Thank you for considering us as your ESOP plan service provider. We'll do our best to make your search as easy as possible.

Welcome to Principal

LEARN ABOUT PRINCIPAL

The Principal difference

Unlike other providers, retirement is at the heart of our business. Retirement and asset management operations represent 95% of our assets under management.* We're committed to serving our retirement clients and investing in our business.

* Principal data as of Dec. 31, 2022.

We're proud of our culture

Our people shape and reinforce our culture of service, inclusion, and innovation while helping our customers reach their goals for financial security and live their best lives.

We typically receive industry accolades like these proving we make our values come to life.

Top 100 Most Sustainable Companies in America

Barron’s, February 2022

America’s Best Employers for Diversity

Forbes, April 2022

World’s Most Ethical Companies®

Ethisphere Institute, February 2021

Multiple plans. One integrated experience.

PRINCIPAL® TOTAL RETIREMENT SOLUTIONS

With Principal® Total Retirement Solutions you'll have one simple experience on a streamlined digital platform with one experienced relationship manager and one experienced team instead of multiple service providers. Plus, your employees can check their retirement benefits with just one click, one call, one app.

1 Based on defined contribution participant count. PLANSPONSOR July 2022 Recordkeeping Survey.

2 Based on number of plans, PLANSPONSOR DB Administration survey, May 2021.

3 Based on number of Section 409A plans, PLANSPONSOR Recordkeeping Survey, July 2022.

4 Based on number of ESOP plans, PLANSPONSOR Recordkeeeping Survey, July 2022.

Top Reasons for choosing Principal Financial Group®

to provide ESOP Services

Breadth of our experience and companies we work with

ESOP expertise and passion for helping participants

No cost ESOP repurchase liability forecasting tool

Hassle-free elections

Tailored employee owner communication and education

Financial Wellness at your fingertips

* Employer-sponsored retirement plans are defined benefit or defined contribution. The guarantee applies to employer sponsored defined benefit, ESOP or defined contribution plans and is effective for unauthorized activity that occurs through no fault of your own. Exclusions to the policy may apply. https://www.principal.com/customer-protection-guarantee

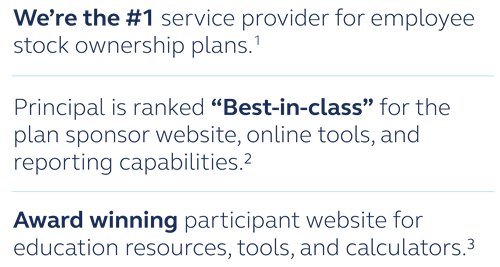

1 PLANSPONSOR Recordkeeping Survey, July 2022.

2 PLANSPONSOR DC Survey, January 2022, $200MM - $1B in plan assets.

3 Corporate Insight, Retirement Plan Monitor Report, December 2021.

For financial professional/institutional use only.

PARTICIPANT EXPERIENCE

Personalized experiences to help drive participant outcomes

Engage from the beginning

What your participants enjoy:

- A single website with one login/password with on-demand consolidated statements keeps the ESOP benefit top of mind.

- One call center for questions.

- A single mobile app that covers it all.

Elevate the experience

Take retirement to the next level.

- Motivational peer comparison

- Principal® app

- Hola Futuro Spanish website

Expand beyond retirement

Access holistic financial wellness tools and resources through Principal® Milestones.

- Standard will and other legal documents participants can prepare

- Student loan repayment resources and access to more than 15,000 scholarships

- Money management education

Principal e-DistributionSM &

Principal e-DiversificationSM

Benefits of the services include:

- Help with cash management and budgeting through online reports, including cumulative elections.

- Paperless elections simplify process of collecting and processing forms.

- Printing and mailing costs, as well as extra time for mailings, are eliminated.

- Electronic efficiency decreases the potential for manual errors or lost forms.

- Immediate and ongoing access during the distribution election window.*

- Election changes at any time during the election window.*

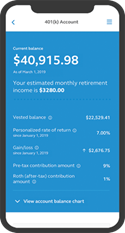

Putting retirement planning at participants’ fingertips

Mobile-first approach

The Principal® app makes it easy for participants to manage their account on the go and plan for their future.

Principal® app

Our digital experience, DALBAR awards us with the Mobile Communications Seal of Excellence (2022) for the second year in a row.

For illustrative purposes only

* For eligible participants.

Custom communication samples

Multiple campaign touchpoints

For illustration use only.

CYBERSECURITY

Committed to keeping customers’ assets and information secure

Safeguarding customers’ info is a top priority

Our approach, paired with third-party expertise, provides flexibility to act quickly on any potential threats. We go beyond the Department of Labor cybersecurity best practices by:

- Including two-factor authentication

- Conducting ongoing third party cyber attack testing

- Working closely with local, state, and national government agencies

- Conducting background checks on all employees

- Having cybersecurity insurance

- Serving as active members of industry groups such as:

- SPARK Data Security Oversight Board

- Cyber Readiness Institute (CRI)

- FS-ISAC

Our simple customer protection guarantee

Third-party validation

2 Financial Advisor IQ Service Awards, October 2021.