Need Help? 800-952-3343, ext. 41722

Monday through Friday, 7:30 a.m. – 7 p.m. CT

1-800-952-3343

ext. 41722

Learn how a 401(k) plan can help you and your employees.

Learn how a 401(k) plan can help you and your employees.

Business is changing. What about your benefits?

With small businesses growing at a record pace, it’s getting a lot harder to attract and retain good talent. To stay competitive, your benefits may need a refresh.

In the past, cash was king. Today, total benefits rule. A growing number of employees say they prefer a retirement plan over a pay raise.1 And 4 in 5 small business employees now expect their employer to offer a plan such as a 401(k).2

A retirement plan is no longer just a "nice to have." It's now seen as a "need to have" benefit for you to remain competitive and keep your employees satisfied. Now's the time. Don't let not having a retirement plan be the reason why you lose your business's most valuable asset — your people.

Yes, we have a SEP or SIMPLE IRA.

Yes, we have a 401(k) plan.

No, we don't offer a retirement plan.

I don't know.

Why start a 401(k) plan?

Helps you and your employees save for retirement.

Helps attract and retain top talent.

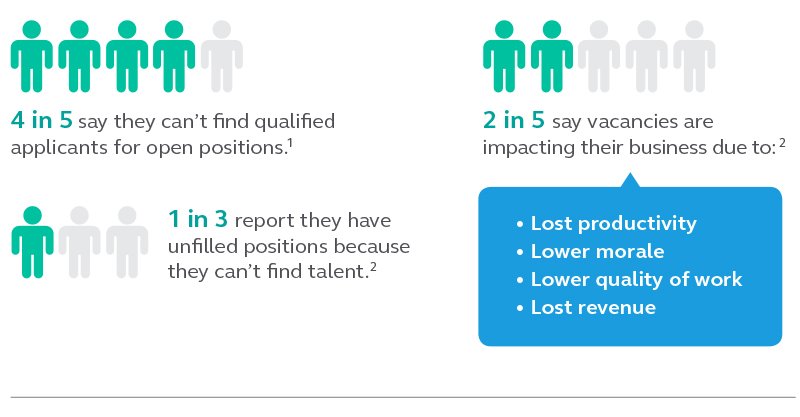

Small employers are feeling the impact of the current "talent war".

Small employers want to hire, but ...

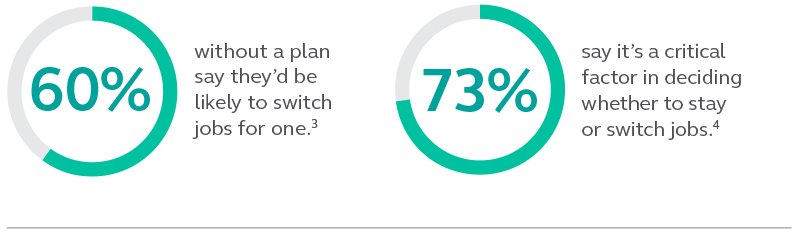

Employees could be willing to leave their current employer for one who offers a retirement plan.

How many employees are really willing to go?

Employees could be willing to sacrifice for better benefits.

Given a choice of a salary increase or retirement plan:

2 in 5 choose the retirement plan.5

4 in 5 say they'll take a minimal pay cut (3.6%) to get better benefits from their employer.6

1. March 2018 Report: Small Business Optimism Index, NFIB, April 2018.

2. Survey Reveals 5 Small Business Hiring Trends for 2018, CareerBuilder, Jan. 16, 2018.

3. Annual Retirement Survey of Workers, Transamerica Center for Retirement Studies, December 2016.

4. The State of Employee Benefits, EBRI, April 2018.

5. Employees Want Plan Features That Accelerate Retirement Savings, American Century Investments, 2017.

6. Experience a more human workplace: U.S. Employee Benefit Trends Study, MetLife 2018.

HZ2950D | 535021-062018

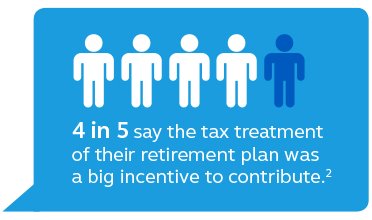

Provides tax advantages for you — and employees.

Employers can get tax incentives for helping employees get on track for retirement.

Never had a plan?

Employers with >100 employees may claim tax credit of 50% of startup costs for first three years1.

Willing to contribute?

You can deduct matching contributions from the business's income, up to a certain limit.

Employees get tax benefits too.

Contributions are made pre-tax — helping to reduce taxable income.

Assets in the plan grow tax-deferred.

And they appreciate it.

1. Limited to $500 per tax year.

2. American Views on Defined Contribution Plan Saving, Investment Company Institute (ICI), February 2018.

HZ2950E | 535021-062018

Starting a 401(k) plan at your small business could make a big difference.

It can help boost morale, loyalty and, most importantly, retirement savings for employees.

Employers and their businesses benefit too.

When employers added a retirement plan, it helped alleviate their talent concerns.

• 9 in 10 say it helped attract and retain employees.6

• Half reported attracting better quality employees.7

• 9 in 10 say it had a positive impact on employee performance.6

Employers said it helped them too.

• 1 in 3 say offering a 401(k) reduced personal taxes and business taxes.7

And most importantly, employers who offer a plan are more financially prepared for retirement themselves, as it's a great savings vehicle for them as well.

Have questions or want more information? We're here to help!

800-952-3343, ext. 41722

Monday through Friday, 7:30 a.m. – 7 p.m. CT