Have a client starting a small business retirement plan? That’s a great idea.

A retirement program can help your client and their employees.

Reap the benefits

Your client may be able to get tax deductions for starting and contributing to a qualified retirement plan. If they have never had a 401(k) or 403(b) plan, there’s a tax credit for starting one.

Save on expenses, too. Businesses that have never had a 401(k) or 403(b) plan may claim tax credit of 50% of startup costs for the first three years.1

They're not required to make an employer or "matching" contribution. But if they do contribute, the amount is tax deductible, up to a certain limit.

Recruit and reward

Giving employees benefits is a great way to make sure they’re happy, loyal to the organization and ready to help the business succeed.

Pay is one thing, but retirement benefits are another (hint: they want both)

- 81% of employees, regardless of age, say a retirement plan is important. In fact, it’s prioritized as the second most valuable benefit, only behind medical insurance.2

- The #1 reason employers offer benefits/perks is to retain current employees.3

Retire

It’s a win-win! A retirement program helps your clients' employees save for retirement and your clients save for their own retirement. And employees retiring on time can help your clients' bottom line.

Employees count on their employer retirement plans.

Workers rely on their workplace retirement plans as a source of income – 8 in 10 believe this will be a major or minor source of income in retirement.4

Participating in a retirement plan helps drive retirement confidence. When employees (or their spouses) have money in a plan, they’re nearly twice as likely (78%) as those without money in a plan (41%) to be very or somewhat confident they’ll have enough money to live on throughout retirement.4

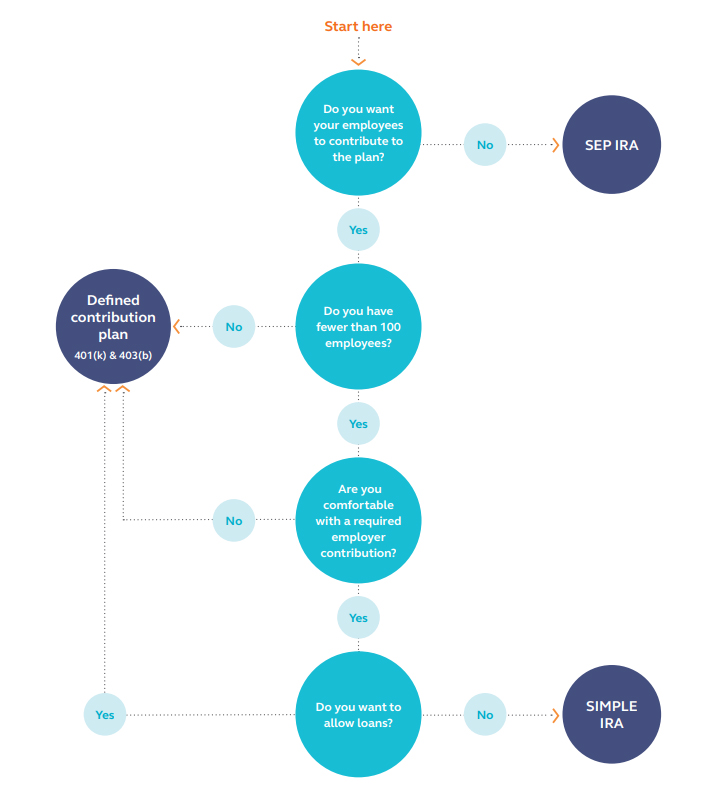

Types of retirement plans

- DC Plans

Pooled Employer Plan (PEP)

SEP IRA

- SIMPLE IRA