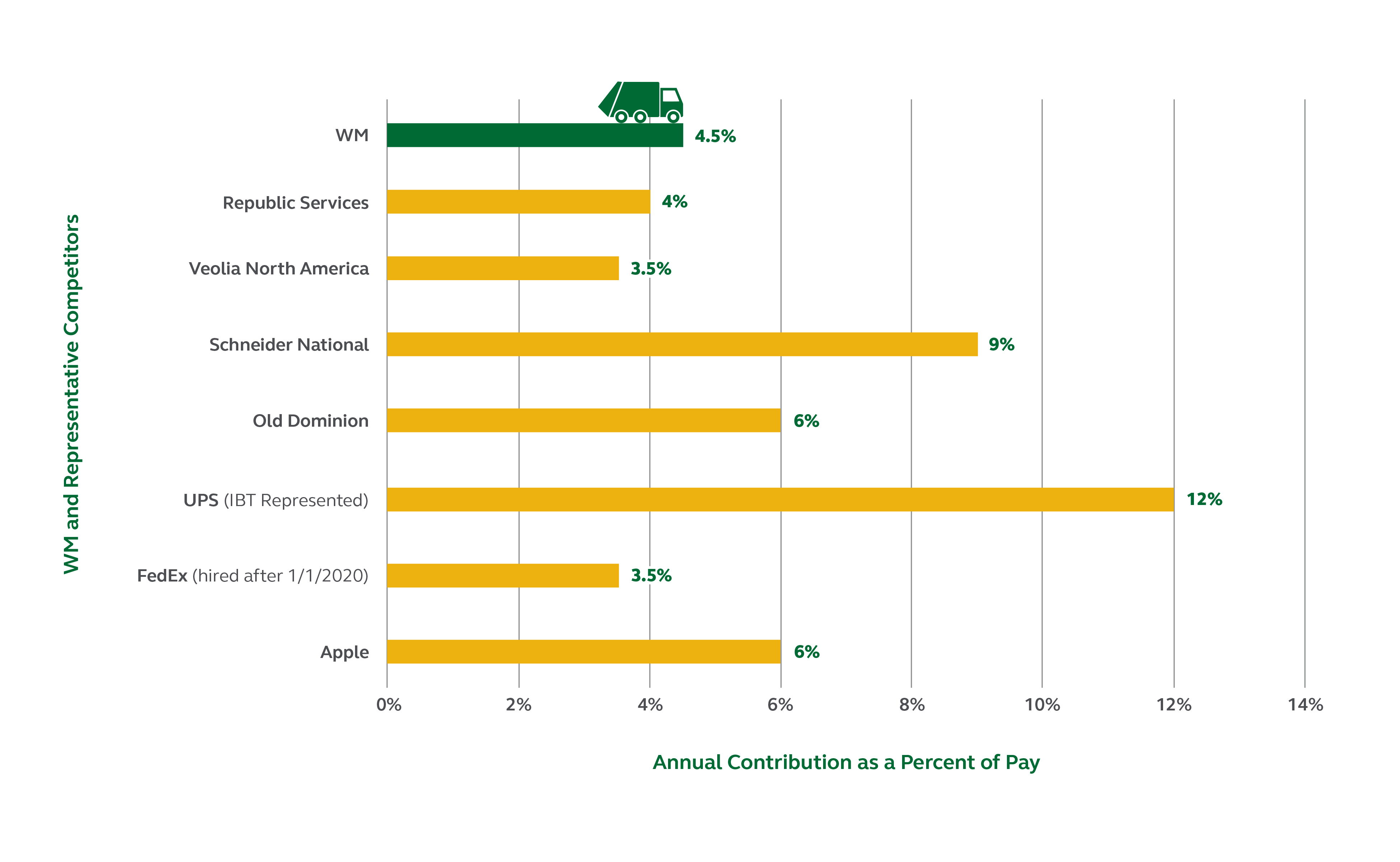

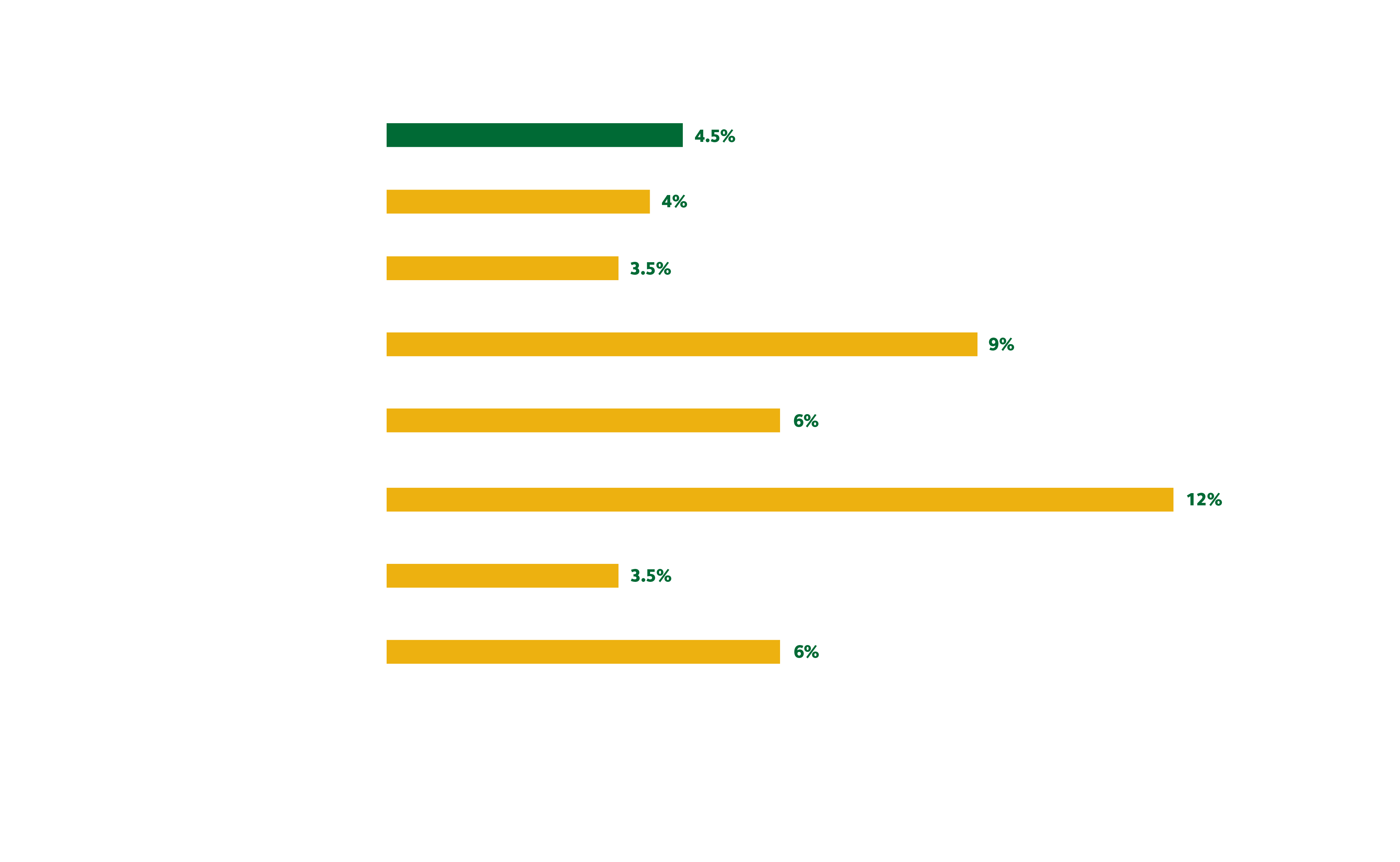

Maximum Employer Contribution Comparison

We understand the importance in recruiting and retaining great team members for organizations like WM. The right retirement plan design can improve overall team member satisfaction, and reduce overall benefit expenses in the meantime.

WM offers a generous benefits program to your team members, including contributions toward team member retirement plans. The graph below illustrates WM's maximum employer contribution to retirement as a percent of salary and how it compares to your competitors, both in your industry and in others who hire similar talent. (Information from most recent 5500 filings – 12/31/20)

Maximum Team Member Contribution to Retirement as a Percent of Salary

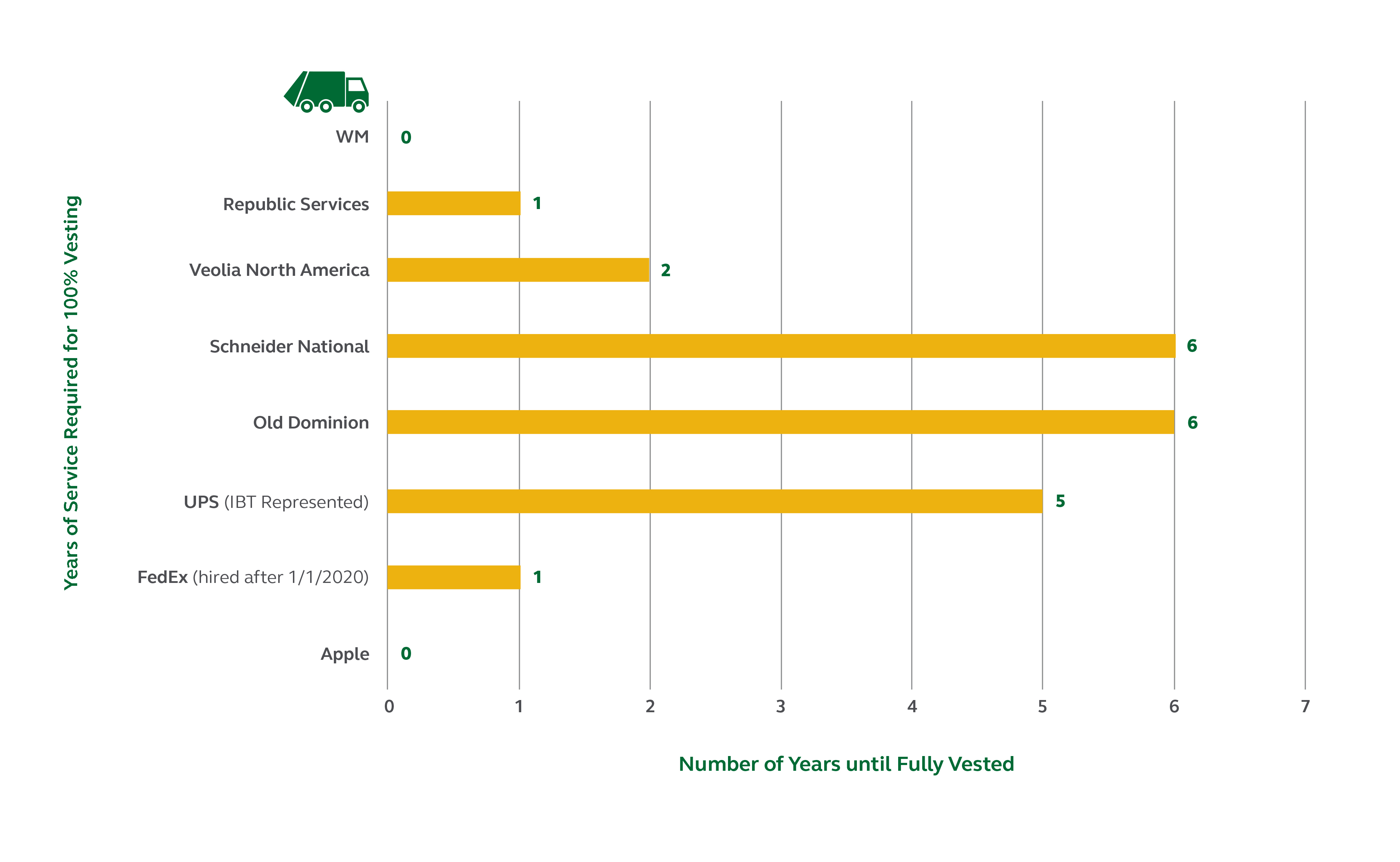

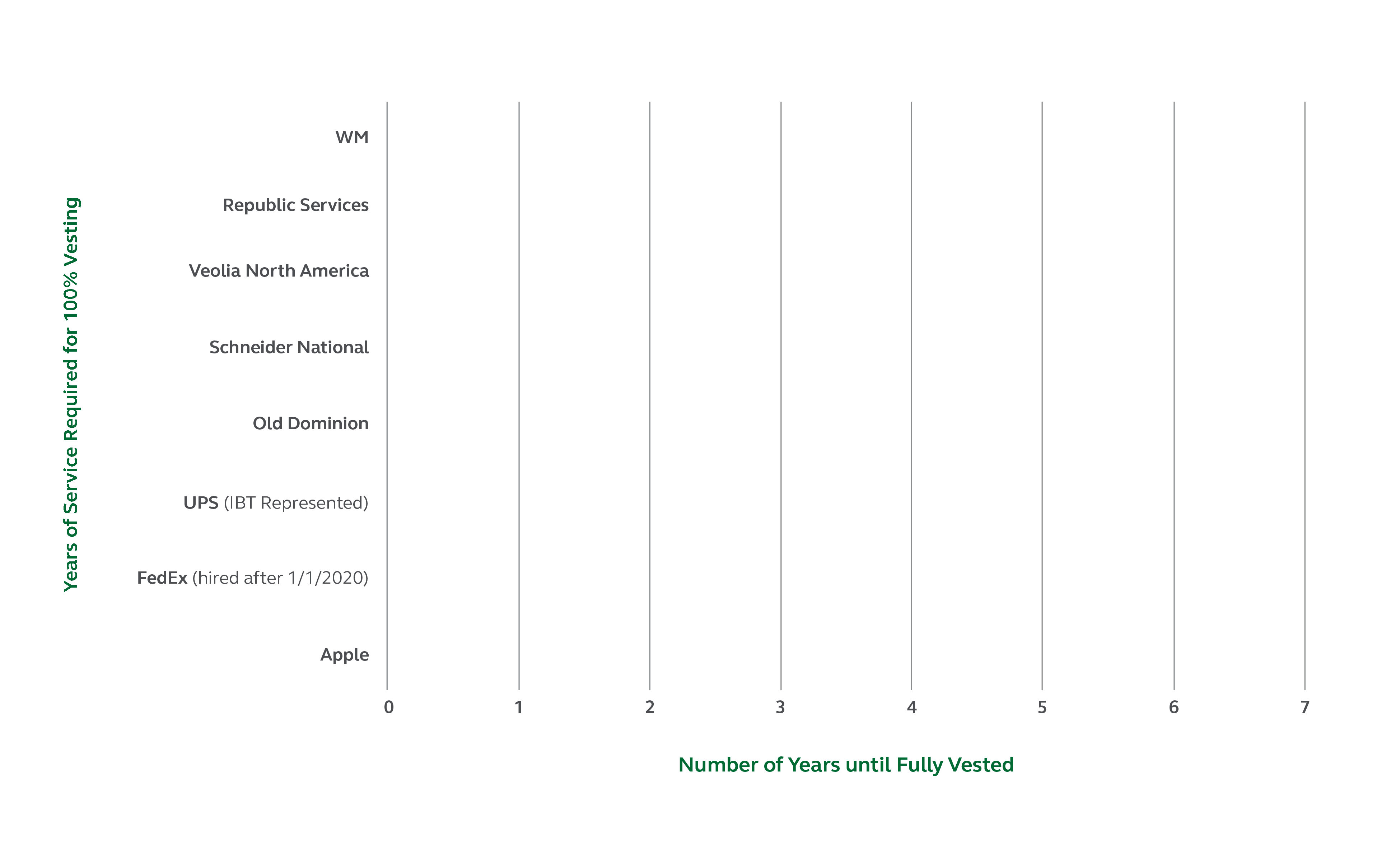

Team member match vesting comparison

Number of Years Until Fully Vested

Opportunities for team member impact

Possible opportunity for enhancement:

WM is contributing more than others in their industry, but with earlier vesting – both of which add cost to the program.

WM’s retirement program is less competitive vs those of traditional logistics firms.

WM is contributing more than others in their industry, but with earlier vesting. Both of which add cost to program

WM’s retirement program is less competitive vs those of traditional logistics firms.

Therefore, WM could improve these positions by changing your plan to a newer version of Safe Harbor. This would move the plan to a 3.5% total team member contribution with 2 year vesting and auto-escalation to 10%.

Potential impacts of such a change:

- Improve overall outcomes via auto-escalation and increased team member savings.

- Reduce overall expenses by an estimated $6-8M. This breaks out as follows:

- $4-5M from reduction in match and,

- $2-3M from reduction in WM money paid out with short service team members (under 2 years).

This could allow WM to redirect this estimated $6-8M cost savings to increase sign-on and retention bonus offerings for CDL drivers and other difficult-to-recruit skill sets.

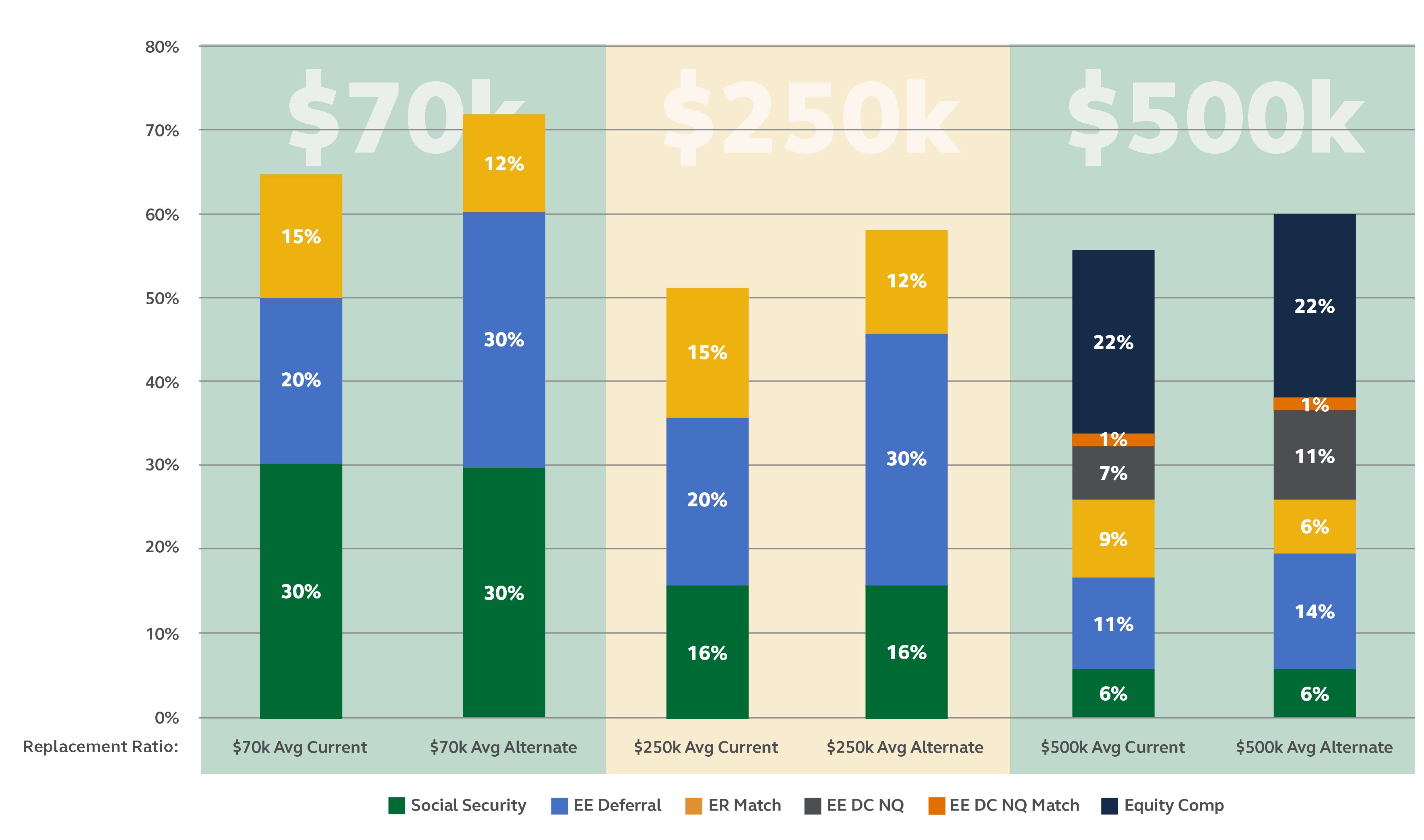

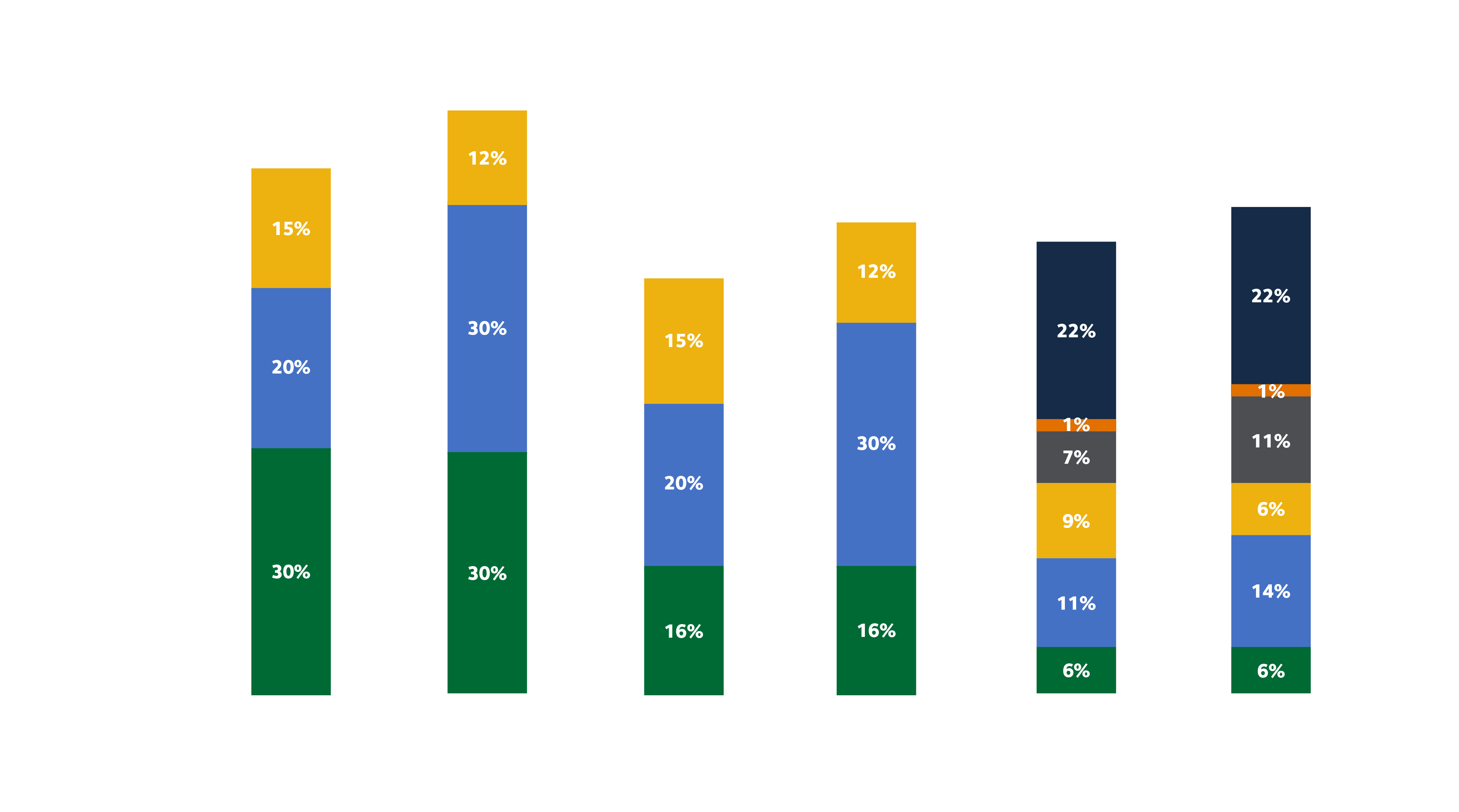

Projected Retirement Outcomes at Various Salary Levels