A streamlined onboarding experience

Your centralized hub to more efficiently onboard TPA plans at Principal®.

Onboarding digital efficiencies

.png?v=06222022181451)

Getting started

Once we receive the commitment, we’ll assign a dedicated client implementation manager and kick off the onboarding process for the plan’s security administrator to set up access.

The plan sponsor, third-party administrator, and financial professional will each get an email with a link to the same collaborative onboarding experience.

For illustrative purposes only.

Convenient onboarding dashboard

Check the status and access all plans you service on the TPA website with the Onboarding dashboard, located under Block of business. Or you’ll see a quick link at the top of your Client List on the plan summary page.

Ready to provide plan provision details? Click Onboard my client.

Tip

Is there anyone at your firm who works on onboarding or performs quality checks, but doesn’t currently have a principal.com account?

Make sure your firm’s security administrator adds everyone who needs access using the Manage security tab at the top of the TPA website.

For illustrative purposes only.

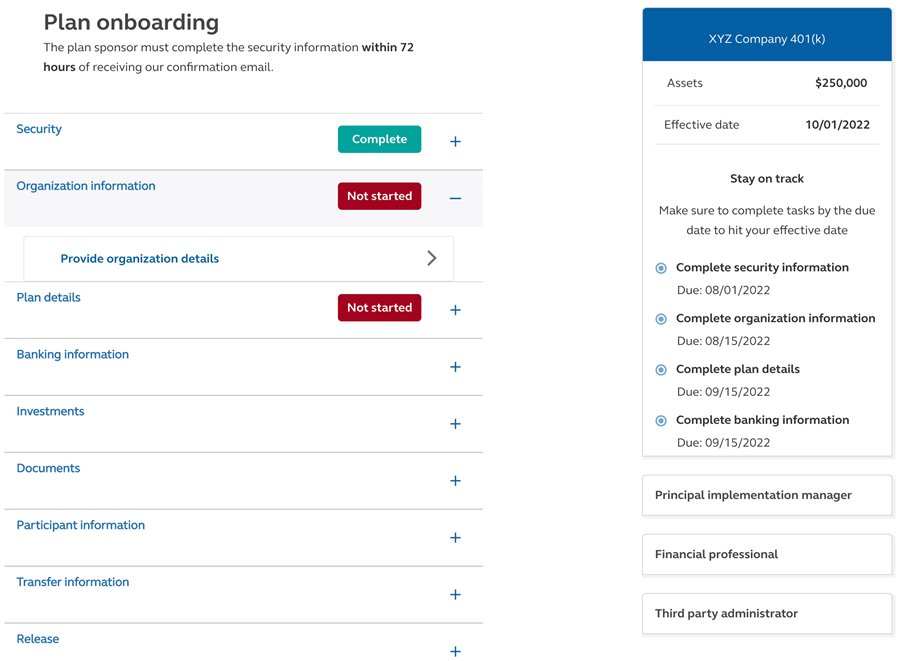

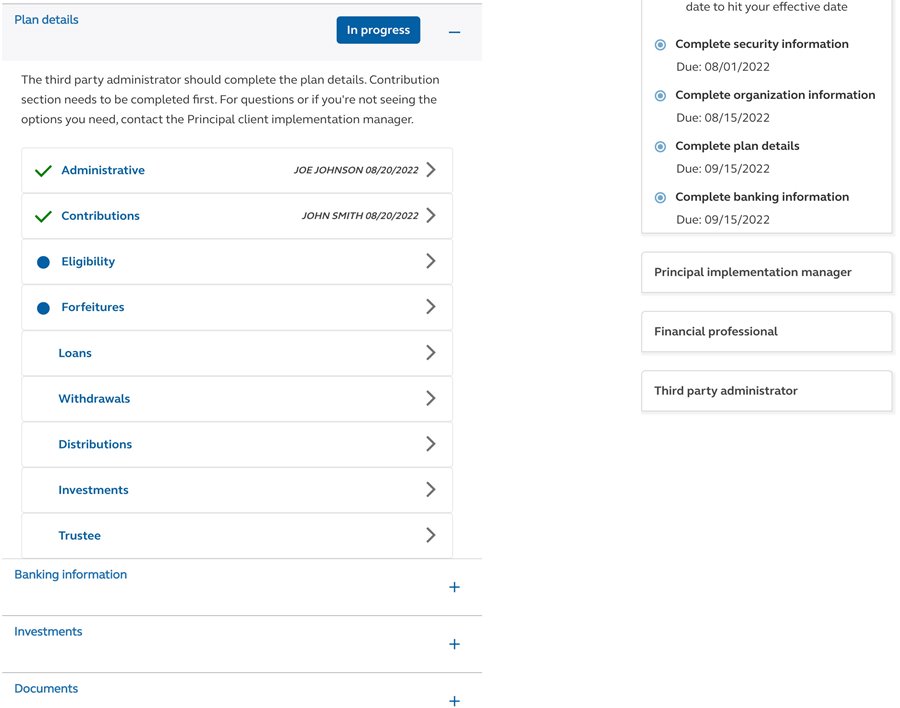

Plan onboarding hub

Easily access the hub via email from your assigned client implementation manager or the TPA onboarding dashboard— this is one shared space for everyone to collaborate and provide details to hit the plan’s effective date.

Easily see clear indicators of the status of each section: not started, in progress, or complete.

Use helpful target completion dates to stay on track and access information for everyone working on the plan, including the assigned client implementation manager.

Tip

Use this page as a guide for client check-in meetings so you’re all referencing the same information. You may find your Principal® client implementation manager using it for key milestone meetings.

For illustrative purposes only.

Security and organization information

The plan sponsor will need to complete the security information section within 72 hours of receiving a separate security set up email from Principal.

The organization information section can be completed by the plan sponsor, third-party administrator, or financial professional—whatever makes the most sense for the plan and the way you do business.

For illustrative purposes only.

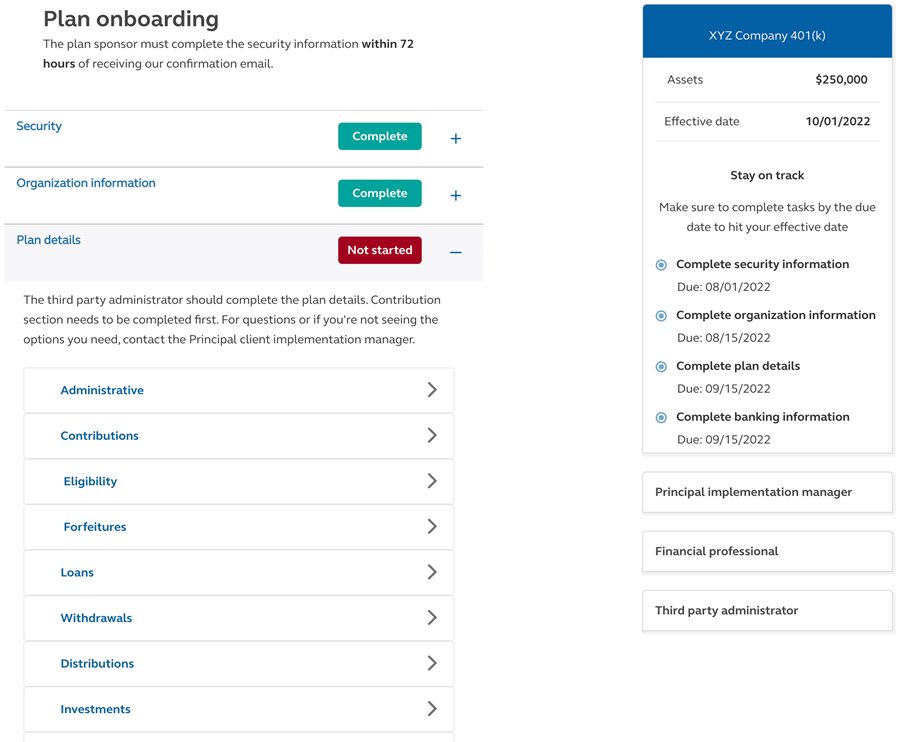

Providing plan details

With the security and organization information complete, we’re ready to start digitally collecting the plan provision information from the third-party administrator team.

To help you smoothly get through implementation, this collaborative process is:

Flexible

Efficient

Smart

For illustrative purposes only.

Flexible

Most questions don’t have to be completed at the same time or in a specific order—although, you will need to complete the Contributions section first as the other sections depend on those inputs. It allows multiple users so each person can complete, save, and submit their details when it works for them.

Tip

If you’re not ready to submit or need someone to verify the inputs, select “Save and exit” to return to the plan details section. If you “Submit” a topic and need to make a change, you can as long as the plan details section still shows In progress. Once it shows Complete, please reach out to your Principal® client implementation manager to make changes.

For illustrative purposes only.

Efficient

Responses go through validation before submission to get information in good working order the first time and to help eliminate the need to go back and forth.

Tip

You’ll only see the validation error when you hit “Save and submit.” This is so you can save and exit without getting an error, so you can work at your pace.

For illustrative purposes only.

Smart

Questions are dynamic to only show what’s needed based on your previous responses to help get through the information quicker.

For illustrative purposes only.

Collaborate efficiently

It’s easy to see when progress is made. If a topic in the section has been started, you’ll see a blue dot to the right. If you start on a section but don’t want to submit or need someone else to validate your inputs, just hit “Save and exit.”

When you’re ready to send us the information on that topic, hit “Save and submit.” Once completed, you’ll see a green checkmark appear.

When every topic in the plan details section is submitted, the progress status will change from In progress to Complete.

Tip

If you need to make a change to a topic after you’ve hit save and submit and the plan design section is still in progress (other sections to be completed still), you can make the changes and resubmit. If you’ve already submitted all the topics and the plan design section is marked Complete, please reach out to your Principal® implementation manager to make the change.

We’re here for you.

Your dedicated client implementation manager will be your go-to for questions and help guide the plan through the experience.

In the meantime, if you need anything, please email the Principal TPA EdgeSM service team or call 800-958-5124.