Thrill Employees & Recruits With Enhanced Top-Tier Benefits

Discover the Principal® proactive, consultative approach to help drive results

Retirement plan design makes all the difference when competing for top talent

Through a service-focused partnership with Principal, we will consult with Nissan to bring you proactive suggestions as well as recommendations from our consultants to help you continue to provide a world-class overall benefits program to your employees. We have included an example below of our consultative approach for your total benefits program.

Out of 130 full-time job openings listed on Nissan’s Career Website as of 3/28/2022:

- Approximately 20% are broad-based professional positions – e.g., HR, accounting, finance, marketing – many located in Franklin, TN

- Approximately 10% are technology-related positions – e.g., cloud architect, network architect, artificial intelligence – roughly half are located in Silicon Valley, CA

- Approximately 10% are engineering-related positions - many in Farmington Hills, MI

Knowing this, we believe that Nissan competes for talent not only with other auto manufacturers but also with tech companies and regional employers of broad-based professionals.

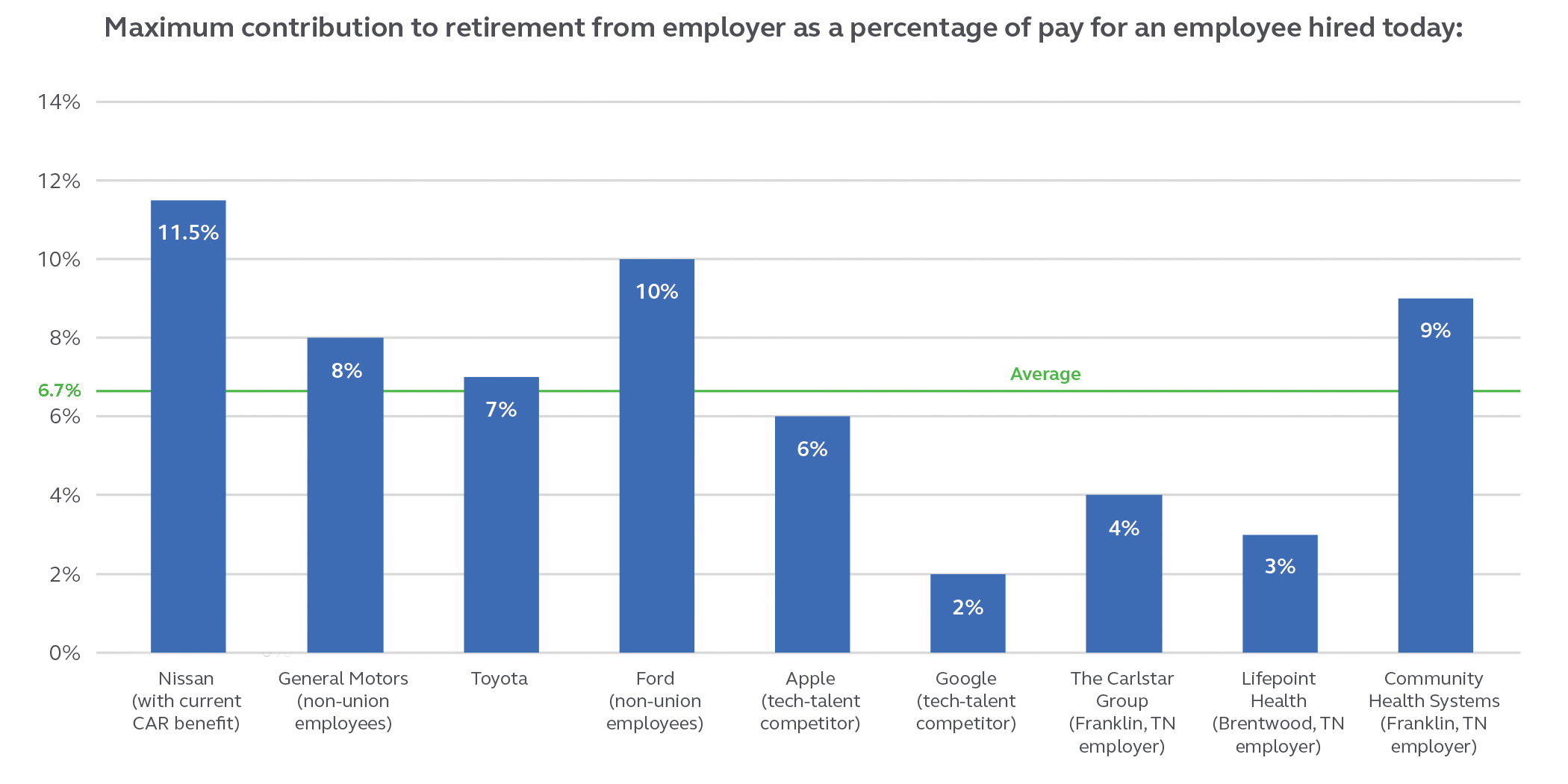

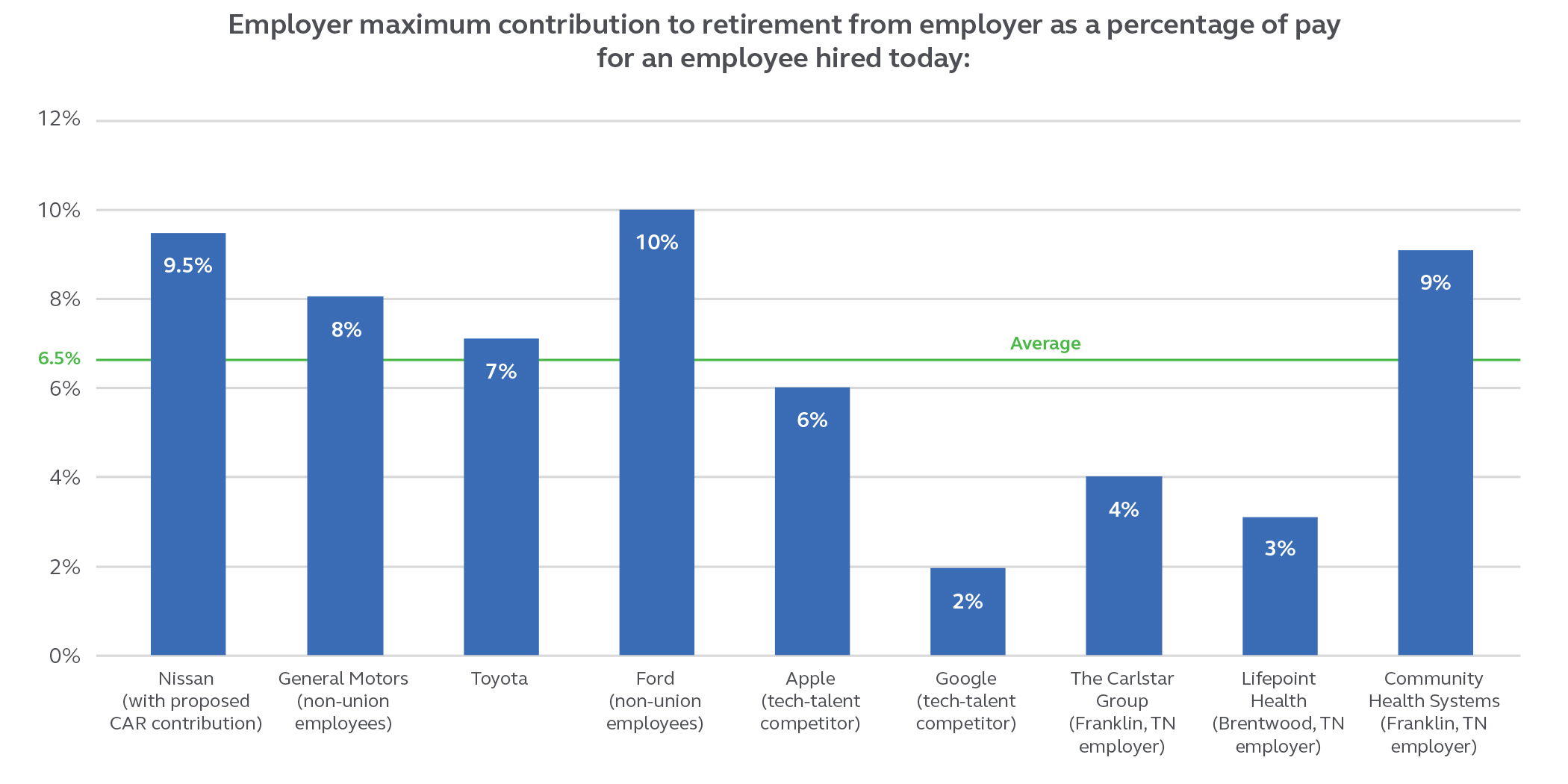

The graphic to the right illustrates Nissan’s current maximum contribution to employee retirement in comparison to a sample of industry competitors, tech companies, and regional employers.

Click on image to expand

Knowing this, we believe that Nissan competes for talent not only with other auto manufacturers but also with tech companies and regional employers of broad-based professionals.

The graphic below Nissan’s current maximum contribution to employee retirement in comparison to a sample of industry competitors, tech companies, and regional employers.

| Current "CAR" Benefit | Possible Future "CAR" Benefit | |

|

Service Bracket (in years) |

||

|

0-5 |

2% |

2% |

| 6-10 | 3% | 3% |

| 11-15 | 5% | 5% |

| 16-20 | 6% | 6% |

| 20-25 | 7% | 6% |

| 26+ | 8% | 6% |

|

Projected impact to Nissan employees

|

|

|

After 10 years

|

No change

|

|

After 25 years

|

Less than 1% decrease in replacement ratio

|

|

After 40 year career

|

Less than 2% decrease in replacement ratio

|

| Number of employees who would see an immediate decrease in contributions due to change today: | Zero |

The assumed rates used for this calculation is hypothetical and does not guarantee any future returns nor represent the returns of any particular investment. Individual taxpayer circumstances may vary. This is for illustrative purposes only.

We estimate the impact to Nissan as your workforce gains longer tenure to be a reduction in spending of roughly $4 million per year which could be reallocated to other employee benefit programs. This is an estimate based on publicly available information as well as certain assumptions about your workforce.

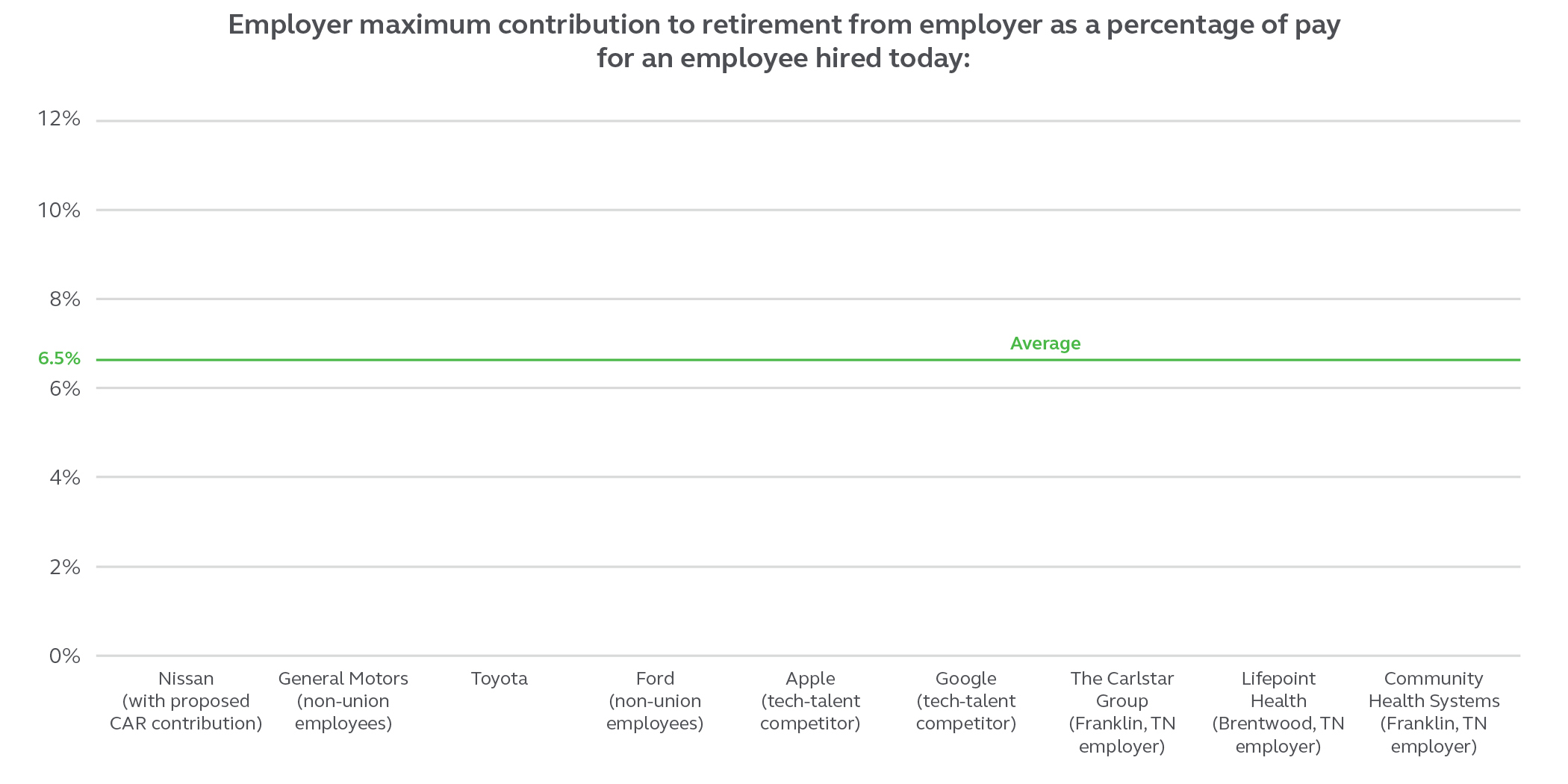

As the graphic to the right illustrates, this change would likely have minimal impact on Nissan’s competitive position regarding employer contributions toward employee retirement.

Click on image to expand

We estimate the impact to Nissan as your workforce gains longer tenure to be a reduction in spending of roughly $4 million per year which could be reallocated to other employee benefit programs. This is an estimate based on publicly available information as well as certain assumptions about your workforce.

As the graphic below illustrates, this change would likely have minimal impact on Nissan’s competitive position regarding employer contributions toward employee retirement.

Take Nissan employee benefits to the next level with a student loan repayment program

One option for redirecting the capital saved through the CAR benefit modification described above would be to create a student loan repayment benefit. Student loan debt continues to be a topic of concern for America’s workforce and can have a crippling effect on employees now and in years to come. Hefty student loan obligations often present or delay employees from saving for retirement.

46 million Americans hold more than $1.75 trillion in student loan debt.1

Among the class of 2020, 55% of bachelor’s degree recipients took out student loans, graduating with an average of $28,400 in student loan debt.1

Today, 8% of employers offer a student loan refinance or repayment benefit - the trend appears to be on the rise and has doubled since 2016.2

Offering a Student Loan Repayment Program can:

- Show support for employees’ wellbeing

- Motivate employees to reassess and take control of their student loan debt

- Clear a path toward longer-term strategies, such as home ownership and retirement

- Provide additional incentives for recruiting and retention in a highly competitive job market

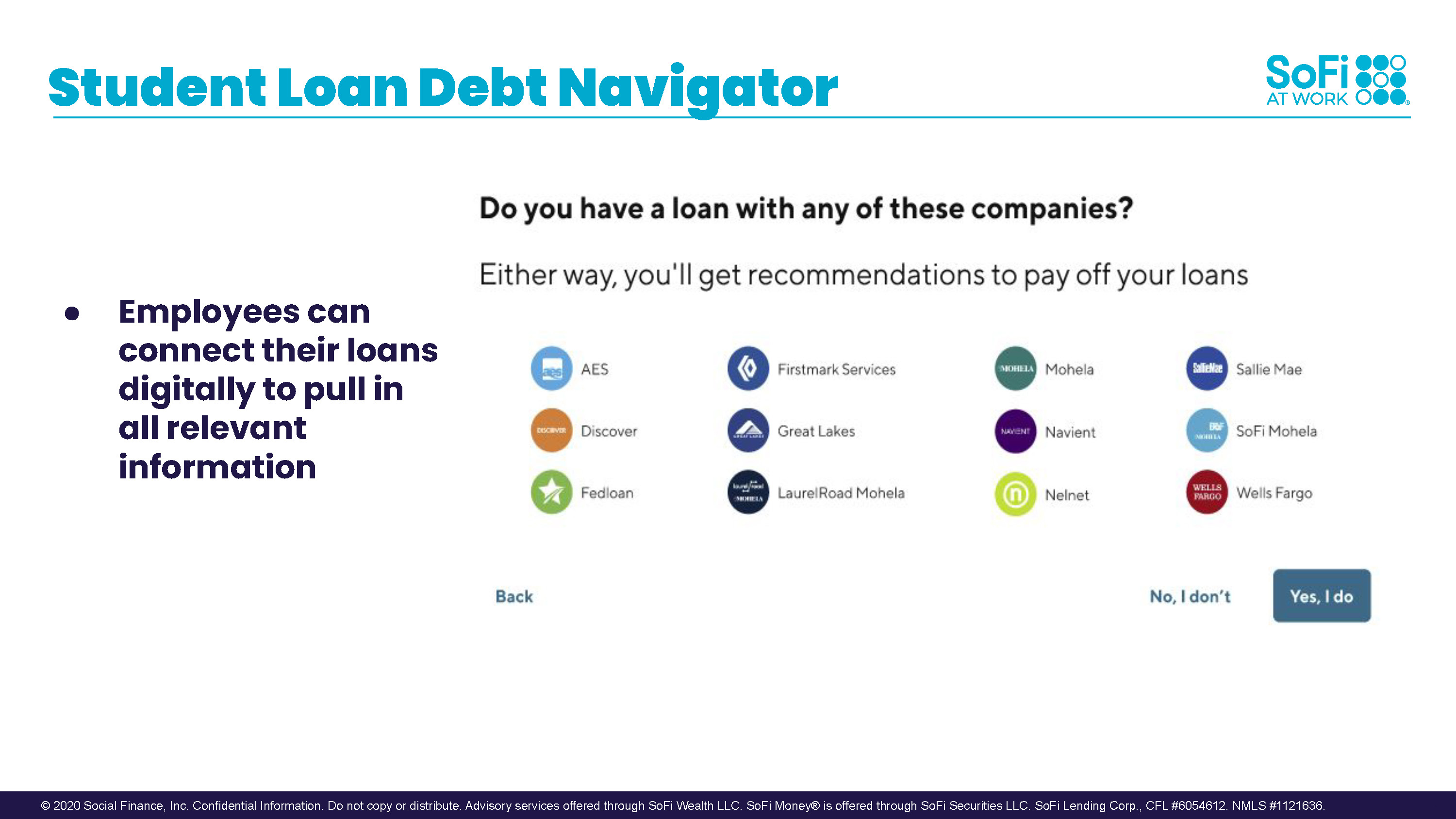

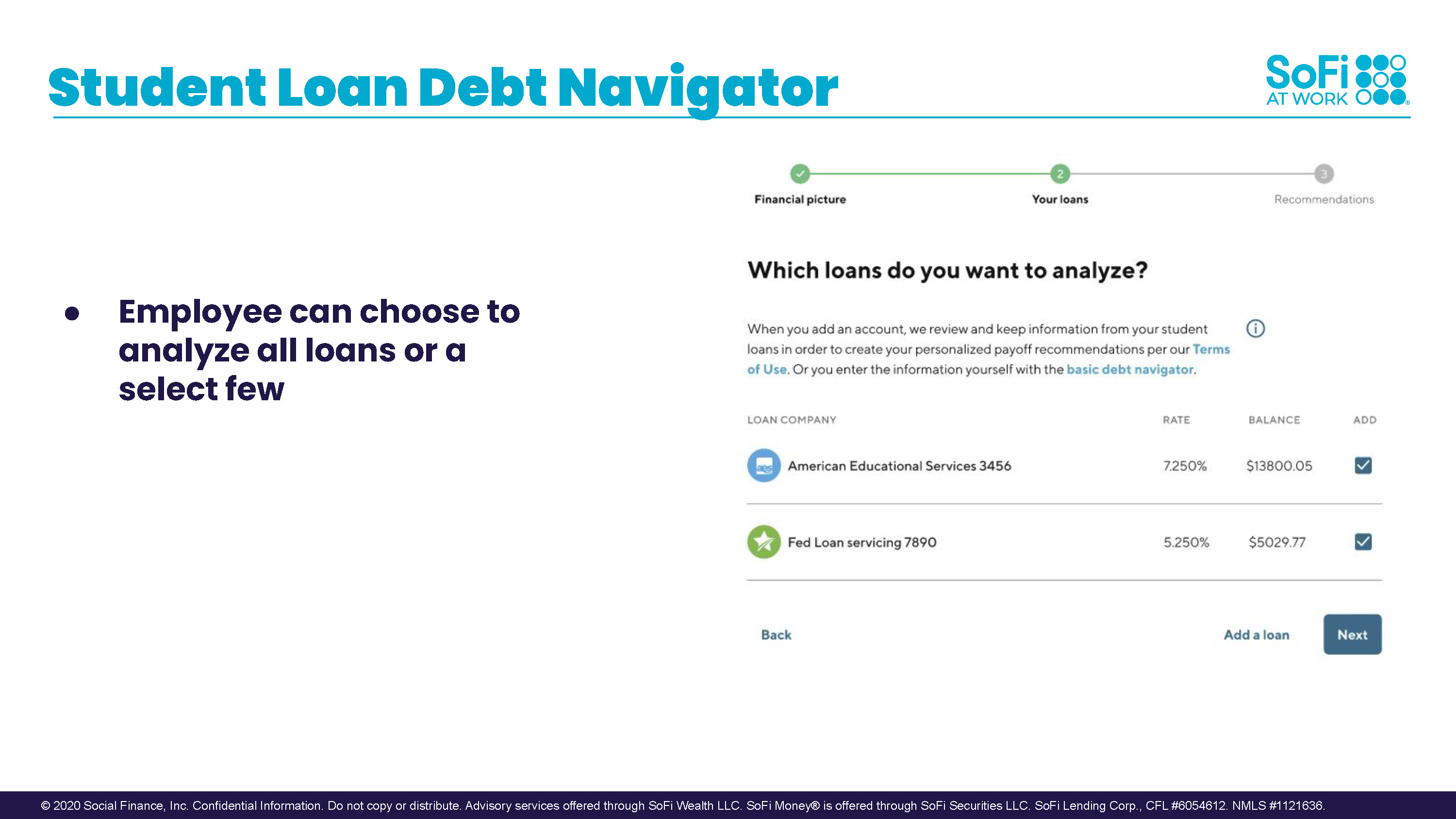

Principal offers support for a Student Loan Repayment Program as part of our overall holistic offering through Principal® Milestones and the Enrich financial wellness platform. Principal and Enrich have partnered with SoFi (a leader in student loan financing) to create the Student Loan Repayment Program, which seamlessly integrate with our single sign-on capabilities with Enrich.

The Student Loan Repayment Program site allows employees to drag and drop all National Student Loan Data System information to help them assess different repayment strategies available to them, including consolidation. If consolidation is ideal for them, the participant chooses a federal or a private option and consolidates from there.

Click on image to expand

Click on image to expand

Click on image to expand

Student loan repayment program options that Nissan can choose to offer to employees include:

- Direct loan payment contribution (“out-of-plan” model)

- Retirement benefit contribution (“in-plan” model)3

Nissan could choose to offer the benefit to all employees, with lower amounts paid, or only to specific skill sets/positions, enabling Nissan to provide a higher contribution to particular talent groups that are in high demand in the marketplace.

We would keep Nissan apprised of legislation that could complement your retirement plan as well as benefit structure. For example, there is proposed legislation, that if passed, would allow you to match student loan repayments (SLRs) within the retirement plan in lieu of deferrals. This could benefit those employees who cannot afford to save for retirement due to other competing costs, including student loan repayments. The idea of matching SLRs is to treat them as elective deferrals for purposes of nondiscrimination testing. This means that the match of the SLR would be considered a match versus today being considered nonelective. If tested as match, it takes away many of the nondiscrimination testing concerns of offering this benefit within a plan.

This is just one example of the proactive, consultative approach we have with our clients. Principal’s consulting process is not to simply bring ideas like this to you, but to then work with you to fully understand the financial impacts of such ideas. As a Principal client, our consulting and actuarial teams, including Nissan’s ERISA Plan Design and Regulatory Consultant, Scott Swalley, would work with your workforce data to better determine the potential cost savings in future years. This sort of work can help significantly when budgeting, particularly if you do decide to redeploy the cost savings elsewhere.

We look forward to working with you to help you to continue to create and promote a top-tier benefits offering to your employees.