What's all the buzz about levelizing retirement plan fees?

What plan fiduciaries need to know

It’s important for financial professionals and plan sponsors to have a thorough understanding of the organization’s retirement plan fees and how those fees are paid.

When it comes to fee payments and allocation, there’s no one right answer.

How retirement plan fees can be paid

Retirement plan fees cover administrative activities performed by providers. Fees also pay for resources and services — like a website or call center — to help plan participants enroll and reach retirement savings goals.

Typically plan fees are allocated or collected through one or a combination of fee methods. When revenue sharing isn’t used or it doesn’t cover all of the plan administrative expenses, fees can be billed directly to the plan sponsor or paid from participant accounts.

Payment methods to cover plan administrative fees

Revenue sharing

Revenue sharing

Billed fees

Billed fees

Deducted fees

Deducted fees

allows the plan sponsor to deduct fees directly from participant accounts.

- Shown as a per-head dollar amount, but calculated either as the same flat-dollar fee for everyone or as a percentage of the participants' account balances.

- Shown as an asset-based fee (basis point) calculated using a percentage of the participants' account balances.

| Per-head fee ($) | Asset-based fee (%) | |||

|---|---|---|---|---|

| Participant | Account balance | In proportion to account balance |

Flat dollar amount | Basis point amount (illustrated in dollars) |

| John | $100,000 | $300.00 | $116.25 | 0.30% ($300.00) |

| Mary | $50,000 | $150.00 | $116.25 | 0.30% ($150.00) |

| James | $25,000 | $75.00 | $116.25 | 0.30% ($75.00) |

| Ashley | $12,500 | $37.50 | $116.25 | 0.30% ($37.50) |

| Robert | $6,250 | $18.75 | $116.25 | 0.30% ($18.75) |

Revenue sharing — how does it work?

Note: There are other terms for revenue sharing, such as sub-transfer agency or administrative services fees. Revenue sharing doesn’t apply to all investment options. For instance, company stock investments, self-directed brokerage accounts, and some mutual fund share classes provide no revenue sharing.

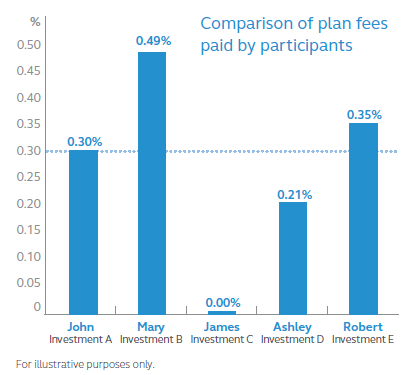

Revenue sharing and plan participants

The amount of revenue sharing paid by an investment option can vary from one option to the next. That means participants may pay a different percentage of the plan’s administrative expenses depending on the investment options they select.

This has raised concern among plan sponsors who want to level the playing field and allocate fees equally among plan participants. There are a number of ways to create fee equality, which we’ll cover in more detail next.

Fee levelization vs. revenue sharing

There are several different approaches to consider for plan sponsors who want to levelize fees among retirement plan participants. We’ll offer some considerations for each approach along with more thoughts on revenue sharing.

Know your options

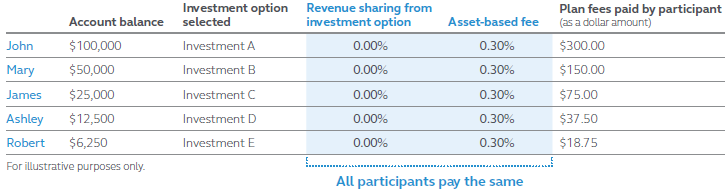

Let’s take a closer look at how each fee method is applied to participant accounts. For ease of comparison, we’ve included examples based on a plan with recordkeeping fees of 30 basis points.

Zero revenue sharing approach

For plan sponsors who want a clear separation of plan administrative and recordkeeping fees from investment expenses, a zero revenue sharing option provides a simple approach. This can be accomplished in a couple of ways:

- Using investment options that provide no revenue sharing.

- Crediting all revenue shared from investment options back to participants.

A plan sponsor may also choose a combination of the two. Once the plan fiduciary selects the approach that best fits their needs, they will then select the most appropriate fee payment method to fit their situation — billed, deducted, asset-based, or a combination. The following examples illustrate collecting recordkeeping fees via an asset-based method:

Zero revenue sharing investment options

Considerations

- Separates recordkeeping fees from investment expenses, making both easily identifiable to plan participants and fiduciaries.

- May provide investment options with lower fees.

- Offers flexibility in payment methods. Fees can be allocated as a dollar amount and/or as an asset-based fee. The plan sponsor can also choose to pay all or a portion of the fees.

- Results in simple, clean participant communication. Participant fee disclosures only include: plan investment expense ratios, any deducted or asset-based plan fees and participant transaction fees.

- May narrow the universe of investment options the plan fiduciary can select because not all investment managers have complete series of zero revenue available.

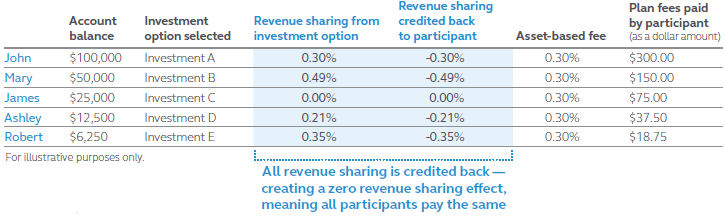

Zero revenue sharing through fee credits

Adjustments may be easier to understand because participants will only see a positive fee adjustment. Take a look.

Considerations

- Separates recordkeeping fees from investment expenses, making both easily identifiable to plan participants and fiduciaries.

- May provide investment options with lower fees.

- Offers flexibility in payment methods. Fees can be allocated as a dollar amount and/or as an asset-based fee. The plan sponsor can also choose to pay all or a portion of the fees.

- Requires disclosure of the fee adjustment rate and actual fee adjustment as a dollar amount applied to the participant’s account.

- Adjustments may be easier to understand because participants will only see a positive fee adjustment.

- How often does the service provider calculate the fee credit? Fee adjustments are generally calculated using an average daily balance and applied to the participants accounts either monthly or quarterly based on when service provider is expected to receive revenue from the fund family.

- Potentially more flexibility in the investment selection process because a larger universe of investment options may be available.

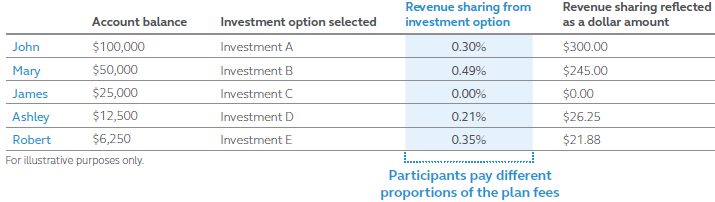

Standard revenue sharing

This approach allows the service provider to use the revenue sharing amounts received from the investment options to offset plan fees. In this case, plan fiduciaries select investment options that may produce varying amounts of revenue deemed reasonable based on the expected amount of plan fees. Check out this example:

Considerations

- Allows revenue sharing (when available) to offset plan fees, often lowering or eliminating the amount of explicit fees paid.

- Recordkeeping fees are not clearly separated from investment options and may not be as transparent to participants.

- Some participants may subsidize more of the retirement plan’s administrative fees than others.

- Provides greater flexibility in the investment process, which may make more investment options available. However, a prudent process must still be established to determine the acceptable range of revenue sharing within each investment option.

- Results in simple, clean participant communication. Participant fee disclosures only include: plan investment expense ratios, any deducted or asset-based plan fees and participant transaction fees.

Understand your fiduciary responsibility

Every plan sponsor and every plan look a little different. So plan fiduciaries need to determine the approach that will best meet their needs. Since there are many factors to consider, an option may work well for one plan and not be the right choice for another.

Key questions for plan fiduciaries

As plan fiduciaries explore the various approaches, consider answering these questions.

- How will fees be paid, by participants through revenue sharing, allocated explicitly to participant accounts, or paid by the plan sponsor?

- If paid by participants, will the fees be paid in proportion to their account balance or as a flat fee amount?

- If through revenue sharing, what amount is appropriate and is it important for participants to pay equally?

- How will you communicate fees and payment methods to participants?

Ensuring a prudent process

- Consider the interests of different classes of participants.

- Determine how the method of allocation may affect each class.

With the above principles in mind, plan fiduciaries must gather and analyze the relevant facts to make an informed and reasoned decision based on participants’:

- Account balances

- Understanding plan fees

- Knowledge of investment-related fees

- Election of investment options

Considerations for a prudent process

- Gather and evaluate relevant facts, including plan participant needs.

- Assess available fee payment methods.

- Determine how fees will be collected and document the process.

- Provide clear, simple communication to build participant understanding.

- Monitor.

Note: There’s no regulation that promotes or suggests any option discussed in this article over the others. Every plan fiduciary has an obligation to act in the best interest of plan participants and should adhere to all laws, regulations, and best practices.

1 An investment option may or may not provide revenue sharing.

2 Field Assistance Bulletin 2003-03.

Intended for financial professionals or plan sponsors.

Principal Life Insurance Company is not a fiduciary in the broad context of operating your plan.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Fiancial Group company, in the United States and are trademarks and services marks of principal Financial Services, Inc., in various countries around the world.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, investment advice or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, investment or accounting obligations and requirements.

2913742-052023

Terms of Use | Disclosures | Privacy | Security | Report Fraud | Contact Us

© 2026 Principal Financial Services, Inc.

Securities offered through Principal Securities, Inc., member SIPC

Insurance products and plan administrative services provided through Principal Life Insurance Co., a member of the Principal Financial Group®, Des Moines, IA 50392.