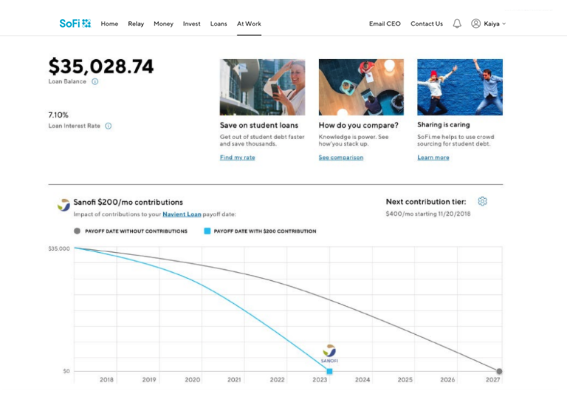

Help employees achieve savings goals by paying off student loan debt.

Employee financial wellness can be negatively affected by student debt. Providing a student loan repayment program could help employees be more productive, improve retention, and lower stress-related healthcare costs.

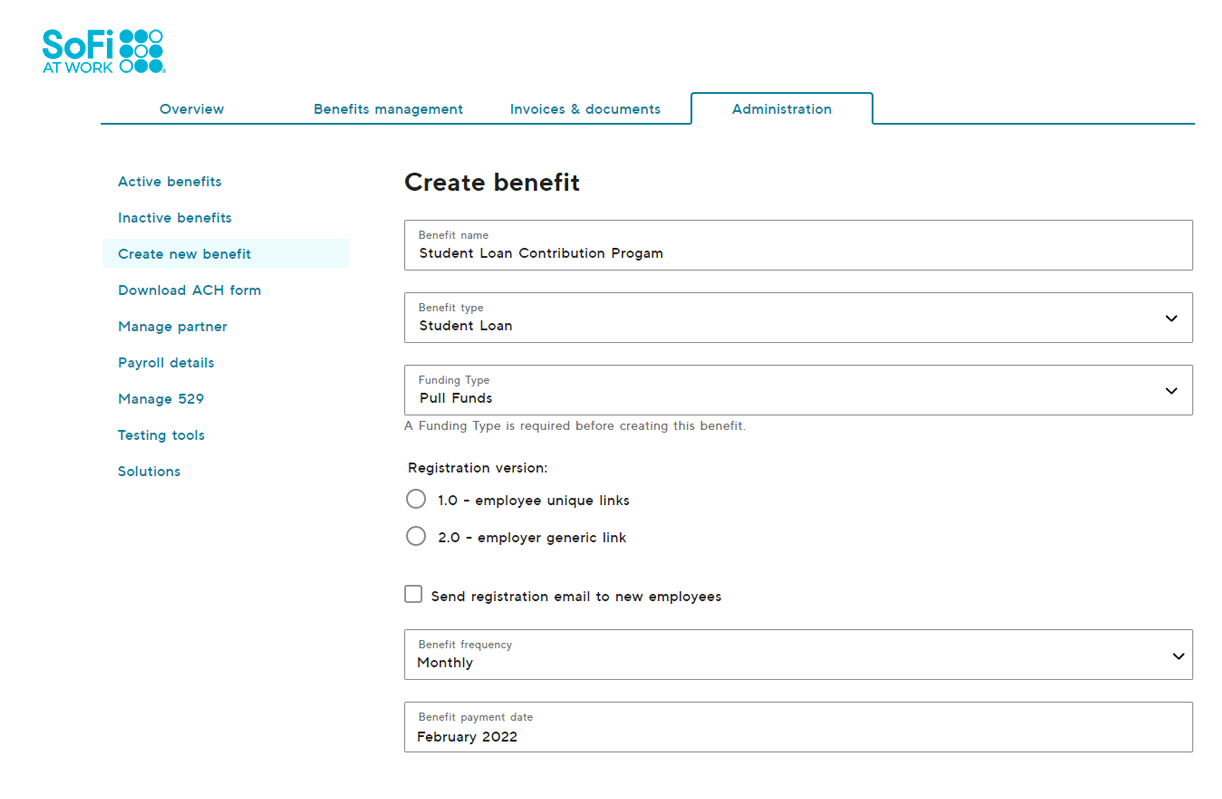

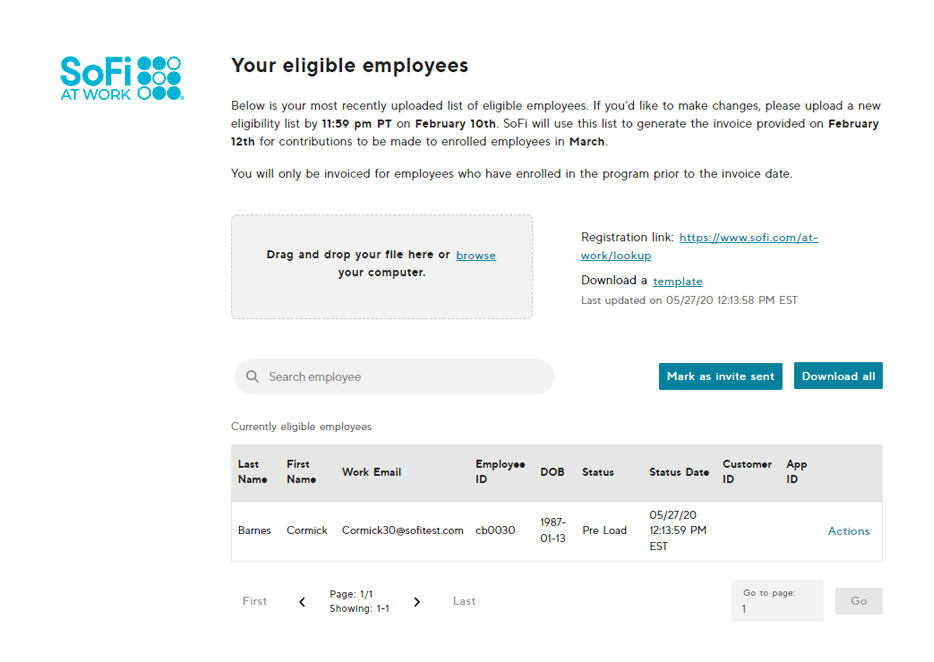

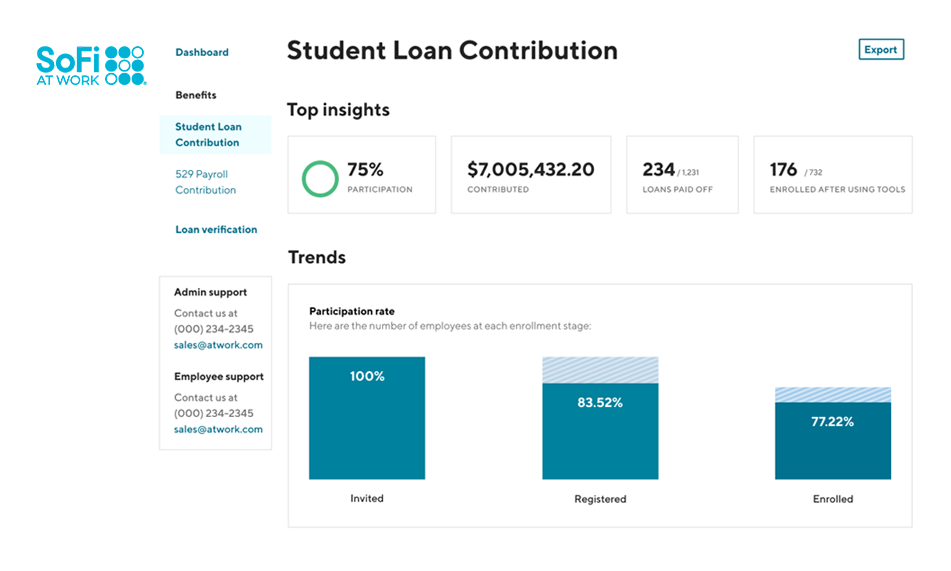

Learn more about the employer's experience.

SELECT

Employer

SELECT

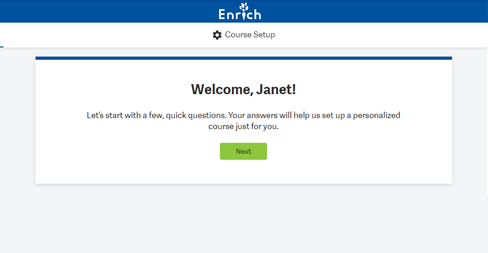

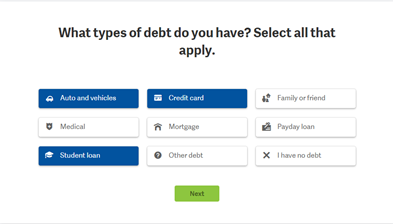

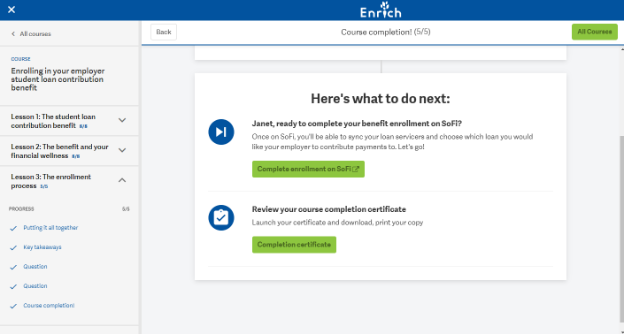

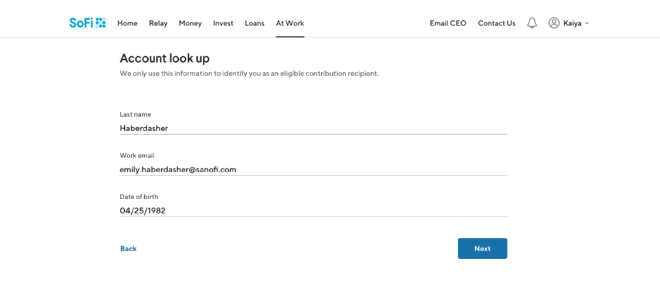

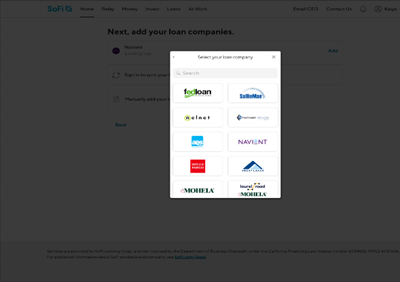

Employee

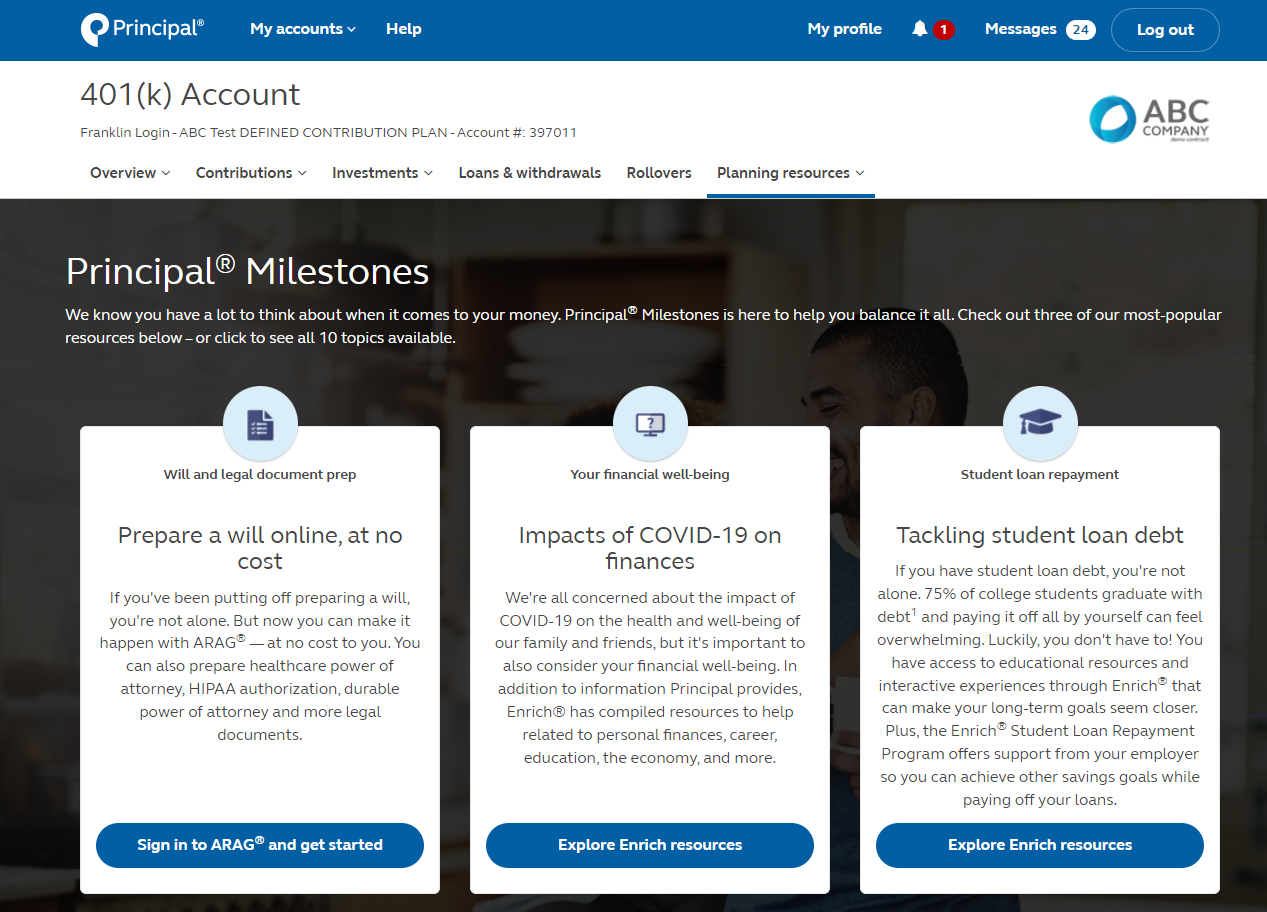

Learn more about the employee's experience.

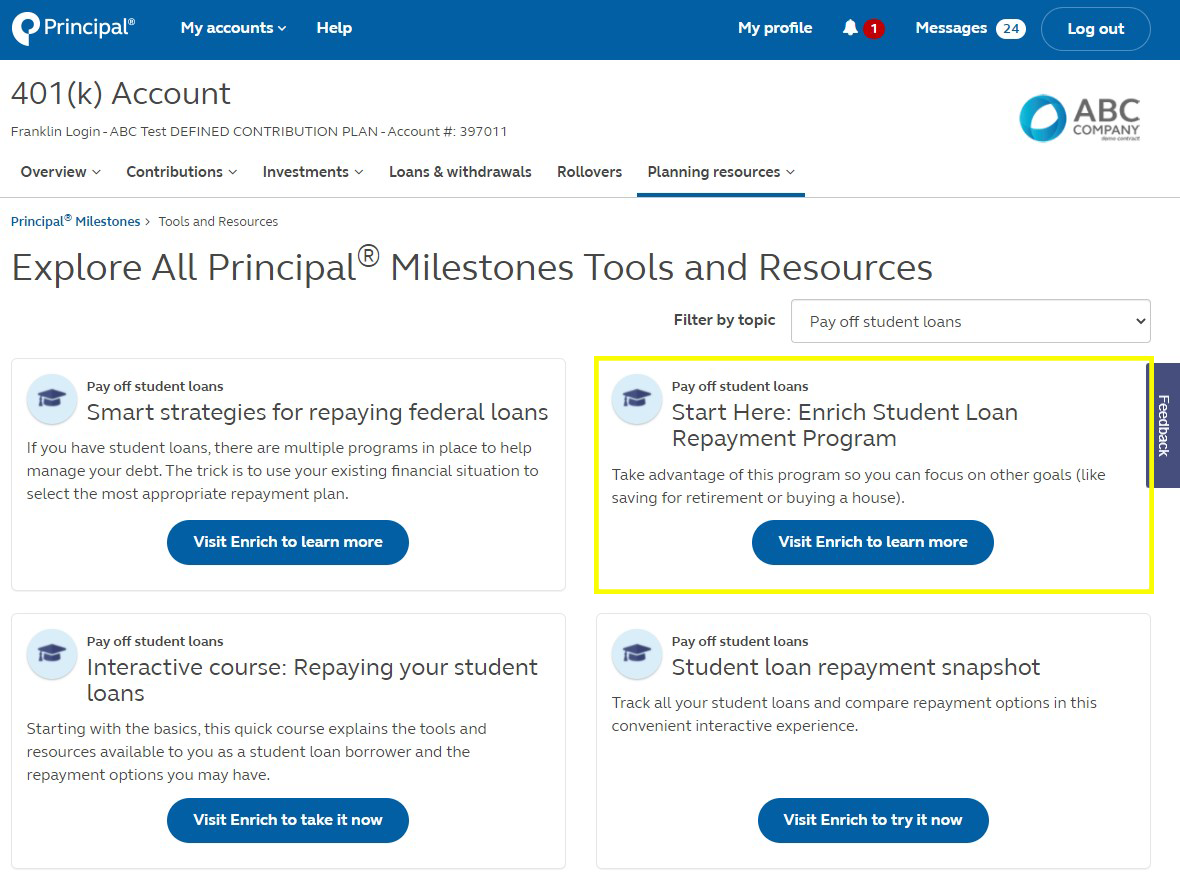

EXPLORE