

HR

14%

C-SUITE

2%

Employee demographics

HR

32%

C-SUITE

22%

The increase of hiring new employees

HR

25%

C-SUITE

19%

Increase in employees leaving/retiring

HR

14%

C-SUITE

8%

Takeaway: The great news here is that employee financial security drives both groups with the highest response. But differences abound and the issue of cost fits nicely in the C-suite’s focus on the bottom line and program metrics. Conversely, HR’s proximity to all employees drives their attention to the people impacted, as shown by more focus on demographics, employee feedback, and worry about the impacts of COVID-19. Consider what might be motivating your contact and hit those points to better meet their needs.

Next steps

Resources to use with clients:

We’re here to help you be successful in the overarching goal to help people achieve financial security. Starting with market intel and understanding your clients’ motivations can improve your recommendations.

- Principal® Business Needs Assessment

- Principal® Benefits Design Tool

- Retirement plan fee information

- Navigating business now – site to share with plan sponsor clients

For you:

As you prepare for conversations with clients or prospects, reach out to your Principal representative for additional perspective on these topics.

Fore more client insights, bookmark our Principal® retirement research and thought capital site.

* All data presented here, unless noted, is from the Principal® Retirement Security Survey, Plan Sponsor Results, September 2021 (Q3).

Principal®, Principal Financial Group® and the Principal logo design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and service marks of Principal Financial Services, Inc., in various countries around the world.

2006419-022022 | 02/2022