Inside your client’s mind:

Thinking, saving, and planning for retirement

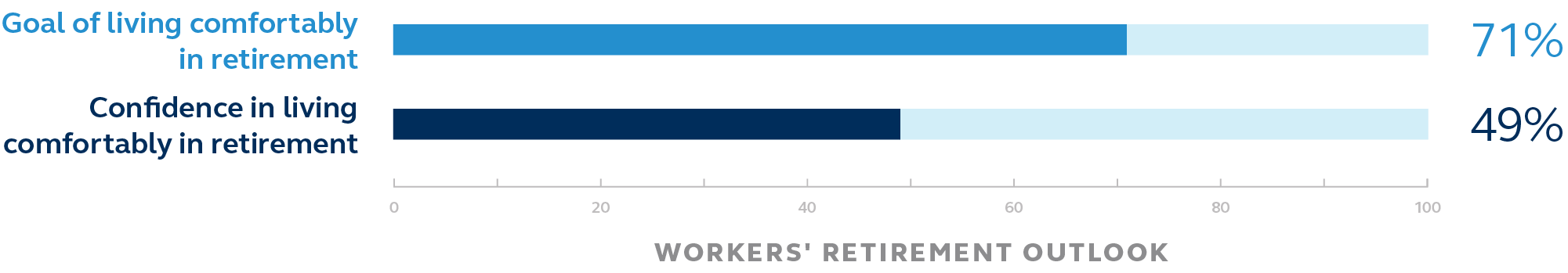

Americans look forward to retirement, yet new findings from our research show that a large percentage are uncertain about what retirement will look like for them, when they should retire, and how they will pay for it all. The survey results reveal a significant gap between workers’ priority to live comfortably in retirement and their confidence in achieving that priority.

Plan sponsors are aware of the confidence gap too, and many are concerned for workers’ financial well-being in retirement.

Just 39% of plan sponsors feel their employees are doing a good job preparing for retirement.

A mere 15% of plan sponsors feel their employees will have enough money saved to live comfortably in retirement.

Only 33% of plan sponsors feel their former employees who have retired have the knowledge to manage their retirement savings successfully.

FINDING 1

Workers consider different influences when determining when to retire.

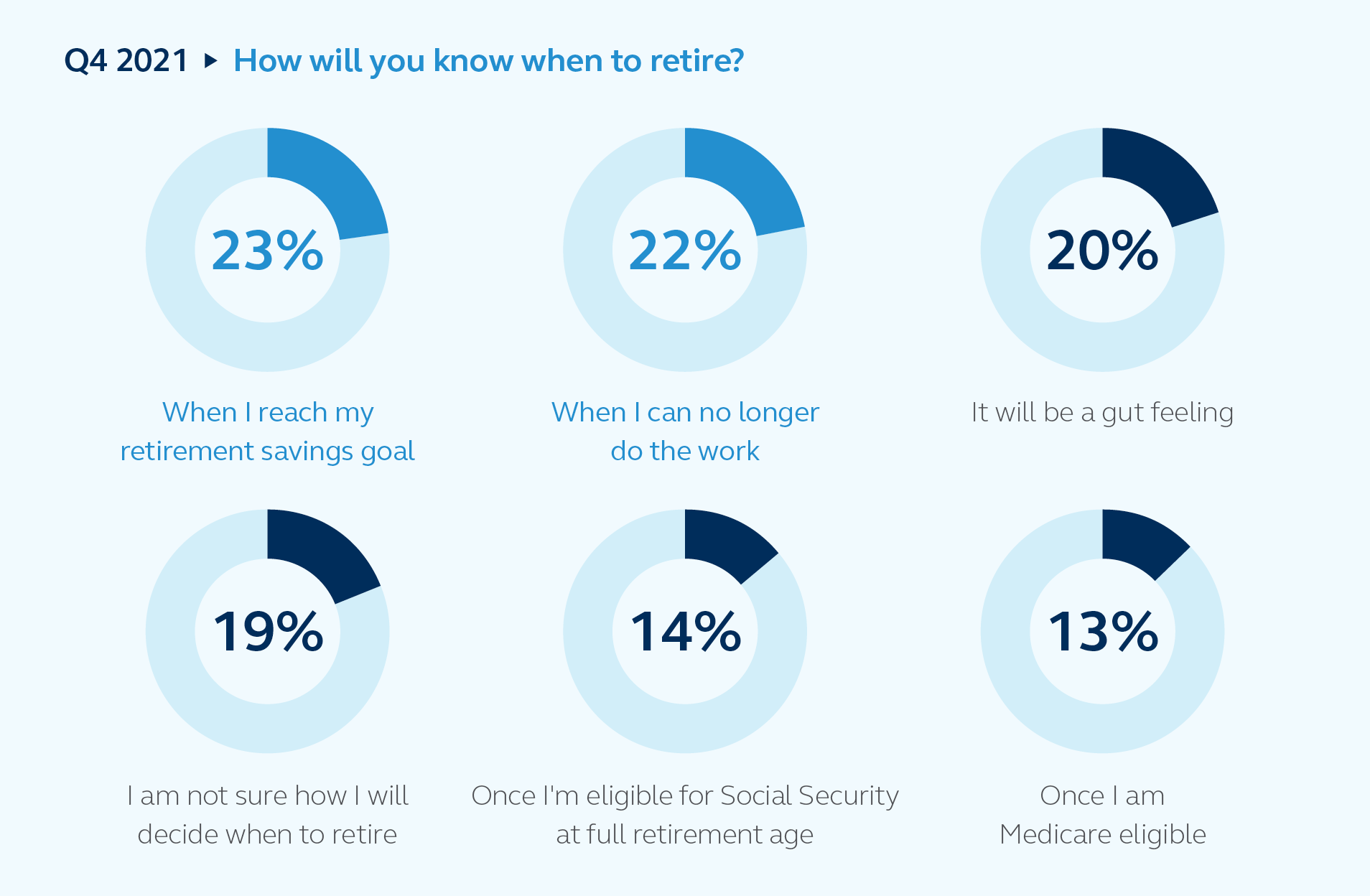

Historically, the consideration of ‘when to retire’ was driven primarily by the date or age a working person could begin collecting Social Security and pension or defined benefit plan payments. And it was common for workers to delay retirement to maximize income from these sources. Today―possibly due to uncertainty with Social Security and a decline in employer-sponsored pension and defined benefit plans―workers consider other factors when determining when to retire.

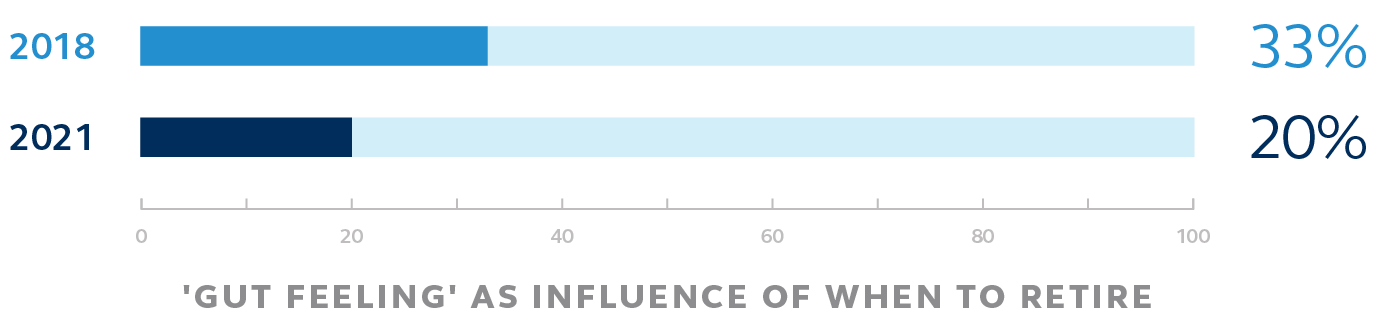

Interestingly, 'gut feeling' is on the decline.

We see a difference between generations when comparing the top influences on deciding when to retire:

- Gen X: 25% “When I reach my retirement savings goal.”

- Baby Boomers: 20% “It will be a gut feeling.”

- Retired: 22% “I retired when my pension or defined benefit monthly amount was significant.”

Note that only 10% of non-retired Baby Boomers selected this as a top influence.

Your client’s planned retirement age and actual retirement age might not match

Despite retirement being prompted by different factors, on average today’s workers still plan to retire at age 65. This differs slightly from the actual average retirement age of 63.5.1

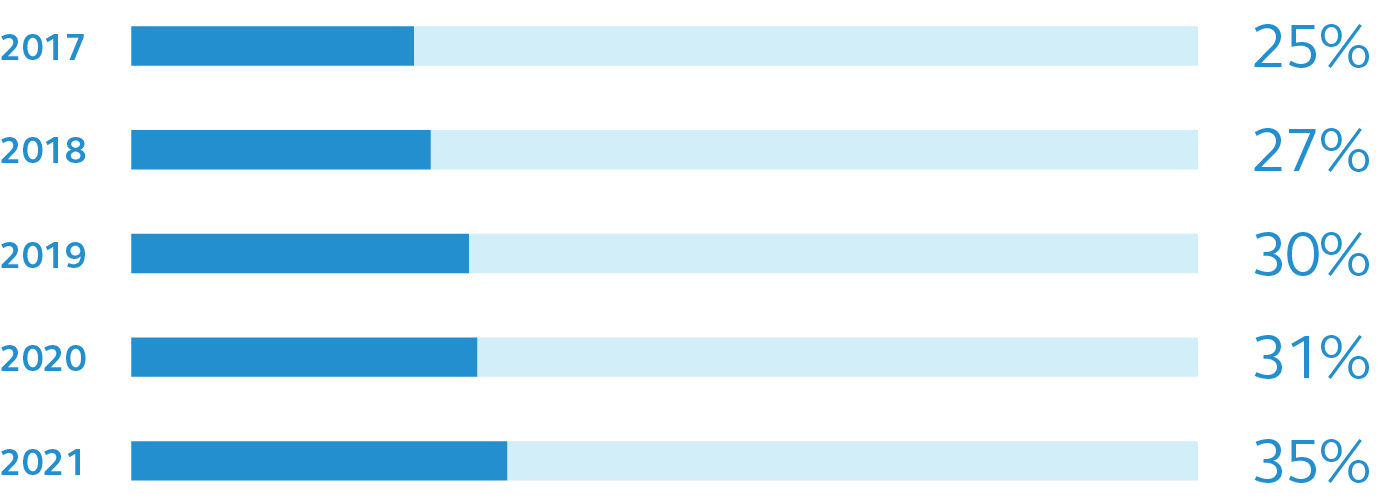

Since 2017, there’s been a notable increase in people leaving the workforce between 60-65 years old.1

Considerations: However, many plan sponsors disagree that the average age for retirement has changed. In fact, 78% of plan sponsors say the average age at which workers retire hasn't changed since 2019 - before the start of the pandemic. This contradicts what our research is showing. We'll be watching (and reporting on) this trend moving forward as it could help plan sponsors better understand their workforce.

1 Principal reporting as of Dec. 31, 2021.

FINDING 2

Your client’s retirement doesn’t necessarily mean leaving work behind.

Plans to work when retired may change as workers approach and enter retirement.

Intent to continue working in retirement varies by generation

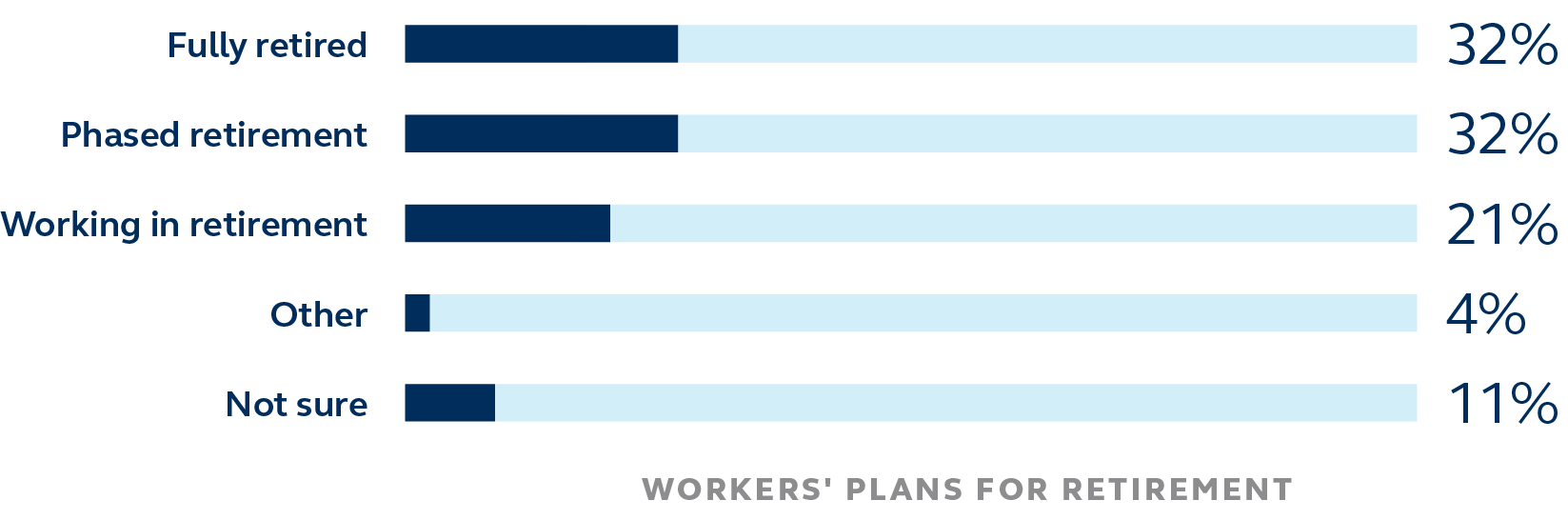

Looking more closely, the intent to continue working in retirement is held most strongly by the older working generations of Gen X and Baby Boomers. Thinking about retirement, workers see themselves:

Considerations: The aging workforce’s plan to continue working may be further proof of the gap workers experience related to their goal to live a comfortable retirement and their confidence in achieving it.

Plan sponsors may find opportunities to boost the value of their retirement plan for employees nearing retirement by promoting targeted topics such as retirement income planning and drawdown strategies. Interestingly, only 3% of retirees report being dissatisfied with their retirement. Sharing information and snapshots related to retiree satisfaction may also help boost confidence for workers who are approaching and entering retirement.

74% of workers who met with a financial professional sought help with retirement income planning

FINDING 3

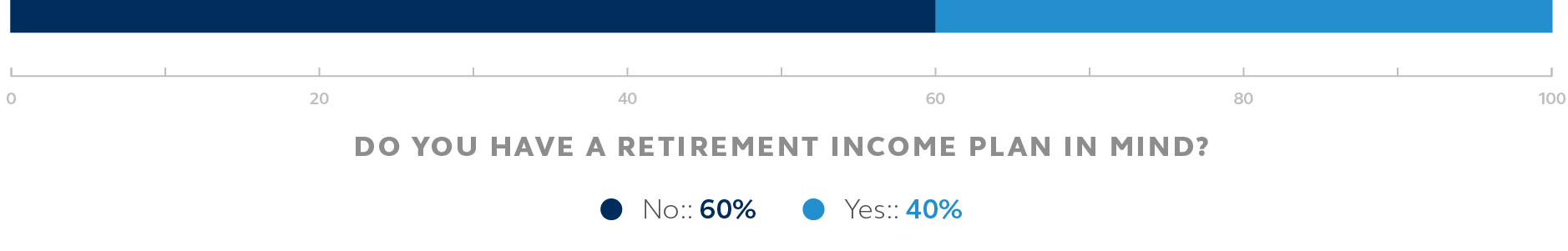

Workers haven’t determined their retirement income needs.

Only 30% of workers created their retirement savings goal based on their estimated expenses in retirement (and 21% don't have a savings goal). This may be another factor contributing to the gap between workers’ goal to live comfortably in retirement and their confidence in achieving it.

Lack of income planning is a concern for workers

34% of workers listed ‘lack of retirement income planning’ as a reason they don’t feel they’ll be financially comfortable in retirement.

The retirement planning process causes anxiety

Less than half of workers are comfortable with the retirement planning process.

Many workers don’t know how much they should save for retirement

50% of workers are either unsure how much they should be saving for retirement, or know they are saving less than they should be to reach their retirement goals.

How workers feel about their current overall level of retirement savings:

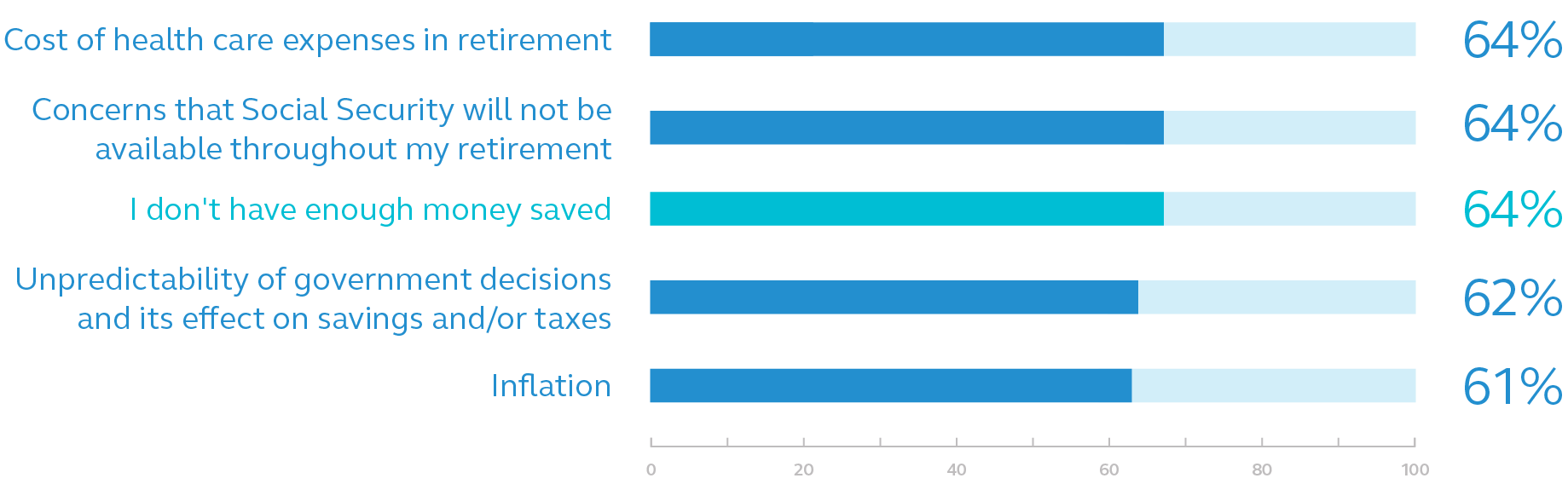

Top factors preventing workers from feeling financially comfortable in retirement.

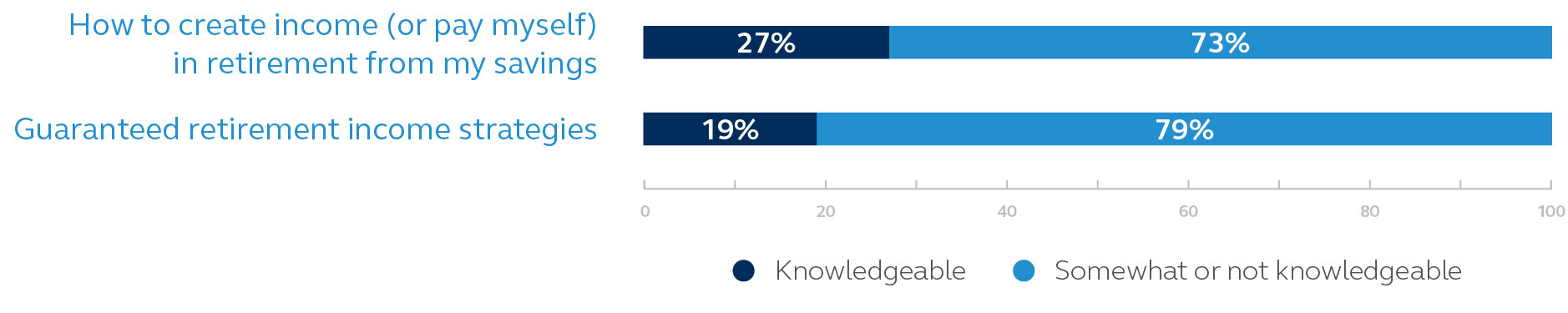

Workers are unfamiliar with how and when to create income from retirement savings

Workers admit they are unsure how to create income for retirement and about guaranteed retirement income strategies.

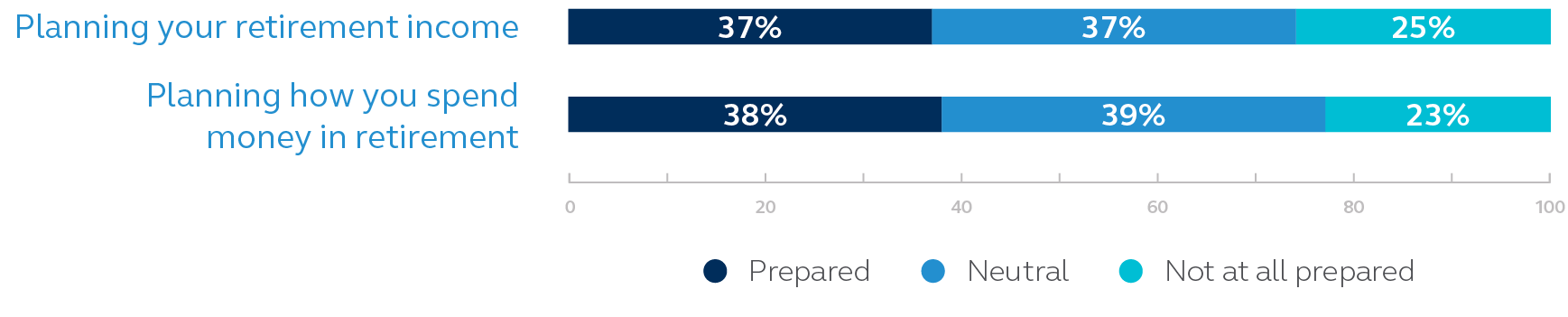

Only some workers feel prepared when it comes to planning retirement income and for spending money in retirement.

Plan sponsors notice that employees are struggling to create retirement income plans

75% of plan sponsors feel employees are doing less than a good job creating a formal retirement income plan.

Plan sponsors say that over one-third (34%) of workers need help knowing when and how to begin planning for retirement income.

And plan sponsors know that there’s opportunity for them to do more―with 33% saying they do less than a good job encouraging employees to start planning for income in retirement.

Considerations: Helping workers explore retirement income strategies can help plan sponsors reinforce the value of their retirement plan. The more confidence workers have that their employer-sponsored retirement plan will help them meet their goal of living comfortably in retirement, the more likely they are to feel that their employer is invested in their long-term well-being. This can help a plan sponsor’s retirement plan be a more powerful "tool" for recruiting and retaining talented employees.

FINDING 4

Many workers aren’t sure what to expect from Social Security.

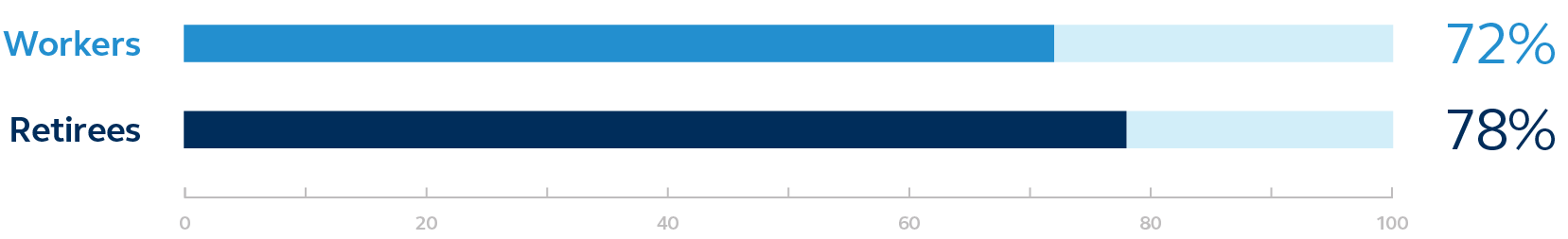

Plans to work when retired may change as workers approach and enter retirement. 80% of surveyed workers plan to continue working in retirement. Interestingly, only 28% of retirees report working in retirement.

Workers lack confidence that Social Security will be available to them

Many workers list Social Security availability as a top reason preventing them from feeling financially comfortable in retirement.

Workers don’t know when to start collecting Social Security

Only 46% of workers say they know how to claim Social Security at the right time to optimize income and one-third of plan sponsors agree that their workers don’t know when to start collecting Social Security.

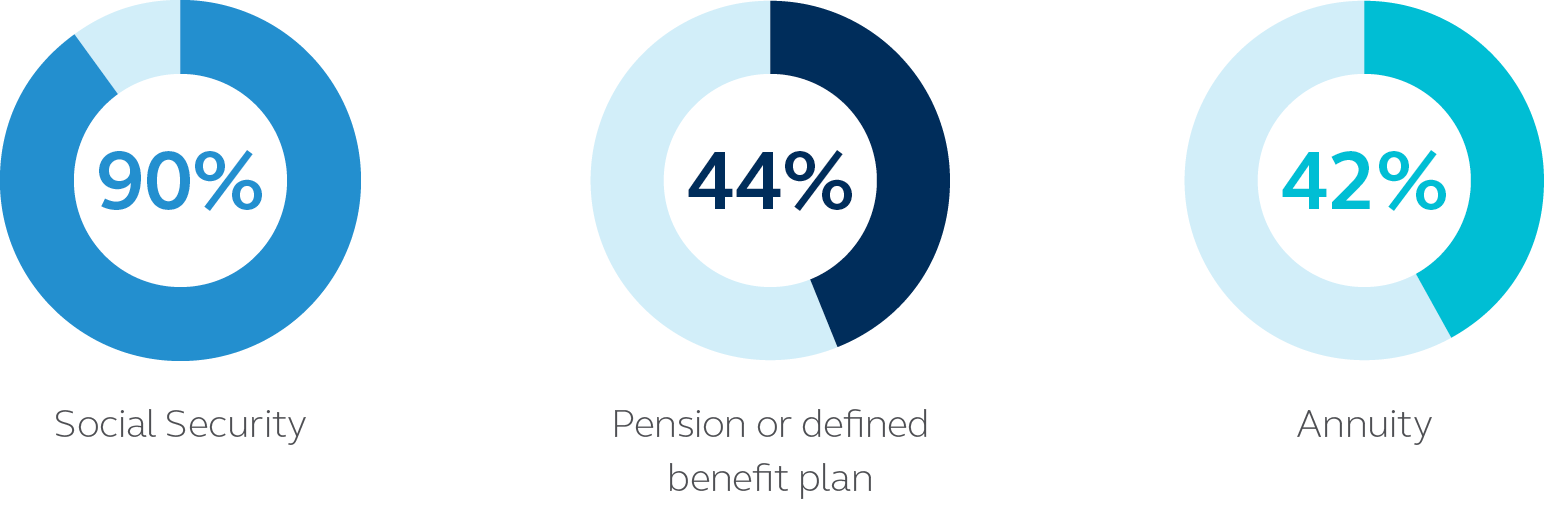

Despite uncertainty, workers see Social Security as the primary source of guaranteed retirement income.

Workers’ top expected sources of guaranteed income in retirement include:

Both workers and retirees say Social Security is the top income source for essential expenses in retirement.

Considerations: Plan sponsors can ask their plan service provider for resources that may help plan participants better understand Social Security and other guaranteed income options. Learning how to create retirement income is an important step toward workers being able to anticipate and enjoy their retirement with confidence.

What can be done to help workers achieve their goal to live comfortably in retirement? And can taking action help boost retirement plan success?

While a majority (68%) of plan sponsors feel responsible for making a retirement plan available to their employees, only 28% feel responsible for helping employees generate income in retirement and even fewer (11%) feel responsible for helping them manage that income. Additonally, less than one-half of plan sponsors (47%) make a financial professional available to their employees, even though it’s a move that could help address their concerns with employees’ retirement preparation—such as starting to save early, creating a retirement savings goal, reviewing Social Security benefits, and retirement income planning.

Knowing that 35% of workers’ biggest retirement concern is ‘outliving my retirement savings’, there’s an opportunity for plan sponsors to help boost retirement confidence and financial well-being for their employees—while at the same time improving the value of their retirement plan offering.

Getting even more specific, workers feel that the top three criteria helping them to reach their retirement goals are:

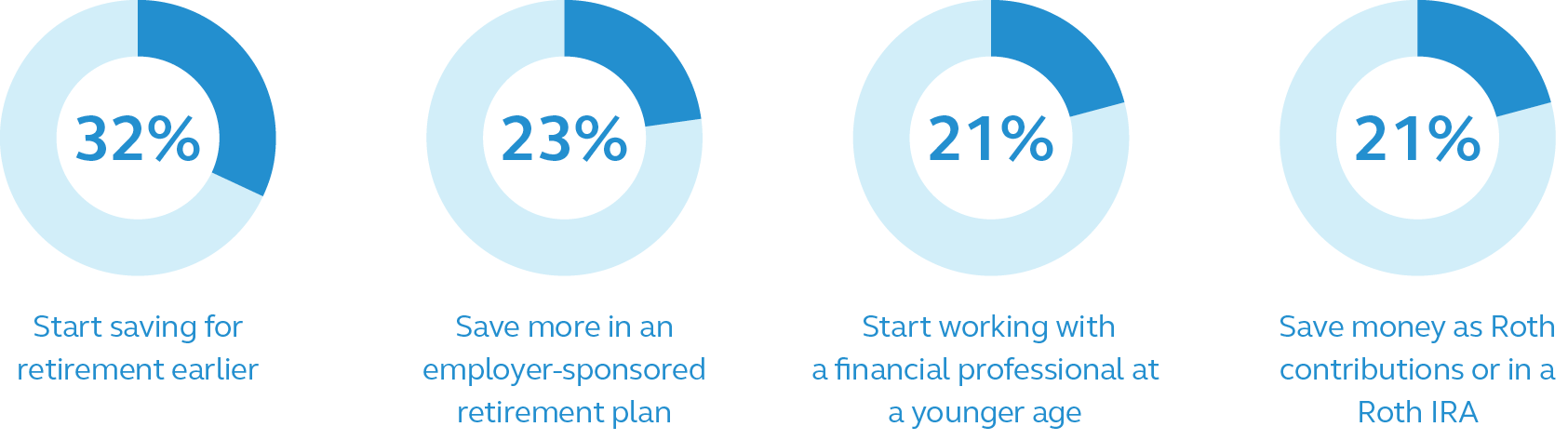

And retirees share the top things they wish they had done during their working years to help prepare for retirement:

Want to know more?

For retirement planning resources, including client guides, educational articles, and checklists, visit principal.com/prepare.

Reach out to your Principal® representative for ways to help people better prepare for retirement.

SURVEY METHODOLOGY AND RESPONDENTS

Online survey

Consumer: 20-minute survey conducted by Principal

Plan Sponsor: 15-minute survey conducted by Principal

Field dates

Nov. 17, 2021 - Dec. 7, 2021

Q4 respondents

2,028 consumers: 49% workers, 51% retirees

248 retirement plan sponsors

Margin of error

Consumer results: +/- 3.1% at the 95% confidence level

Plan sponsor results: +/-6.2% at the 95% confidence level

Qualifications

Consumer: age 20+, U.S. resident, has a financial product or service with Principal

Plan sponsor: key decision maker or day-to-day contact, U.S. resident, has a retirement plan with services by Principal

Background

Principal conducts periodic "pulse" surveys with customers, employers, financial professionals, and consultants to gain insights into timely topics.

The survey findings reported here explore plan sponsor and consumer concerns and actions surrounding saving for retirement as well as financial behaviors related to market volatility and current events. These survey findings should not be construed as a guarantee of future success and do not ensure a client or consumer will have the same response nor are they representative of any one client’s or consumer’s evaluation.

Important information

This subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering consulting, legal, accounting, investment or tax advice. You should consult with appropriate individuals including counsel, financial professionals or other advisors on all matters pertaining to business, legal, tax, investment or accounting obligations and requirements.

Investment and Insurance products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, Principal Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

2919780-062023 | 6/2023