Thank you for considering us as your retirement plan service provider. We'll do our best to make your search as easy as possible. Scroll down to catch a glimpse of what your experience will look like at Principal.

Welcome to Principal

LEARN ABOUT PRINCIPAL

The Principal difference

Unlike other providers, retirement is at the heart of our business. Retirement and asset management operations represent 95% of our assets under management.* We're committed to serving our retirement clients and investing in our business.

* Principal data as of Dec. 31, 2022.

We're proud of our culture

Our people shape and reinforce our culture of service, inclusion, and innovation while helping our customers reach their goals for financial security and live their best lives.

We typically receive industry accolades like these proving we make our values come to life.

Top 100 Most Sustainable Companies in America

Barron’s, February 2022

America’s Best Employers for Diversity

Forbes, April 2022

World’s Most Ethical Companies®

Ethisphere Institute, February 2021

PLAN SPONSOR EXPERIENCE

Expertise to serve complex plans

Multiple plans. One integrated experience.

PRINCIPAL® TOTAL RETIREMENT SOLUTIONS

With Principal® Total Retirement Solutions you'll have one simple experience on a streamlined digital platform with one experienced relationship manager and one experienced team instead of multiple service providers. Plus, your employees can check their retirement benefits with just one click, one call, one app.

Flexible plan solutions.

Easy plan administration. Simple navigation.

Compliance support. File all forms and schedules directly from our plan sponsor website.6 We’ll even remind you to complete a Form 5500 Questionnaire.

1 Principal Financial Group was founded in 1879 and began providing plan services in 1941.

2 Based on defined contribution participant count. PLANSPONSOR July 2022 Recordkeeping Survey.

3 Based on number of plans, PLANSPONSOR DB Administration survey, May 2021.

4 Based on number of Section 409A plans, PLANSPONSOR Recordkeeping Survey, July 2022.

5 Based on number of ESOP plans, PLANSPONSOR Recordkeeeping Survey, July 2022.

6 Principal is a recordkeeper approved by the DOL to file Form 5500. Principal is one of two fully certified recordkeepers. The other providers have exceptions or limitations to their certification. Principal can file all forms and schedules. The others can only prepare and file specific forms and schedules. December 2021 https://www.efast.dol.gov/software/software.html

PARTICIPANT EXPERIENCE

Personalized experiences to help drive participant outcomes

Engage from the beginning

Say hello to a personalized welcome.

- Automated eligibility notice delivery and enrollment reminders1

- Principal® Real Start digital onboarding including text and mobile enrollment

- Dedicated contact center team

- Transcreated experience for Spanish speakers

Elevate the experience

Take retirement to the next level.

- Retirement Wellness Score and Planner

- Motivational peer comparison

- Principal® app

- Hola Futuro Spanish website

Expand beyond retirement

Access holistic financial wellness tools and resources through Principal® Milestones.

- Standard will and other legal documents participants can prepare

- Student loan repayment resources and access to more than 15,000 scholarships

- Money management education

Principal® Real Start

Our online enrollment experience –

DALBAR awarded us with the Superior First Impression Seal (2021) for our commitment to the participant experience. Principal achieved a perfect score for the beneficiary element of the enrollment process for the second consecutive year, the only firm to score perfectly in 2021.

Opens in a new window.

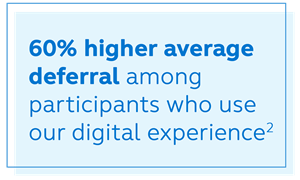

Opens in a new window.Putting retirement planning at participants’ fingertips

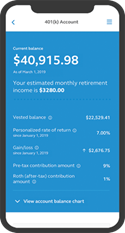

Mobile-first approach

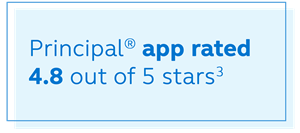

The Principal® app makes it easy for participants to manage their account on the go and plan for their future.

Principal® app

Our digital experience, DALBAR awards us with the Mobile Communications Seal of Excellence (2022) for the second year in a row.

For illustrative purposes only

1 No charge for electronic delivery for clients who deem their employees are “wired at work.” Automated paper delivery is available for a fee.

2 Principal reporting from January 1, 2021 - December 31, 2021. Compares participants who used the resources with those who did not.

3 iOS App Store rating as of December 31, 2022.

4 Principal reporting for all clients that use Principal® Milestones as of December 31, 2021.

Custom communication samples

Multiple campaign touchpoints

For illustration use only.

CYBERSECURITY

Committed to keeping customers’ assets and information secure

Safeguarding customers’ info is a top priority

Our approach, paired with third-party expertise, provides flexibility to act quickly on any potential threats. We go beyond the Department of Labor cybersecurity best practices by:

- Including two-factor authentication

- Conducting ongoing third party cyber attack testing

- Working closely with local, state, and national government agencies

- Conducting background checks on all employees

- Having cybersecurity insurance

- Serving as active members of industry groups such as:

- SPARK Data Security Oversight Board

- Cyber Readiness Institute (CRI)

- FS-ISAC

Our simple customer protection guarantee

Third-party validation

2 Financial Advisor IQ Service Awards, October 2021.